Successful Capital Increase through a private placement via

an accelerated bookbuilding for an amount of approximately 34.1

million euros

Regulatory News:

Not for release, publication or distribution,

directly or indirectly, in or into the United States of America,

Canada, Australia or Japan

Transgene (Euronext Paris: TNG), a biotech company that designs

and develops virus-based immunotherapies for the treatment of

cancer, (“Transgene” or the “Company”) today

announces the successful completion of its capital increase through

the issuance of ordinary shares through a private placement with

waiver of preferential subscription rights, via an accelerated

bookbuilding pursuant to Articles L. 225-136 of the French

Commercial Code and L. 411-2 1° of the French Monetary and

Financial Code for an amount of approximately 34,1 million euros

(the “Capital Increase”).

Hedi Ben Brahim, Chairman and CEO of Transgene, said: “We are

very pleased to have concluded this successful fund raising, which

has been supported by both historical shareholders and specialized

healthcare investors, such as Invus. We are now well placed to

execute on our ambitious corporate strategy of progressing our

world leading myvac® and Invir.IO™ technology platforms through

first clinical validations of our personalized cancer vaccine

TG4050 and our novel oncolytic virus BT-001 while advancing our

randomized Phase II of TG4001. Transgene’s future has never looked

brighter, and I am looking forward to the multiple key

value-driving corporate milestones, we expect to announce over the

next 18 months.”

The capital increase results in the issuance of 13,930,000 new

ordinary shares at a subscription price of 2.45 euros (including

issue premium), representing 16,6 % of the current share capital of

the Company for a total amount of approximately 34,1 million euros.

The subscription price represents a discount of 6.5% compared to

the closing price of Transgene on June 21, 2021 (€2.62).

Institut Mérieux, which currently holds 99.5% through its

subsidiary TSGH, 60% of the company’s share capital, and SITAM

Belgium, which holds 4.9% of the company’s share capital,

subscribed for new ordinary shares in the capital increase for a

total amount of 25 million euros and 1,67 million euros,

respectively. Several specialized healthcare investors, including

Invus, also participated in the Offering.

As a result of the Capital Increase, the company’s share capital

will be made up of 97,771,334 shares, each having a nominal value

of €0.50, for a total share capital of 48,885,667 euros.

The funds raised in the Capital Increase will be used to

strengthen the Company’s financial structure until the fourth

quarter of 2023, in order to be able to conduct its clinical

development plan, in particular on its new innovative product

platforms myvac® and Invir.IO™, with the finalization of clinical

studies, and to be able to serenely negotiate partnership and

co-development agreements based on the results obtained from the

end of 2021.

Funds will be directly used by descending order of strategic

priority:

- circa €25m for the finalization of clinical studies and the

obtention of data with TG4001, TG4050, BT-001 and TG6002;

- circa €4m to launch the clinical development of new oncolytic

viruses based on the Invir.IO™ platform and currently undergoing

preclinical evaluation;

- for the remainder, to finance, together with operational

products of the Company, R&D and operational costs, as well as

current cash consumption.

The transaction will be carried out under the 22nd resolution of

the Combined General Shareholders’ Meeting of May 27, 2020.

The Capital increase was the subject of a placement agreement

entered into by the Company and the Global Coordinators on June 21,

2021. The placement agreement may be terminated by the Global

Coordinators at any time up to (and including) the settlement date

of the Capital Increase which is expected to take place on June 24,

2021, subject to certain customary conditions.

The Capital Increase was conducted by Natixis and Kempen &

Co as Global Coordinators, Joint Lead Managers and Joint

Bookrunners (« Global Coordinators »).

CAPITAL STRUCTURE POST CAPITAL INCREASE

To the Company’s knowledge, the breakdown of its share capital

after the Capital Increase is as follows(1):

Shareholder

Number of shares

% of capital

% of exercisable voting

rights

Before the

Capital

Increase

After the

Capital

Increase

Before the

Capital

Increase

After the

Capital

Increase

Before the

Capital

Increase

After the

Capital

Increase

TSGH

50,323,665

60,527,665

60.02%

61.91%

71.49%

71.67%

SITAM Belgique

4,144,856

4,824,856

4.94%

4.93%

3.46%

3.6%

Other

29,372,813

32,418,813

35.03%

33.16%

25.05%

24.72%

Total

83,841,334

97,771,334

100.00%

100.00%

100.00%

100.00%

(1) On a non-diluted basis: before the potential exercise of the

41,352 stock-options outstanding as of the date of this press

release and representing 0,0004% of both share capital and voting

rights of Transgene.

SHAREHOLDERS’ SUBSCRIPTION AND LOCK-UP AGREEMENTS

TGSH and SITAM Belgique have agreed with the Global Coordinators

for the contemplated transaction that they will not sell or

transfer its shares of Transgene for a period ending 90 days after

the settlement and delivery of the Capital Increase, subject to the

customary exceptions.

In connection with the Capital Increase, the Company will enter

into a lock-up agreement with the Global Coordinators for a period

ending 90 days after the settlement and delivery of the Capital

Increase, subject to the customary exceptions.

RISKS FACTORS

Transgene draws the attention of the public to:

- The risk factors presented in the Universal Registration

Document; the materialization of any or all of these risks is

likely to have a detrimental effect on the activity, financial

situation, or the results of Transgene or on its ability to achieve

its objectives.

- The main risks associated with the Capital Increase are the

following:

- the market price of the Company shares may fluctuate and fall

below the subscription price of the new shares;

- due to stock market fluctuations, the volatility and liquidity

of the Company shares may vary significantly;

- the sale of Company shares may occur on the secondary market,

after the capital increase, and have a negative impact on the

Company share price;

- regarding the use of the expected proceeds of the issuance

within the context of the Capital Increase, the Company has room

for maneuver as to the use of the funds raised and could use them

in a way that the shareholders may not adhere to or that would not

increase the value of their investment in the short term; and

- a new market-based call by the Company, after the Capital

Increase, could result in further dilution for the investors.

A corporate presentation of the Company is available on the

Company’s website (https://www.transgene.fr/en/investors)

***

About Transgene

Transgene (Euronext: TNG) is a biotechnology company focused on

designing and developing targeted immunotherapies for the treatment

of cancer. Transgene’s programs utilize viral vector technology

with the goal of indirectly or directly killing cancer cells.

The Company’s clinical-stage programs consist of two therapeutic

vaccines (TG4001 for the treatment of HPV-positive cancers, and

TG4050, the first individualized therapeutic vaccine based on the

myvac® platform) as well as two oncolytic viruses (TG6002 for the

treatment of solid tumors, and BT-001, the first oncolytic virus

based on the Invir.IO™ platform).

With Transgene’s myvac® platform, therapeutic vaccination enters

the field of precision medicine with a novel immunotherapy that is

fully tailored to each individual. The myvac® approach allows the

generation of a virus-based immunotherapy that encodes

patient-specific mutations identified and selected by Artificial

Intelligence capabilities provided by its partner NEC.

With its proprietary platform Invir.IO™, Transgene is building

on its viral vector engineering expertise to design a new

generation of multifunctional oncolytic viruses. Transgene has an

ongoing Invir.IO™ collaboration with AstraZeneca.

Additional information about Transgene is available at:

www.transgene.fr

Follow us on Twitter: @TransgeneSA

Disclaimer

This press release contains forward-looking statements, which

are subject to numerous risks and uncertainties, which could cause

actual results to differ materially from those anticipated. The

occurrence of any of these risks could have a significant negative

outcome for the Company’s activities, perspectives, financial

situation, results, regulatory authorities’ agreement with

development phases, and development. The Company’s ability to

commercialize its products depends on but is not limited to the

following factors: positive pre-clinical data may not be predictive

of human clinical results, the success of clinical studies, the

ability to obtain financing and/or partnerships for product

manufacturing, development and commercialization, and marketing

approval by government regulatory authorities. For a discussion of

risks and uncertainties which could cause the Company’s actual

results, financial condition, performance or achievements to differ

from those contained in the forward-looking statements, please

refer to the Risk Factors (“Facteurs de Risque”) section of the

Universal Registration Document, available on the AMF website

(http://www.amf-france.org) or on Transgene’s website

(www.transgene.fr). Forward-looking statements speak only as of the

date on which they are made, and Transgene undertakes no obligation

to update these forward-looking statements, even if new information

becomes available in the future.

Disclaimer

This press release does not constitute an offer to sell nor a

solicitation of an offer to buy, nor shall there be any sale of

shares in any state or jurisdiction in which such an offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

The distribution of this document may, in certain jurisdictions,

be restricted by local legislations. Persons into whose possession

this document comes are required to inform themselves about and to

observe any such potential local restrictions.

This press release is an advertisement and not a prospectus

within the meaning of Regulation (EU) 2017/1129 of the European

Parliament and of the Council of 14 June 2017 (as amended, the

“Prospectus Regulation”). Any decision to purchase shares

must be made solely on the basis of publicly available information

on the Company.

With respect to any member state of the European Economic Area,

including France, any offer of the Company’s securities will be

directed exclusively to qualified investors within the meaning of

Article 2(e) of the Prospectus Regulation and in France in

accordance with the provisions of Article L.411-2, 1° of the French

Monetary and Financial Code.

The distribution of this press release has not been made, and

has not been approved, by an “authorised person” within the meaning

of Article 21(1) of the Financial Services and Markets Act 2000. As

a consequence, this press release is only being distributed to, and

is only directed at, persons in the United Kingdom that (i) are

“investment professionals” falling within Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005 (as amended, the “Order”), (ii) are persons falling

within Article 49(2)(a) to (d) (“high net worth companies,

unincorporated associations, etc.”) of the Order, or (iii) are

persons to whom an invitation or inducement to engage in investment

activity (within the meaning of Article 21 of the Financial

Services and Markets Act 2000) in connection with the issue or sale

of any securities may otherwise lawfully be communicated or caused

to be communicated (all such persons together being referred to as

“Relevant Persons”). Any investment or investment activity

to which this document relates is available only to Relevant

Persons and will be engaged in only with Relevant Persons. Any

person who is not a Relevant Person should not act or rely on this

document or any of its contents. With respect to the United

Kingdom, securities may not be offered or sold absent the

publication of a prospectus in the United Kingdom or an exemption

from such publication under the Prospectus Regulation, as it forms

part of domestic law by virtue of the European Union (Withdrawal)

Act 2018 (the “UK Prospectus Regulation”). As a consequence,

this document is directed only at persons who are qualified

investors as defined in Article 2(e) of the UK Prospectus

Regulation.

This press release may not be published, distributed or

transmitted in the United States (including its territories and

dependencies). This press release does not constitute or form part

of any offer of securities for sale or any solicitation to purchase

or to subscribe for securities or any solicitation of sale of

securities in the United States. The securities referred to herein

have not been and will not be registered under the U.S. Securities

Act of 1933, as amended (the “Securities Act”) or the law of

any State or other jurisdiction of the United States, and may not

be offered or sold in the United States absent registration under

the Securities Act or pursuant to an exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act. The Company does not intend to register all or any

portion of the Securities in the United States under the Securities

Act or to conduct a public offering of securities in the United

States.

Not for distribution directly or indirectly in the United States

of America, Australia, Canada, or Japan.

This press release contains forward-looking statements subject

to a number of risks and uncertainties that could cause actual

results to be materially different from those anticipated. There

can be no guarantee that (i) the results of preclinical work and

previous clinical trials are predictive of the results of the

clinical trials currently underway, (ii)that regulatory approvals

for the Company’s therapies will be obtained or (iii) that the

Company will find partners to develop and market its therapies

within a reasonable timeframe and under satisfactory conditions.

The occurrence of these risks could have a material adverse effect

on the Company’s business, prospects, financial condition, results

of operations or developments.

For a description of the risks and uncertainties that could

affect the Company’s results, financial condition, performance or

achievements and thus cause a variation from the forward-looking

statements, please refer to the "Risk Factors" section of the

Universal Registration Document filed with the AMF and available on

the websites of the AMF (www.amf-france.org) and of the Company

(www.transgene.fr).

The forward-looking statements are made as of the date of this

document and the Company and the Global Coordinators and their

respective affiliates do not undertake to update these

forward-looking statements, even if new information should become

available in the future.

The Global Coordinators are acting exclusively for the Company

and no one else in connection with the offer of new ordinary shares

and will not regard any other person as their respective clients

and will not be responsible to anyone other than the Company for

providing the protections afforded to their respective clients in

connection with any offer of new ordinary shares of the Company or

otherwise, nor for providing any advice in relation to the offer of

new ordinary shares, the content of this press release or any

transaction, arrangement or other matter referred to herein.

None of the Global Coordinators or any of their respective

directors, officers, employees, advisers or agents accepts any

responsibility or liability whatsoever for or makes any

representation or warranty, express or implied, as to the truth,

accuracy or completeness of the information in this press release

(or whether any information has been omitted from this press

release) or any other information relating to the Company, whether

written, oral or in a visual or electronic form, and howsoever

transmitted or made available or for any loss howsoever arising

from any use of this announcement or its contents or otherwise

arising in connection therewith. Therefore, the Company and the

Global Coordinators expressly disclaim, to the fullest extent

permitted by applicable law, any liability, whether in tort or

contract, or otherwise arising out of or in connection with this

document and/or these statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210621005842/en/

Transgene: Lucie Larguier Director Corporate

Communications & IR +33 (0)3 88 27 91 04

investorrelations@transgene.fr

Media: Medistrava Consulting David Dible/Sylvie

Berrebi +44 (0)77 1430 6525 transgene@medistrava.com

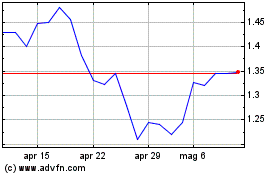

Grafico Azioni Transgene (EU:TNG)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Transgene (EU:TNG)

Storico

Da Apr 2023 a Apr 2024