VALBIOTIS Announces a Cash Position of €10.9M at 30 June 2020

28 Luglio 2020 - 7:35AM

Business Wire

Nearly €8M in Additional Resources Already

Secured:

- CHF 3M from the first milestone payment from Nestlé Health

Science, due in September

- €2M raised from AMIRAL GESTION, as part of the capital increase

carried out in the form of a private placement with a 5.4%

premium1

- €3M of a PGE (Loan Guaranteed by the French State),

non-dilutive financing of €3M from Bpifrance, BNP Paribas and

Société Générale

Regulatory News:

VALBIOTIS (Paris:ALVAL) (FR0013254851 - ALVAL, PEA/SME

eligible), a Research & Development company committed to

scientific innovation for preventing and combating metabolic

diseases, today announces the strengthening of its cash position

with nearly €8M of additional resources already secured.

At 30 June 2020, VALBIOTIS had a cash position of €10,913 K

(unaudited data), compared to €8,033 K at 31 December 2019. This

cash position does not include additional financing obtained since

that date:

- The receipt of CHF 3M during September for

Nestlé Health Science's first milestone payment following the first

patient visit in the REVERSE-IT clinical study;

- The proceeds of the capital increase

carried out with a new shareholder, AMIRAL GESTION, for a gross

amount of €2M, on the basis of a price per share of €4.50,

representing a 5.4% premium over the closing share price on 16 July

2020;

- The payment of a PGE (Loan Guaranteed by

the French State) for an amount of €3M.

With a strengthened and sustainable financial structure, the

Company, while continuing the final stages of the development of

TOTUM-63 financed by Nestlé Health Science, who will also be in

charge of its commercialization, can accelerate development of its

research programs on the reduction of LDL blood cholesterol

(TOTUM-070), the reduction of blood pressure (TOTUM-854) and the

reduction of hepatic steatosis (TOTUM-448).

Jocelyn PINEAU, co-founder and CFO of VALBIOTIS, comments: "The

first half of 2020 saw a number of milestones achieved. We signed a

partnership with Nestlé Health Science to fund the completion of

the development of TOTUM-63, our first product, through to

commercialization and health claim submissions to the US and

European authorities. New revenues resulting from this agreement

combined with AMIRAL GESTION's entry into the capital and obtaining

a PGE considerably strengthens our cash position and secures our

financial situation. We would like to thank the public authorities

and our banking partners, as well as all our institutional and

individual shareholders. We are now able to focus all our efforts

on the further development of our promising pipeline with a view to

concluding new licensing agreements, in line with our strategic

plan.”

ABOUT VALBIOTIS VALBIOTIS is a Research

& Development company committed to scientific innovation for

preventing and combating metabolic diseases in response to unmet

medical needs. VALBIOTIS has adopted an innovative approach, aiming

to revolutionize healthcare by developing a new class of

nutritional health solutions designed to reduce the risk of major

metabolic diseases, based on a multi-target approach and made

possible by the use of plant-based ingredients. Its products are

intended to be licensed to players in the health world. VALBIOTIS

was founded in La Rochelle in early 2014 and has formed numerous

partnerships with top academic centers. The Company has established

three sites in France – Périgny, La Rochelle (17) and Riom (63).

VALBIOTIS is a member of the "BPI Excellence" network and received

the "Innovative Company" status accorded by BPI France. Valbiotis

has also been awarded "Young Innovative Company" status and has

received major financial support from the European Union for its

research programs by obtaining support from the European Regional

Development Fund (ERDF). VALBIOTIS is a PEA-SME eligible company.

Find out more about VALBIOTIS: www.valbiotis.com

Name: Valbiotis ISIN code: FR0013254851

Mnemonic code: ALVAL

DISCLAIMER This press release contains forward-looking

statements about VALBIOTIS' objectives, based on rational

hypotheses and the information available to the company at the

present time. However, in no way does this constitute a guarantee

of future performance, and these projections can be reconsidered

based on changes in economic conditions and financial markets, as

well as a certain number of risks and doubts, including those

described in the VALBIOTIS core document, filed with the French

Financial Markets Regulator (AMF) on 31 July 2019 (application

number R19-030) as well in its supplement approved by the AMF on

Octobre 9, 2019. These documents being available on the Company’s

website (www.valbiotis.com). This press release, as well as the

information contained herein, does not constitute an offer to sell

or subscribe to, or a solicitation to purchase or subscribe to,

VALBIOTIS' shares or securities in any country.

--------------------------------------------

1 Based on a share price of €4.50, which represents a 5.4%

premium over the closing share price on 16 July 2020.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200727005585/en/

CORPORATE COMMUNICATION / VALBIOTIS Carole ROCHER / Marc

DELAUNAY +33 5 46 28 62 58 media@valbiotis.com

FINANCIAL COMMUNICATION / ACTIFIN Stéphane RUIZ +33 1 56 88 11

14 sruiz@actifin.fr

MEDIA RELATIONS / MADIS PHILEO Guillaume DE CHAMISSO +33 6 85 91

32 56 guillaume.dechamisso@madisphileo.com

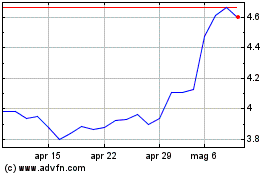

Grafico Azioni Valbiotis (EU:ALVAL)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Valbiotis (EU:ALVAL)

Storico

Da Apr 2023 a Apr 2024