Tritax EuroBox PLC Exchange Rate for Dividend Payment (5785Q)

26 Febbraio 2021 - 5:49PM

UK Regulatory

TIDMEBOX TIDMBOXE

RNS Number : 5785Q

Tritax EuroBox PLC

26 February 2021

26 February 2021

Tritax EuroBox plc

(the "Company")

EXCHANGE RATE FOR DIVIDEND PAYMENT

On 10 February 2021, the Company declared an interim dividend in

respect of the period from 1 October 2020 to 31 December 2020 of

1.25 cent per Ordinary Share, payable on 12 March 2021 to

shareholders on the Register on 19 February 2021.

In accordance with the Company's dividend policy, dividends are

declared in Euro and paid, by default, in Sterling. The

Euro/Sterling exchange rate for dividend payments made in Sterling

has been determined as 0.8693 resulting in an interim dividend of

1.0866 pence per Ordinary Share. 0.21 cent of each 1.25 cent

dividend per Ordinary Share will be designated as interest

distribution **.

Note:

** As an investment trust under Chapter 4 of Part 24 of the

Corporation Tax Act 2010 ("CTA 2010"), the Company has elected for

the "streaming regime" (the modified UK tax treatment permitted

under CTA 2010) to apply to the dividend paid in respect of

"qualifying interest income" with such dividend designated by the

Company as an "interest distribution", and shareholders will be

taxed accordingly.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Tritax Group

Nick Preston

Mehdi Bourassi

Jo Blackshaw/ Ian Brown (Investor

Relations) +44 (0) 20 7290 1616

Maitland/AMO (Communications Adviser) +44 (0) 20 7379 5151

James Benjamin tritax-maitland@maitland.co.uk

The Company's LEI is: 213800HK59N7H979QU33.

Notes:

Tritax EuroBox plc invests in and manages a well-diversified

portfolio of well-located Continental European logistics real

estate assets that are delivering an attractive capital return and

secure income to shareholders. These assets fulfil key roles in the

logistics and distribution supply-chain focused on the most

established logistics markets and on the major population centres

across core Continental European countries.

Occupier demand for Continental European logistics assets is in

the midst of a major long-term structural change principally driven

by the growth of e-commerce. This is evidenced by technological

advancements, increased automation and supply-chain

optimisation.

The Company's Manager, Tritax Management LLP, has assembled a

full-service European logistics asset management capability

including specialist "on the ground" asset and property managers

with strong market standings in the Continental European logistics

sector.

Further information on Tritax EuroBox plc is available at

www.tritaxeurobox.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DIVDKABQABKDOBB

(END) Dow Jones Newswires

February 26, 2021 11:49 ET (16:49 GMT)

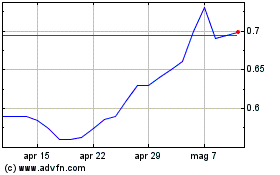

Grafico Azioni Tritax Eurobox (LSE:BOXE)

Storico

Da Mar 2024 a Apr 2024

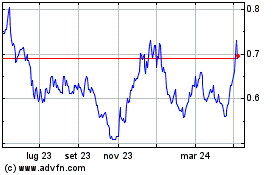

Grafico Azioni Tritax Eurobox (LSE:BOXE)

Storico

Da Apr 2023 a Apr 2024