Tower Resources PLC Extension of Loan Facility and Issue of Warrants (6159R)

01 Luglio 2020 - 8:00AM

UK Regulatory

TIDMTRP

RNS Number : 6159R

Tower Resources PLC

01 July 2020

1 July 2020

Tower Resources plc

Extension of Loan Facility

Issue of Warrants

Tower Resources plc (the "Company" or "Tower" (TRP.L, TRP LN)),

the AIM listed oil and gas company with its focus on Africa,

announces a further extension of its Loan Facility ("Facility") of

US$750,000.

The Facility will now be due for repayment on or before 15

August 2020 (the "Extension") and the terms of the extension

include the issue of 4.5 million of five-year warrants with a

strike price of 0.35 pence, being a premium of 11.1% to the closing

price on 30 June 2020. The reason for the extension is the delay to

the completion of the farm-out to OilLR, and the timing reflects

the Company's expectation in respect of the first payment into

escrow. The Facility does also contain a grace period of 21 working

days in the event of any further modest delay.

On 15 October 2019 a restructuring of the Facility was announced

resulting in Pegasus Petroleum Ltd ("Pegasus") holding 100% of the

Facility. Pegasus is a company owned and controlled by Tower's

Chairman and CEO, Jeremy Asher.

Background and Issue of Warrants

The Facility was originally established as a bridging loan by

Pegasus in April 2019, and was joined by a number of third parties

in May 2019. At the end of July 2019, when the facility was already

overdue for repayment, an extension to the end of August was agreed

with all the parties to the Facility, in return for the issue of 3

million five year warrants with a strike price slightly above the

then-prevailing share price. The Company has looked to this

transaction as a guide to a reasonable basis for extending the

Facility for a further month and 15 days at this juncture.

The Company has agreed with Pegasus an extension of the

repayment of the Facility until 15 August 2020 in return for the

issue of 4.5 million five-year warrants with a strike price of

0.35p per share. The value of these warrants, based on a Bloomberg

valuation using Black-Scholes, is approximately 0.223p per warrant,

with the aggregate warrant value of GBP10,053 corresponding to

approximately 1.66% of the value of the Facility, and is intended

to compensate the Facility lender for its additional risk and for

the additional default interest that the lender will forego by

granting the extension. The Bridging Loan will continue to have a

preferential right of repayment from any future financing in excess

of US$2,500,000, and will remain secured by the Company with

interest due of 1% per month (accrued and paid on repayment) along

with a fixed and floating charge over the Company's assets.

The warrants will be issued to Pegasus, which holds 100% of the

Facility. Jeremy Asher, as a director of the Company, and Pegasus,

are considered to be "related parties" as defined under the AIM

Rules and accordingly, the Extension and issue of warrants

constitute related party transactions for the purposes of Rule 13

of the AIM Rules. The table of Director warrants will therefore be

updated as follows:

Director Number of Total number Shareholding % of issued

Warrants of Warrants upon exercise share capital

being issued held including of total upon exercise

this issue* number of of Warrants++

Warrants

held

Jeremy Asher 4,500,000 192,854,191 494,130,301 28.4%

-------------- ---------------- --------------- ---------------

Peter Taylor - 36,928,643 55,380,369 3.2%

-------------- ---------------- --------------- ---------------

David M Thomas - 13,186,813 13,186,813 0.8%

-------------- ---------------- --------------- ---------------

*Warrants are held at different prices

Warrants issued to Pegasus Petroleum Ltd; a company beneficially

owned by Jeremy Asher

++Excludes share options

Related Party Transaction

The Directors independent of the Facility, being Peter Taylor

and David M Thomas, consider, having consulted with SP Angel

Corporate Finance LLP, the Company's nominated adviser, that the

terms of the extension to the Facility and issue of warrants are

fair and reasonable insofar as the Company's shareholders are

concerned.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

Contacts

Tower Resources plc +44 20 7157 9625

Jeremy Asher

Chairman and CEO

Andrew Matharu

VP - Corporate Affairs

SP Angel Corporate Finance

LLP

Nominated Adviser and

Joint Broker + 44 20 3470 0470

Stuart Gledhill

Caroline Rowe

Turner Pope Investments

(TPI) Limited

Joint Broker

Andy Thacker

Zoe Alexander + 44 20 3657 0050

Whitman Howard Limited

Joint Broker

Nick Lovering + 44 20 7659 1234

NOTIFICATION AND PUBLIC DISCLOSURE OF TRANSACTIONS BY PERSONS

DISCHARGING MANAGERIAL RESPONSIBILITIES AND PERSONS CLOSELY

ASSOCIATED WITH THEM:

1. Details of the person discharging managerial responsibilities/person

closely associated

a) Name: Jeremy Asher

--------------------------------- ------------------------------------------

2. Reason for the notification

-----------------------------------------------------------------------------

a) Position/status: Chairman and Chief

Executive Officer

--------------------------------- ------------------------------------------

b) Initial notification/Amendment: Initial notification

--------------------------------- ------------------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-----------------------------------------------------------------------------

a) Name: Tower Resources PLC

--------------------------------- ------------------------------------------

b) LEI: 2138002J9VH6PN7P2B09

--------------------------------- ------------------------------------------

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-----------------------------------------------------------------------------

a) Description of the financial Ordinary Shares of

instrument, type of instrument: 0.001 pence each

Identification code: GB00BZ6D6J81

--------------------------------- ------------------------------------------

b) Nature of the transaction: Bridging Loan Extension

Facility warrants

--------------------------------- ------------------------------------------

c) Price(s) and volume(s): Price(s) Volume(s)

0.35 pence 4,500,000

----------

--------------------------------- ------------------------------------------

d) Aggregated information: Single Transaction

Aggregated volume: as in 4 c) above Price(s) Volume(s)

Price: 0.35 pence 4,500,000

--------------------------------- ------------------------------------------

e) Date of the transaction: 1 July 2020

07:00 BST

--------------------------------- ------------------------------------------

f) Place of the transaction: Outside a trading

venue

--------------------------------- ------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCWPUBUQUPUGRU

(END) Dow Jones Newswires

July 01, 2020 02:00 ET (06:00 GMT)

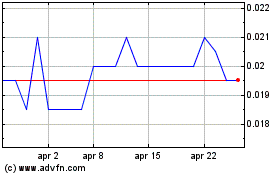

Grafico Azioni Tower Resources (LSE:TRP)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Tower Resources (LSE:TRP)

Storico

Da Apr 2023 a Apr 2024