TIDMTRP

RNS Number : 8862P

Tower Resources PLC

15 October 2019

THIS ANNOUNCEMENT IS NOT FOR RELEASE, PUBLICATION OR

DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN, INTO

OR FROM THE UNITED STATES, CANADA, AUSTRALIA, THE REPUBLIC OF SOUTH

AFRICA OR JAPAN OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD

CONSTITUTE A BREACH OF THE RELEVANT SECURITIES LAWS OF SUCH

JURISDICTION.

This announcement does not constitute a prospectus or offering

memorandum or an offer in respect of any securities and is not

intended to provide the basis for any decision in respect of Tower

Resources PLC or other evaluation of any securities of Tower

Resources PLC or any other entity and should not be considered as a

recommendation that any investor should subscribe for or purchase

any such securities.

15 October 2019

Tower Resources plc

Completion of Placing, Issue of Fee shares and Director's

Dealings

Issue of Warrants

Tower Resources plc (the "Company" or "Tower" (TRP.L, TRP LN)),

the AIM listed oil and gas company with its focus on Africa, is

pleased to announce that, further to the Company's announcement

earlier today outlining the proposed placing and subscription (the

"Placing") for 461,538,462 Ordinary Shares (the "Placing Shares")

and issue of 50,784,001 Ordinary Shares in lieu of fees (the "Fee

Shares"), the Company has issued a total of 512,322,462 Ordinary

Shares together with Warrants and raised gross proceeds from the

Placing totalling GBP1.5million at a Placing Price of 0.325 pence

per share., plus a further GBP165,048 in Fee Shares on the same

terms.

As previously disclosed, the purpose of the Placing is

principally to allow the Company to cover ongoing operational

costs, pay creditors and also secure the services of Geoquip

Marine's MV Investigator to undertake the site survey and drill

boreholes, which is the final step needed prior to being able to

bring the drill rig itself to the site.

As announced earlier today, in order to provide Pegasus and

Jeremy Asher respectively with sufficient time to realise other

assets to facilitate the further advance by Pegasus under the

Facility and the subscription by Jeremy Asher for GBP700,000 of new

ordinary shares in the Placing, the Placing comprises two

tranches:

-- the first tranche of GBP401,250, comprising a subscription

for 123,461,538 ordinary shares (the "First Tranche") including

GBP100,000 of Jeremy Asher's subscription, which is unconditional;

and

-- the second tranche of GBP1,098,750, comprising a subscription

for 338,076,923 ordinary shares (the "Second Tranche") including

GBP600,000 of Jeremy Asher's subscription is conditional on:

(i) the further advance by Pegasus of US$375,000 under the

Facility; and the repayment by the Company to the other Facility

lenders of $375,000 principal together with accrued interest;

and

(ii) completion of the subscription by Jeremy Asher for the

remaining GBP600,000 of new ordinary shares described below.

Completion of the First Tranche is expected on or around 21

October 2019 and completion of the Second Tranche is expected on or

around 12 November 2019.

As part of the Placing, Jeremy Asher, Chairman and CEO, has

entered into an Agreement (the "Subscription Agreement") to

subscribe for, in aggregate, 215,384,615 new Ordinary Shares in the

Placing (with attached warrants) for GBP700,000 as further detailed

below.

The Placing has also been supported by a number of the Company's

existing large shareholders, including Peel Hunt LLP who is

considered as a related party of the Company and has subscribed for

GBP250,000 pursuant to the Placing.

In addition, as noted above, certain service providers have

subscribed for 50,784,001 Ordinary shares ("Fee Shares") at the

Placing Price in lieu of fees either owing or arising over the next

six months. Furthermore the Company's broker Turner Pope

Investments (TPI) Ltd has agreed to take half of its commission in

the form of shares at the Placing price (without attached warrants,

as it is already receiving warrants in connection with the Placing)

and the precise amount of these shares (the "Commission Shares")

will be disclosed when the commission calculation is reconciled and

these shares are allotted.

The participation of Jeremy Asher constitutes a related party

transaction in accordance with AIM Rule 13. Accordingly, Peter

Taylor and David M Thomas, acting as the independent Directors,

consider, having consulted with the Company's Nominated Adviser, SP

Angel Corporate Finance LLP, that the terms of Jeremy Asher's

participation in the Placing is fair and reasonable insofar as the

Company's shareholders are concerned.

The participation of Peel Hunt LLP constitutes a related party

transaction in accordance with AIM Rule 13. Accordingly, Jeremy

Asher, Peter Taylor and David M Thomas, acting as the independent

Directors, consider, having consulted with the Company's Nominated

Adviser, SP Angel Corporate Finance LLP, that the terms of Peel

Hunt's participation in the Placing is fair and reasonable insofar

as the Company's shareholders are concerned.

The following table sets out the Directors' shareholdings and

percentage interests in the issued share capital of the Company

following completion of the subscription.

Holding prior to Number of Immediately following Admission

the announcement Placing of the Placing and Fee Shares

of Placing Shares acquired

pursuant

to the Placing

Number of % of Number of Number of % of % of fully

Ordinary issued Ordinary Ordinary issued diluted

Shares share Shares Shares share share capital

capital capital

----------- --------- ----------------- ------------ --------- --------------

Jeremy Asher(*) 85,891,495 14.8 215,384,615 301,276,110 27.6 18.7

----------- --------- ----------------- ------------ --------- --------------

Peter Taylor 18,451,726 3.2 - 18,451,726 1.7 1.1

----------- --------- ----------------- ------------ --------- --------------

David M Thomas(#) - - - - - -

----------- --------- ----------------- ------------ --------- --------------

* 1,805,308 of these shares are held by Agile Energy Limited,

which is owned by the Asher Family Trust of which Jeremy Asher is a

lifetime beneficiary

(#) Independent Director

Share Capital Following the Placing and Issue of Fee Shares

Application will be made for the Placing Shares and Fee Shares

to be admitted to trading on AIM when each tranche of shares is

formally allocated. It is expected that Admission of the First

Tranche of Placing Shares and Fee Shares will occur on or around 21

October 2019 and completion of the Second Tranche is expected on or

around 12 November 2019.

Following admission of the First Tranche of Placing Shares and

Fee Shares, the Company's enlarged issued share capital will

comprise 754,961,591 Ordinary Shares of 0.001 pence each with

voting rights in the Company. This figure may be used by

shareholders in the Company as the denominator for the calculations

by which they will determine if they are required to notify their

interest in, or a change in the interest in, the share capital of

the Company under the FCA's Disclosure and Transparency Rules.

Following admission of the Second Tranche of Placing Shares and

Fee Shares, and the Company's current estimate of the Commission

Shares, the Company's enlarged issued share capital will comprise

1,093,038,514 Ordinary Shares of 0.001 pence each with voting

rights in the Company.

Issue of Warrants

Warrants are being issued in lieu of GBP15,000 (in aggregate) of

Directors fees to Peter Taylor (Non-Executive Director), and Jeremy

Asher (as Chairman) in partial settlement of fees due for the

period from 1 October 2019 to 31 December 2019, to conserve the

Company's working capital.

The Warrants are exercisable at 0.5 pence per share and are

exercisable for a period of 5 years from the date of issue. The

exercise period for the Director warrants differs from the exercise

period for the Placing and Broker Warrants because the Company's

long-standing practice has been to offer the Directors 5-year

warrants in lieu of fees, and by offering five-year warrants the

aggregate number of warrants being provided to Directors for a

given level of fees is reduced. The Warrants being issued are

detailed below:

Director Number Number Number Total number Shareholding % of issued

of Director of First of Second of Warrants upon exercise share

Warrants Tranche Tranche held including of total capital

being Placing Placing this issue* number of upon exercise

issued Warrants Warrants Warrants of Warrants

being issued being issued held

Peter

Taylor 3,675,644 - - 22,276,628 40,728,354 2.6%

------------- -------------- -------------- ---------------- --------------- ---------------

Jeremy

Asher 7,315,289 10,256,410 61,538,462 166,346,169 467,652,279 28.7%

------------- -------------- -------------- ---------------- --------------- ---------------

*Warrants are held at different prices, and Jeremy Asher's total

includes warrants held by Pegasus

As previously announced, the Directors will consider issuing

further warrants in lieu of fees for each calendar quarter based on

the closing price of the stock and the warrant valuation on the

last day of the previous quarter and will make an election and

announce the issue of warrants (if so elected) at the earliest

opportunity in each calendar quarter. This election will be made by

the Board with each Director taking into consideration the working

capital position of the Company.

Peter Taylor and Jeremy Asher are considered to be "related

parties" as defined under the AIM Rules and accordingly, the issue

of Warrants to them constitutes a related party transaction for the

purposes of Rule 13 of the AIM Rules.

David M Thomas, being the sole Director independent of the

transaction, considers, having consulted with SP Angel Corporate

Finance LLP, the Company's Nominated Adviser, that the terms of the

issue of warrants are fair and reasonable insofar as the Company's

shareholders are concerned.

In addition, one warrant is being issued for each three Placing

shares and Fee shares issued, totalling 170,774,151 warrants

("Placing and Fee Warrants"). The Placing and Fee Warrants are

exercisable at 1.0 pence per share for a period of three years from

issue.

A further 9,600,000 warrants with an exercise price of 0.5 pence

per share and exercisable for a period of three years are being

issued to Turner Pope Investments ("TPI") Limited for services

pursuant to the Placing ("Broker Warrants").

The Placing and Fee Warrants and Broker Warrants will be issued

on the conditional approval of an increase to the Company's

existing authorities to allot shares at the Company's next

EGM/AGM.

Following the issue of the both tranches of placing warrants and

the Broker Warrant and Director warrants, there will be 444,284,489

warrants in issue, which represents 28.9% of the fully diluted

share capital of 1,537,323,003 shares after exercise of the above

warrants and excluding stock options. The fully diluted share

capital including all warrants and stock options would then be

1,608,940,403 shares.

IMPORTANT NOTICE

This announcement does not constitute or form part of any offer

or invitation to purchase, or otherwise acquire, subscribe for,

sell, otherwise dispose of or issue, or any solicitation of any

offer to sell, otherwise dispose of, issue, purchase, otherwise

acquire or subscribe for, any security in the capital of the

Company in any jurisdiction.

The information contained in this announcement is not to be

released, published, distributed or transmitted by any means or

media, directly or indirectly, in whole or in part, in or into the

United States or to any US Person. This announcement does not

constitute an offer to sell, or a solicitation of an offer to buy,

securities in the United States or to any US Person. Securities may

not be offered or sold in the United States absent: (i)

registration under the Securities Act; or (ii) an available

exemption from registration under the Securities Act. The

securities mentioned herein have not been, and will not be,

registered under the Securities Act and will not be offered to the

public in the United States.

This announcement does not constitute an offer to buy or to

subscribe for, or the solicitation of an offer to buy or subscribe

for, Ordinary Shares in the capital of the Company or any other

security in any jurisdiction in which such offer or solicitation is

unlawful. The securities mentioned herein have not been, and the

Ordinary Shares will not be, qualified for sale under the laws of

any of Canada, Australia, the Republic of South Africa or Japan and

may not be offered or sold in Canada, Australia, the Republic of

South Africa or Japan or to any national, resident or citizen of

Canada, Australia, the Republic of South Africa or Japan. Neither

this announcement nor any copy of it may be sent to or taken into

the United States, Canada, Australia, the Republic of South Africa

or Japan. In addition, the securities to which this announcement

relates must not be marketed into any jurisdiction where to do so

would be unlawful.

Note regarding forward-looking statements

This announcement contains certain forward-looking statements

relating to the Company's future prospects, developments and

business strategies. Forward-looking statements are identified by

their use of terms and phrases such as "targets" "estimates",

"envisages", "believes", "expects", "aims", "intends", "plans",

"will", "may", "anticipates", "would", "could" or similar

expressions or the negative of those, variations or comparable

expressions, including references to assumptions.

The forward-looking statements in this announcement are based on

current expectations and are subject to risks and uncertainties

which could cause actual results to differ materially from those

expressed or implied by those statements. These forward-looking

statements relate only to the position as at the date of this

announcement. Neither the Directors nor the Company undertake any

obligation to update forward-looking statements, other than as

required by the AIM Rules for Companies or by the rules of any

other applicable securities regulatory authority, whether as a

result of the information, future events or otherwise. You are

advised to read this announcement and the information incorporated

by reference herein, in its entirety. The events described in the

forward-looking statements made in this announcement may not

occur.

Neither the content of the Company's website (or any other

website) nor any website accessible by hyperlinks on the Company's

website (or any other website) is incorporated in, or forms part

of, this announcement.

Any person receiving this announcement is advised to exercise

caution in relation to the Placing. If in any doubt about any of

the contents of this announcement, independent professional advice

should be obtained.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

Contacts

Tower Resources plc info@towerresources.co.uk

Jeremy Asher

Chairman and CEO

Andrew Matharu

VP - Corporate Affairs

SP Angel Corporate Finance

LLP

Nominated Adviser +44 20 3470 0470

Stuart Gledhill

Caroline Rowe

Turner Pope Investments

(TPI) Limited

Joint Broker

Andy Thacker

Zoe Alexander +44 20 3657 0500

Whitman Howard Limited

Joint Broker

Nick Lovering +44 20 7659 1234

Yellow Jersey PR Limited +44 20 3735 8825

Sarah Hollins

Henry Wilkinson

Notes:

Tower Resources Cameroon S.A, a wholly-owned subsidiary of Tower

Resources plc, holds a 100% interest in the shallow water Thali

(formerly known as "Dissoni") Production Sharing Contract (PSC), in

the Rio del Rey basin, offshore Cameroon. Tower was awarded the PSC

on 15 September 2015 for an Initial Exploration Period of 3

years.

The Thali PSC covers an area of 119.2 km(2), with water depths

ranging from 8 to 48 metres, and lies in the prolific Rio del Rey

basin, in the eastern part of the Niger Delta. The Rio del Rey

basin has, to date, produced over one billion barrels of oil and

has estimated remaining reserves of 1.2 billion barrels of oil

equivalent ("boe"), primarily within depths of less than 2,000

metres. The Rio del Rey is a sub-basin of the Niger Delta, an area

in which over 34.5 billion barrels of oil has been discovered, with

2.5 billion boe attributed to the Cameroonian section.

An independent Reserve Report conducted by Oilfield

International Limited (OIL) have highlighted the contingent and

potential resources on the Thali licence and the associated

Expected Monetary Value (EMV) as follows:

-- Gross mean contingent resources of 18 MMbbls of oil across

the proven Njonji-1 and Njonji-2 fault blocks;

-- Gross mean prospective resources of 20 MMbbls of oil across

the Njonji South and Njonji South-West fault blocks;

-- Gross mean prospective resources of 111 MMbbls of oil across

four identified prospects located in the Dissoni South and Idenao

areas in the northern part of the Thali licence;

-- Calculated EMV10s of US$118 million for the contingent

resources, and US$82 million for the prospective resources,

respectively.

In accordance with the guidelines for the AIM market of the

London Stock Exchange, Dr Mark Enfield, BSc, PhD, FGS, Advisor to

the Board of Tower Resources plc, who has over 30 years' experience

in the oil & gas industry, is the qualified person that has

reviewed and approved the technical content of this

announcement.

NOTIFICATION AND PUBLIC DISCLOSURE OF TRANSACTIONS BY PERSONS

DISCHARGING MANAGERIAL RESPONSIBILITIES AND PERSONS CLOSELY

ASSOCIATED WITH THEM:

MANAGERIAL RESPONSIBILITIES AND PERSONS CLOSELY ASSOCIATED WITH

THEM

1. Details of the person discharging managerial responsibilities/person

closely associated

a) Name: Jeremy Asher

------------------------------------ ---------------------------------

2. Reason for the notification

-----------------------------------------------------------------------

a) Position/status: Chairman and Chief

Executive Officer

------------------------------------ ---------------------------------

b) Initial notification/Amendment: Initial notification

------------------------------------ ---------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-----------------------------------------------------------------------

a) Name: Tower Resources PLC

------------------------------------ ---------------------------------

b) LEI: 2138002J9VH6PN7P2B09

------------------------------------ ---------------------------------

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-----------------------------------------------------------------------

a) Description of the financial Ordinary Shares of

instrument, type of instrument: 0.001 pence each

Identification code: GB00BZ6D6J81

------------------------------------ ---------------------------------

b) Nature of the transaction: 1. Placing shares-

First and Second Tranche

2. Warrants in lieu

of Directors fees

3. Placing Warrants-

First and Second Tranche

------------------------------------ ---------------------------------

c) Price(s) and volume(s): Price(p) Volume(s)

0.325 215,384,615

------------

Price(p) Volume(s)

0.50 7,315,289

----------

Price(p) Volume(s)

0.325 71,794,872

-----------

------------------------------------ ---------------------------------

d) Aggregated information: Single transaction

Aggregated volume: as in 4 c) above

Price:

------------------------------------ ---------------------------------

e) Date of the transaction: 15 October 2019

07:30 BST

------------------------------------ ---------------------------------

1. Details of the person discharging managerial responsibilities/person

closely associated

a) Name: Peter Taylor

--------------------------------- ---------------------------------------

2. Reason for the notification

--------------------------------------------------------------------------

a) Position/status: Non-Executive Director

--------------------------------- ---------------------------------------

b) Initial notification/Amendment: Initial notification

--------------------------------- ---------------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

--------------------------------------------------------------------------

a) Name: Tower Resources PLC

--------------------------------- ---------------------------------------

b) LEI: 2138002J9VH6PN7P2B09

--------------------------------- ---------------------------------------

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

--------------------------------------------------------------------------

a) Description of the financial Ordinary Shares of

instrument, type of instrument: 0.001 pence each

Identification code: GB00BZ6D6J81

--------------------------------- ---------------------------------------

b) Nature of the transaction: Warrants in lieu of

Directors fees

--------------------------------- ---------------------------------------

c) Price(s) and volume(s): Price(p) Volume(s)

0.50 3,675,644

----------

--------------------------------- ---------------------------------------

d) Aggregated information: Single transaction

Aggregated volume: as in 4 c) above Price(p) Volume(s)

Price: 0.50 3,675,644

--------------------------------- ---------------------------------------

e) Date of the transaction: 15 October 2019

07:30 BST

--------------------------------- ---------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCCKPDDBBDKKKD

(END) Dow Jones Newswires

October 15, 2019 02:30 ET (06:30 GMT)

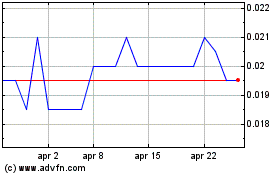

Grafico Azioni Tower Resources (LSE:TRP)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Tower Resources (LSE:TRP)

Storico

Da Apr 2023 a Apr 2024