U.K. to Ban Huawei From Its 5G Network -- 2nd Update

14 Luglio 2020 - 4:12PM

Dow Jones News

By Stephen Fidler and Max Colchester

LONDON -- The British government said it would bar telecom

companies from purchasing new equipment made by China's Huawei

Technologies Co. and gave them until 2027 to remove its technology

from their 5G networks, a sharp about-face that marks a significant

victory for the U.S.

The decision follows new U.S. restrictions on Huawei computer

chips and comes amid a broader deterioration of relations between

the U.K. and China, most recently relating to China's imposition of

a new security law over the former British colony of Hong Kong.

Oliver Dowden, the British minister in charge of digital issues,

told the House of Commons on Tuesday that new purchases of Huawei

5G equipment would be barred starting the end of this year and that

the Chinese company's gear would have to be stripped out of British

networks by the end of 2027. As recently as January, the U.K. said

it could mitigate the risk of Huawei equipment in its networks.

The U.K is also launching a consultation on when to ban the

purchase of Huawei equipment for the country's fiber-optic network.

This will be followed by a transition period that isn't expected to

exceed two years.

The move comes as U.S. pressure builds on European governments

to shut Huawei out of their 5G networks. Senior U.S. officials, led

by U.S. national security adviser Robert O'Brien and his

counterparts from Italy, Germany, France and the U.K. are meeting

in Paris this week.

The Trump administration ratcheted up its pressure on Huawei in

May with restrictions that stop foreign semiconductor manufacturers

whose operations use U.S. software and technology from shipping

chips to Huawei without first getting a license from U.S.

officials. British officials said this restriction raised questions

about the quality of Huawei equipment in the future.

U.S. officials have long said Beijing could direct Huawei to

sabotage or spy through 5G networks, which promise to provide

superfast wireless speeds for coming technologies such as

self-driving cars. Huawei and the Chinese government reject the

charges.

Mr. Dowden said the move, which would be written into law in the

fall, would delay the development of 5G by two to three years and

cost up to GBP2 billion ($2.5 billion). He said the U.S. measure

was "a significant material change" in the risk associated with

using Huawei technology. The sector suffered from "a global market

failure," he said, and was "dangerously reliant on too few

vendors."

The U-turn followed a new review by the U.K.'s National Cyber

Security Centre, part of the nation's GCHQ electronic-intelligence

agency, triggered by the U.S. export ban in May. The swift policy

reversal played out during the coronavirus pandemic.

Ed Brewster, a spokesman for Huawei UK, said the decision

"threatens to move Britain into the digital slow lane." Urging the

government to reconsider, he said the new U.S restrictions wouldn't

have affected the security of the products supplied to the UK.

Mr. Brewster said Huawei, whose equipment will remain in 2G, 3G

and 4G networks in the U.K., would conduct a detailed review of its

business in the U.K. Hours before the announcement, John Browne,

chairman of Huawei's U.K. board, resigned.

The decision is expected to fuel broader discussions about how

the U.K., U.S. and other allies can wean themselves off Chinese

technology and production, an issue underscored in recent months

during the coronavirus pandemic by reliance on Chinese-made medical

supplies for hospitals and caregivers.

Canada remains the lone country in the Five Eyes intelligence

alliance -- which also includes the U.S., U.K. Australia and New

Zealand -- that has yet to decide whether Huawei equipment can be

used in its domestic 5G network.

The long phase-out of Huawei gear suggests the government has

listened to British telecom executives who argued that imposing a

rapid deadline to tear out Huawei gear from their networks would

lead to coverage blackouts for customers, cost billions of pounds

and delay the introduction of 5G.

Senior executives from Vodafone Group PLC and BT Group PLC told

a parliamentary committee last week that a five-to-seven-year time

frame would be needed to remove Huawei equipment to avoid

disruption. Share prices of both companies rose after the

announcement.

A group of Conservative lawmakers has been pressing the

government to remove the equipment at a faster pace.

The providers also use equipment from Huawei's two biggest

competitors, Sweden's Ericsson AB and Finland's Nokia Corp. The

void left by Huawei's could be filled by smaller industry players,

including South Korea's Samsung Electronics Co. and Japan's NEC

Corp.

--Jenny Strasburg and Stu Woo contributed to this article.

Write to Stephen Fidler at stephen.fidler@wsj.com and Max

Colchester at max.colchester@wsj.com

(END) Dow Jones Newswires

July 14, 2020 09:57 ET (13:57 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

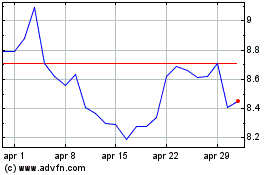

Grafico Azioni Vodafone (NASDAQ:VOD)

Storico

Da Mar 2024 a Apr 2024

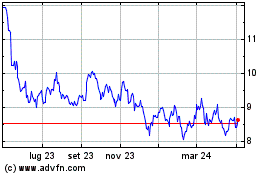

Grafico Azioni Vodafone (NASDAQ:VOD)

Storico

Da Apr 2023 a Apr 2024