U.S. Dollar Lower As Rate Worries Recede

10 Maggio 2021 - 11:00AM

RTTF2

The U.S. dollar came under pressure against its major

counterparts in the European session on Monday, as a disappointing

U.S. jobs data intensified hopes that the Fed will not pull back

its easy monetary policy anytime soon.

U.S. non-farm payroll employment rose by 266,000 jobs in April,

well below expectations for a rise of 978,000 jobs.

The unemployment rate rose to 6.1 percent in April.

The data helped boost expectations that interest rates would

remain low for longer.

Federal Reserve Bank of Minneapolis President Neel Kashkari told

Bloomberg Television that Friday's job numbers validates the

central bank's new outcome-based approach to policy.

Investors focus on inflation data due out on Wednesday for more

direction.

No major economic data is due today.

The greenback fell to 2-1/2-month lows of 0.8987 against the

franc and 1.4121 against the pound, down from last week's closing

values of 0.9002 and 1.3986, respectively. The next possible

support for the greenback is seen around 0.86 against the franc and

1.45 against the pound.

The greenback dropped back to 1.2175 against the euro, heading

to pierce its Asian session's 2-1/2-month low of 1.2177. If the

greenback slides further, 1.24 is likely seen as its next support

level.

Survey results from Sentix showed that Eurozone investor

confidence improved to the highest level in more than three years

in May suggesting that the recession caused by the coronavirus has

been overcome.

The investor confidence index rose notably to 21.0 in May from

13.1 in April. The score was the highest since March 2018. The

reading was forecast to climb moderately to 14.0.

The greenback depreciated to a 2-1/2-month low of 0.7890 against

the aussie and more than a 2-month low of 0.7300 versus the kiwi,

compared to Friday's values of 0.7840 and 0.7276, respectively. The

greenback is likely to challenge support around 0.82 against the

aussie and 0.74 versus the kiwi.

The greenback declined to a 3-1/2-year low of 1.2094 against the

loonie from Friday's close of 1.2123. Next key support for the

currency is seen around the 1.19 level.

The U.S. currency pulled back to 108.65 against the yen, from a

high of 109.06 hit at 3:30 am ET. The greenback is seen finding

support around the 106.00 mark.

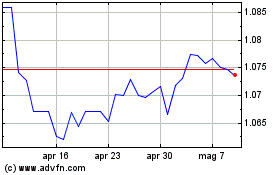

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Mar 2024 a Apr 2024

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Apr 2023 a Apr 2024