VGP NV: Allianz and VGP Joint Venture Completes €232M Logistics Purchase

28 Novembre 2019 - 6:11PM

VGP NV: Allianz and VGP Joint Venture Completes €232M Logistics

Purchase

PRESS RELEASE

Regulated Information

Antwerp, Belgium / Munich, Germany, 28

November 2019 (6.00 p.m. CET)

VGP NV ('VGP' or 'the Company') and Allianz Real

Estate, acting on behalf of several Allianz Group companies, today

announced a successful sixth closing with its 50:50 joint venture,

VGP European Logistics (‘First Joint Venture’). The transaction

comprised of 13 logistic buildings, including 7 buildings in 3 new

VGP parks and another 6 newly completed logistic buildings which

were developed in parks previously transferred to the Joint

Venture.

The 13 buildings are located in Germany (9) and

in the Czech Republic (4).

The transaction value is in excess of €

232 million1, which includes some future development pipeline. The

gross proceeds from this transaction amounts to circa € 130

million.

The proceeds have been applied towards the

repayment of short term bank debt of € 50.0 million which was

incurred in the run-up to the closing. The remaining proceeds will

be applied towards the further expansion of the development

pipeline i.e. acquisition of new development land and financing of

existing projects under construction and new projects which will be

started-up shortly.

Following the completion of this sixth closing

of the First Joint Venture, the Joint Ventures’2 property

portfolio consist of 91 completed buildings (of which 81 buildings

held by the First Joint Venture) representing 1,761,000 m² of

lettable area (of which 1,584,000 m² related to the First Joint

Venture), with a 99.5% occupancy rate.

Following the closing the own property portfolio

of VGP now consists of 5 completed buildings representing 117,000

m² of lettable area, with an 100% occupancy rate. Besides this, VGP

is currently developing another 34 new buildings of which 12

buildings (193,000 m²) are being developed on behalf of the Joint

Ventures².

For Allianz Real Estate, this transaction adds

to its €6.6 billion global logistics AuM, an asset class in which

the firm has materially increased its exposure over the last few

years with a focus on grade A logistics portfolios in prime

locations.

The increase in the Joint Ventures’ portfolio

should have a further positive impact on the fee income generated

by the asset-, property-, and development management services

rendered by VGP to the Joint Ventures.

CONTACT DETAILS FOR INVESTORS AND MEDIA

ENQUIRIES

|

Martijn Vlutters VGP – Investor Relations |

Tel: +32 (0)3 289 1433 |

|

Petra Vanclova VGP – External Communications |

Tel: +42 0 602 262 107 |

|

Phillip LeeAllianz Real Estate – Marketing &

Communications |

Tel: +49 89 3800 8234 |

|

Anette NachbarBrunswick Group |

Tel: +49 152 288 10363 |

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking

statements. Such statements reflect the current views of management

regarding future events, and involve known and unknown risks,

uncertainties and other factors that may cause actual results to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. VGP is providing the information in this press release

as of this date and does not undertake any obligation to update any

forward-looking statements contained in this press release in light

of new information, future events or otherwise. The information in

this announcement does not constitute an offer to sell or an

invitation to buy securities in VGP or an invitation or inducement

to engage in any other investment activities. VGP disclaims

any liability for statements made or published by third parties and

does not undertake any obligation to correct inaccurate data,

information, conclusions or opinions published by third parties in

relation to this or any other press release issued by VGP.

ABOUT VGP

VGP is a leading pan-European developer, manager

and owner of high-quality logistics and semi-industrial real

estate. VGP operates a fully integrated business model with

capabilities and longstanding expertise across the value chain. The

company has a well-advanced development land bank of 7.0 million m²

and the strategic focus is on the development of business parks.

Founded in 1998 as a family-owned real estate developer in the

Czech Republic, VGP with a staff of over 200 employees today owns

and operates assets in 12 European countries directly and through

VGP European Logistics and VGP European Logistics 2, both joint

ventures with Allianz Real Estate. As of June 2019, the Gross Asset

Value of VGP, including the joint venture at 100%, amounted to €2.2

billion and the company had a Net Asset Value (EPRA NAV) of €604

million. VGP is listed on Euronext Brussels and on the Prague Stock

Exchange (ISIN: BE0003878957).

For more information, please

visit: http://www.vgpparks.eu

ABOUT ALLIANZ REAL ESTATE

Allianz Real Estate is the dedicated real estate

investment manager within the Allianz Group and has grown to become

the world’s largest investor in real estate. The firm develops and

executes worldwide tailored portfolio and investment strategies on

behalf of a range of global liability driven investors, including

Allianz companies, creating value for clients through direct as

well as indirect investments and real estate loans. Headquartered

in Munich and Paris, the operational management of investments and

assets is performed out of 19 offices in key gateway cities across

5 regions (West Europe, North & Central Europe, Switzerland,

USA and Asia Pacific). As at 30 June 2019, Allianz Real Estate held

67.1 billion euros assets under management.

For more information, please visit:

http://www.allianz-realestate.com

1 The transaction value is composed of the purchase price for

the completed income generating buildings and the net book value of

the development pipeline which is transferred as part of a closing

but not yet paid for by the First Joint Venture.

2 Joint Ventures means either and each of (i) the First Joint

Venture i.e. VGP European Logistics S.à r.l., the 50:50 joint

venture between VGP and Allianz; and (ii) the Second Joint Venture

i.e. VGP European Logistics 2 S.à r.l., the 50:50 joint

venture between VGP and Allianz. For more information

regarding the joint ventures, please visit:

https://www.vgpparks.eu/en/about/joint-ventures/

- Sixth closing VGP European Logistics JV - EN

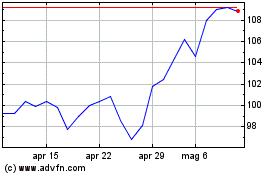

Grafico Azioni VGP NV (EU:VGP)

Storico

Da Mar 2024 a Apr 2024

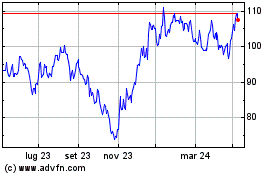

Grafico Azioni VGP NV (EU:VGP)

Storico

Da Apr 2023 a Apr 2024