U.S. Bancorp 3Q Profit Rises On Credit, Collateral Performance

14 Ottobre 2021 - 1:35PM

Dow Jones News

By Dave Sebastian

U.S. Bancorp said its profit for the third quarter rose due to

lower provision for credit losses driven by a reserve release as

the global economy improved, as well as strong credit and

collateral performance.

The Minneapolis-based bank company, the parent of U.S. Bank, on

Thursday posted net income attributable to the company of $2.03

billion, compared with $1.58 billion in the same period last year.

Earnings were $1.30 a share, compared with 99 cents a share in the

prior year. Analysts polled by FactSet were expecting $1.15 a

share.

Net interest income was $3.17 billion, down from $3.23 billion

in the comparable period last year. Analysts were expecting $3.18

billion. The metric fell due to changes in loan portfolio

composition and lower average loan balances primarily due to

commercial loan paydowns by corporate customers accessing the

capital markets and the Small Business Administration Paycheck

Protection Program, the company said.

Net revenue was $5.89 billion, down from $5.96 billion in the

prior year. Analysts were looking for $5.76 billion.

Provision for credit losses was a benefit of $163 million,

compared with $635 million set aside for possible bad loans in the

year-ago period. Net charge-offs were $147 million, down from $515

million in the third quarter of 2020.

In 2021, the company said additional government stimulus,

widespread vaccine availability in the U.S. and lower levels of new

virus cases have contributed to economic recovery. But economic

uncertainty remains tied to rising inflationary concerns,

additional virus variants and lack of clear path to government

funding, the company said.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

October 14, 2021 07:20 ET (11:20 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

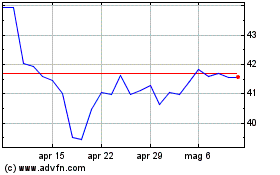

Grafico Azioni US Bancorp (NYSE:USB)

Storico

Da Mar 2024 a Apr 2024

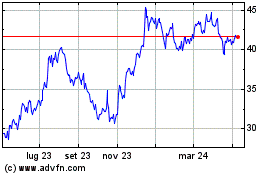

Grafico Azioni US Bancorp (NYSE:USB)

Storico

Da Apr 2023 a Apr 2024