Van Lanschot Kempen trading update: first quarter of 2020

07 Maggio 2020 - 7:30AM

Van Lanschot Kempen trading update: first quarter of 2020

- The unprecedented impact of Covid-19 on the world’s

economies, financial markets and society at large has also affected

our performance

- The underlying activities of primarily Private Banking

and Asset Management are making good progress

- A series of incidental items related to the market

volatility has resulted in net losses of €10.5

million

- Net AuM inflows of €1.8 billion underpins the success

of our integrated wealth management model

- Limited credit exposure makes for low levels of

provisioning

- Liquidity and solvency remain very robust at an LCR of

151.6% and a CET 1 ratio of 22.8%

Van

Lanschot Kempen today published its trading update for the first

quarter of 2020. Please note that due to the exceptional

circumstances, additional financial information has been

provided.

Constant Korthout, Chief Financial & Risk Officer, said:

“The world is facing the substantial challenge of addressing the

issues related to the coronavirus crisis. Current circumstances are

extraordinary, with nearly 90% of our staff working from home. The

pandemic has had an impact on our clients as well. We are very

aware that these are times when we can make a difference by being

there for our clients and by providing tailored and client-specific

assistance, particularly with respect to our private banking

clients. Needless to say, we are very grateful to our clients for

their trust, as evidenced by the inflows recorded at Private

Banking and Asset Management.

“Regrettably, we have to report a loss for this first quarter;

the outcome of a very volatile market leading to a number of

incidental items. As part of our 2013 strategic reorientation, we

have been able to materially re-risk our balance sheet.

Consequently, our credit exposure is limited, largely consisting of

Dutch residential mortgages. As such, this has allowed us to

maintain low levels of provisioning.

“Client assets and assets under management (AuM) have declined

during the quarter – from €102.0 billion to €94.5 billion and from

€87.7 billion to €80.6 billion respectively. The net inflows of

€1.8 billion were not sufficient to offset the negative market

impact. Savings and deposits were unchanged at €9.5 billion while

the overall loan portfolio was marginally higher at €8.8

billion.

“Our capital and liquidity ratios have remained robust.

“First-quarter costs developed in line with the guidance given

earlier. We have also proactively initiated a series of additional

cost saving measures. With these measures and in normal market

conditions, we expect the year to end on a positive note.”

PRESENTATION/WEBCAST In view of the current

circumstances, we will discuss our Q1 2020 results in a conference

call to be held on 7 May at 9:00 am. This may be viewed live at

www.vanlanschotkempen.com/results and played back at a later date.

ADDITIONAL INFORMATIONFor additional information,

go to www.vanlanschotkempen.com/financial

FINANCIAL CALENDAR28 May 2020

Annual general meeting26 August

2020 Publication of 2020 half-year results

Media Relations: +31 20 354 45 85;

mediarelations@vanlanschotkempen.com Investor Relations: +31 20 354

45 90; investorrelations@vanlanschotkempen.com

About Van Lanschot Kempen Van Lanschot Kempen,

a wealth manager operating under the Van Lanschot, Evi and Kempen

brand names, is active in Private Banking, Asset Management and

Merchant Banking, with the aim of preserving and creating wealth,

in a sustainable way, for its clients. Van Lanschot Kempen, listed

at Euronext Amsterdam, is the Netherlands’ oldest independent

financial institution with a history dating back to 1737.

For more information, please visit vanlanschotkempen.com

Disclaimer and cautionary note on forward-looking

statements This press release may contain forward-looking

statements on future events and developments. These forward-looking

statements are based on the current insights, information and

assumptions of Van Lanschot Kempen’s management about known and

unknown risks, developments and uncertainties. Forward-looking

statements do not relate strictly to historical or current facts

and are subject to such risks, developments and uncertainties which

by their very nature fall outside the control of Van Lanschot

Kempen and its management.

Actual results, performances and circumstances may differ

considerably from these forward-looking statements as a result of

risks, developments and uncertainties relating to, but not limited

to, (a) estimates of income growth, (b) costs, (c) the

macroeconomic and business climate, (d) political and market

trends, (e) interest rates and currency exchange rates, (f)

behaviour of clients, competitors, investors and counterparties,

(g) the implementation of Van Lanschot Kempen’s strategy, (h)

actions taken by supervisory and regulatory authorities and private

entities, (i) changes in law and taxation, (j) changes in ownership

that could affect the future availability of capital, (k) changes

in credit ratings, and (l) evolution and economic and societal

impact of a pandemic.

Van Lanschot Kempen cautions that forward-looking statements in

this press release are only valid on the specific dates on which

they are expressed, and accepts no responsibility or obligation to

revise or update any information, whether as a result of new

information or for any other reason.

The financial data in this press release have not been audited,

unless specifically stated otherwise. Small differences are

possible in the tables due to rounding.

This press release does not constitute an offer or solicitation

for the sale, purchase or acquisition in any other way or

subscription to any financial instrument and is not a

recommendation to perform or refrain from performing any

action.

Elements of this press release contain information about Van

Lanschot Kempen NV and/or Van Lanschot Kempen Wealth Management NV

within the meaning of Article 7(1) to (4) of EU Regulation No.

596/2014.

This press release is a translation of the Dutch language

original and is provided as a courtesy only. In the event of any

disparities, the Dutch language version will prevail. No rights can

be derived from any translation thereof.

- Press release Q1 2020 trading update

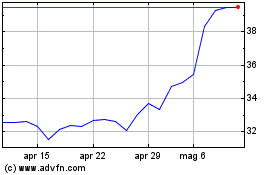

Grafico Azioni Van Lanschot Kempen NV (EU:VLK)

Storico

Da Mar 2024 a Apr 2024

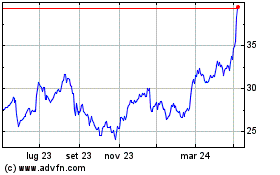

Grafico Azioni Van Lanschot Kempen NV (EU:VLK)

Storico

Da Apr 2023 a Apr 2024