TIDMEBOX TIDMBOXE

RNS Number : 5188F

Tritax EuroBox PLC

10 March 2020

10 March 2020

Tritax EuroBox plc

(the "Company")

EPRA INDEX INCLUSION AND TRADING UPDATE

The Board of Tritax EuroBox plc (tickers: EBOX (Sterling), BOXE

(Euro)) , which invests in Continental European logistics real

estate assets, is pleased to announce a trading update and

inclusion in the FTSE EPRA/NAREIT Global Real Estate Index

Series.

EPRA Index Inclusion

-- The Board is pleased to advise that it has been notified by

EPRA, the European Public Real Estate Association, that the Company

will be added to the FTSE EPRA/NAREIT Global Real Estate Index

Series with effect from 23 March 2020 having successfully satisfied

the required eligibility criteria during the Index's recent

Quarterly Review.

Trading Update

Market Environment

-- Structural drivers of accelerating e-commerce growth,

automation of omni-channel supply chains, and ongoing urbanisation

continue to increase demand for prime big box logistics assets

across Continental Europe with vacancy rates and the supply of new

development sites now at historic lows.

-- The supply/demand imbalance, alongside rising construction

costs, has led to upward pressure on rental levels across the

Company's chosen markets.

-- Individual asset location, size of property and the resulting

efficiency for tenants remain key considerations with the supply

shortage most acute in large format buildings in established

distribution hubs with strong transportation links near densely

populated areas.

Portfolio Update

-- The Company has built a portfolio of twelve prime, large

logistics assets located across Continental Europe in line with its

investment strategy.

-- The portfolio has exposure to Germany, Italy, Poland, Spain,

Belgium and the Netherlands, with an average property size of

76,000 sqm.

-- Indexation events embedded in the portfolio's leases provide

regular compounding annual increases in income. The portfolio now

benefits from contracted annual rental income of EUR40.4

million.

-- Weighted average unexpired lease term across the portfolio is 9.8 years.

Asset Management Initiatives

-- Completion of a number of income and value enhancing

initiatives since September 2019 including:

o Leasing of vacant space at the asset in Bochum, Germany and

regearing of a lease at Bornem, Belgium, further strengthening the

income profile and diversifying the tenant base of the

portfolio.

o An 88,000 sqm extension has been agreed to the Company's

property in Barcelona, Spain, which is already fully pre-let and

utilises a vacant land plot adjacent to the existing property

already owned by the Company.

-- Further asset management activity is expected across the

portfolio including agreeing pre-let developments on a number of

zoned plots of unused land and further leasing of unoccupied space

(currently subject to rental guarantees) in Breda, Netherlands and

Strykow, Poland.

-- In total these asset management initiatives could add up to

EUR6.1 million of income to the portfolio over the medium term.

Financial Returns

-- Following the recent acquisition in Poland, the Company has

now substantially invested its available cash with the rental

income generated by the current portfolio meaning that the Company

is on schedule to increase the dividend towards the target

level.

-- The combination of the dividend, indexation of rents, value

adding initiatives and capturing of market rental value growth will

assist the Company in delivering the target total accounting return

of 9.0% per annum over the medium term.

Robert Orr, Independent Chairman of Tritax EuroBox,

commented:

"The Board is pleased that the Company will be added to the

FTSE/EPRA NAREIT Index, which is widely followed by global real

estate investors and should assist in continuing to broaden the

Company's investor base and to increase the liquidity of our

shares."

Nick Preston, Fund Manager of Tritax EuroBox, commented:

"We are pleased to be able to report that the portfolio we have

assembled since IPO continues to provide us with opportunities to

create additional shareholder value through active asset

management. Working closely with our management teams and tenants,

we have already delivered a number of these opportunities adding

further income as well as value to the portfolio. We continue to

identify further initiatives and look forward to providing further

updates in due course."

FOR FURTHER INFORMATION, PLEASE CONTACT:

Tritax Group +44 (0) 20 7290 1616

Nick Preston

Mehdi Bourassi

Jefferies International Limited +44 (0) 20 7029 8000

Gary Gould

Stuart Klein

Tom Yeadon

Kempen & Co +31 (0) 20 348 8500

Dick Boer

Thomas ten Hoedt

Akur Limited +44 (0)20 7493 3631

Anthony Richardson

Tom Frost

Siobhan Sergeant

Maitland/AMO (Communications

Adviser) +44 (0) 20 7379 5151

James Benjamin tritax-maitland@maitland.co.uk

The Company's LEI is: 213800HK59N7H979QU33.

NOTES:

Tritax EuroBox plc invests in and manages a well-diversified

portfolio of well-located Continental European logistics real

estate assets that are expected to deliver an attractive capital

return and secure income to shareholders. These assets fulfil key

roles in the logistics and distribution supply-chain focused on the

most established logistics markets and on the major population

centres across core Continental European countries.

Occupier demand for Continental European logistics assets is in

the midst of a major long-term structural change principally driven

by the growth of e-commerce. This is evidenced by technological

advancements, increased automation and supply-chain optimisation,

set against a backdrop of resurgent economic growth across much of

Continental Europe.

The Company's Manager, Tritax Management LLP, has assembled a

full-service European logistics asset management capability

including specialist "on the ground" asset and property managers

with strong market standings in the Continental European logistics

sector.

The Company is targeting, on a fully invested and geared basis,

an initial Ordinary Share dividend yield of 4.75% p.a. (1) , which

is expected to increase progressively through regular indexation

events inherent in underlying lease agreements, and a total return

on the Ordinary Shares of 9.0% p.a. (1) over the medium-term. The

Company pays dividends on a quarterly basis with shareholders able

to receive dividends in Sterling or Euro.

Further information on Tritax EuroBox plc is available at

www.tri taxeurobox.co.uk

1. Euro denominated returns, by reference to IPO issue price.

These are targets only and not profit forecasts. There can be no

assurances that these targets will be met, and they should not be

taken as indications of the Company's expected or actual future

results. Accordingly, potential investors should not place any

reliance on the target in deciding whether or not to invest in the

Company and should not assume that the Company will make any

distributions at all and should decide themselves whether or not

the target is reasonable or achievable.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCKZGGFGLVGGZZ

(END) Dow Jones Newswires

March 10, 2020 03:00 ET (07:00 GMT)

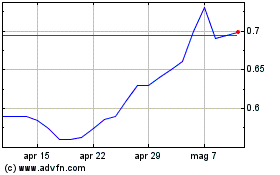

Grafico Azioni Tritax Eurobox (LSE:BOXE)

Storico

Da Mar 2024 a Apr 2024

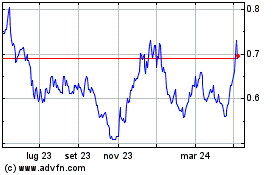

Grafico Azioni Tritax Eurobox (LSE:BOXE)

Storico

Da Apr 2023 a Apr 2024