VGP NV: Successfully Prices Accelerated Bookbuild Offering for €200 Million

21 Aprile 2020 - 6:00PM

VGP NV: Successfully Prices Accelerated Bookbuild Offering for €200

Million

NOT FOR DISTRIBUTION IN OR INTO THE UNITED STATES OF

AMERICA, JAPAN, CANADA, AUSTRALIA OR SWITZERLAND

21 April 2020, 6:00pm, Antwerp

(Berchem), Belgium: VGP NV (‘VGP’ or ‘the Company’), a

leading European provider of high-quality logistics and

semi-industrial real estate, announces today that it successfully

priced an offering of €200.0 million in gross proceeds by means of

a private placement of new ordinary shares via an accelerated

bookbuild offering to international institutional investors of

2,000,000 new shares (approximately 10.8% of the Company's

outstanding shares on completion of the offering) at an issue price

of €100.00 per share, representing a discount of 4.58% compared to

the last traded price of the Company’s share on 21 April 2020 of

€104.8 (the ‘Capital Increase’).

In line with their pre-commitments, Little Rock

SA, controlled by Mr Jan Van Geet, and VM Invest NV, controlled by

Mr Bart Van Malderen, have each subscribed for 33.81% and 20.16% of

the new shares respectively, and received full allocations.

VGP’s Chief Executive Officer,

Mr. Jan Van Geet, said: "We are

very pleased to announce the successful completion of this equity

raising which met with strong demand from both local and

international investors. This exercise has provided us with

additional resources to pursue our strategy of capturing investment

opportunities and will ensure we can deliver on our significant

pre-committed pipeline. We are grateful for the ongoing support by

existing and welcome our new investors.”

VGP will use the net proceeds from the Capital

Increase to further increase its financial purchasing power and

strengthen its shareholders’ equity in order to finance the

investment pipeline and to be able to benefit from additional

investment opportunities.

J.P. Morgan Securities plc and KBC Securities NV

acted as Joint Global Coordinators and Joint Bookrunners of the

Capital Increase, and Belfius Bank NV/SA acted as Joint Bookrunner

(together, the ‘Underwriters’).

The Company has agreed, subject to customary

exceptions, that it will not, for a period of 180 days from the

Closing Date, without the prior written consent of the Joint Global

Coordinators, acting on behalf of the Underwriters, issue, offer or

sell any Shares of the Company or any securities convertible into

Shares of the Company, or file any registration statement under the

U.S. Securities Act or any similar document with any other

securities regulator, stock exchange or listing authority with

respect to any of the foregoing.

The payment and delivery of the new shares is

expected to take place on or about 23 April 2020 (the ‘Closing

Date’), and an application will be made to admit the new shares to

trading on the regulated market of Euronext Brussels and Prague

Stock Exchange at the same time. The new shares will be issued in

accordance with Belgian law and are ordinary shares that represent

the capital of the Company, in the same form as the existing

ordinary shares. They shall confer the same rights as the existing

ordinary shares. The new shares will be entitled to dividends from

the moment of admission. They therefore confer the right to the

dividend for which VGP envisages a gross amount of €60,394,913,

with payment date in 2020 calendar year (the determination of the

exact payment date is proposed to be delegated to the board of

directors by the ordinary shareholders’ meeting scheduled for 8 May

2020). Based on the total number of new ordinary shares outstanding

after the Capital Increase, the dividend per share for all shares

will therefore be adjusted to €2.9342 per share (instead of €3.25

per ordinary share as previously announced).

As a result of the issuance of the new shares,

the Company's outstanding shares will increase from 18,583,050 to

20,583,050 ordinary shares.

DISCLAIMER

This announcement shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of the securities referred to herein, in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior

to registration, exemption from registration or qualification under

the securities laws of any such jurisdiction.

This announcement is not for distribution,

directly or indirectly in the United States of America, Canada,

Australia, Japan or Switzerland, or any other jurisdiction where

distribution would not be permitted by law. The information

contained herein does not constitute an offer of securities for

sale in the United States of America, Australia, Canada, Japan,

South Africa or Switzerland.

This announcement does not constitute an offer

of securities in the United States of America, or a solicitation to

purchase securities in the United States of America. The securities

referred to herein have not been and will not be registered under

the United States Securities Act of 1933, as amended (the “US

Securities Act”), or under the securities law of any state or

jurisdiction in the United States of America and may not be

offered, sold, resold, transferred or delivered, directly or

indirectly within the United States of America except pursuant to

an applicable exemption from the registration requirements of the

US Securities Act and in compliance with any applicable securities

laws of any state or jurisdiction of the United States of America.

The company has not registered, and does not intend to register,

any portion of the offering in the United States of America. There

will be no public offer of securities in the United States of

America.

In the European Economic Area and in the United

Kingdom an offer of securities to which this communication relates

is only addressed to and is only directed at qualified investors in

that Member State and the United Kingdom within the meaning of

Regulation (EU) 2017/1129 of the European Parliament and of the

Council of 14 June 2017 on the prospectus to be published when

securities are offered to the public or admitted to trading on a

regulated market, and repealing Directive 2003/71/EC, and any

implementing measure in each relevant Member State of the EEA and

in the United Kingdom.

- Fides_ABB Pricing Press Release (EN) FINAL

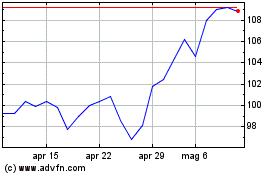

Grafico Azioni VGP NV (EU:VGP)

Storico

Da Mar 2024 a Apr 2024

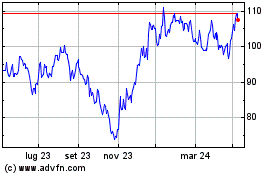

Grafico Azioni VGP NV (EU:VGP)

Storico

Da Apr 2023 a Apr 2024