Venture Capitalist Bill Gurley Takes Personal Position In Ethereum, Here’s Why

01 Settembre 2021 - 7:00PM

NEWSBTC

Investing in Ethereum seems to be top of mind for prominent members

of the finance community. The increasing use cases of the Ethereum

network have brought some significant names into its camp. The

latest on the list though is venture Capitalist Bill Gurley. Gurley

is a general partner at Benchmark, which is a Silicon Valley

venture capital firm that is based in Menlo Park, California.

Gurley has been listed consistently on the Forbes Midas List, while

simultaneously being considered one of the technology’s top

dealmakers. Related Reading | You Can Now Use Your .COM Domain

As An Ethereum Wallet Thanks To This Integration Gurley’s latest

investment interest now happens to be Ethereum. The venture

capitalist revealed that he had taken a personal interest in Ether,

thus leading to him taking a personal position in the digital

asset, which he now owns. Gurley Swayed By Ethereum Community

Venture capitalist Bill Gurley explained why he had taken a

position in Ethereum. Gurley said that he had been swayed by

arguments being made for ETH, thus prom timing him to take a

personal position in the asset. “I have to say I was swayed by the

arguments of the Ethereum crowd,” Gurley revealed. “And so, I’ve

taken a personal position.” Related Reading | Ex-Goldman Exec And

Real Vision Founder Puts Ethereum Value At $20,000 By March 2022

Another important point for Gurley is the commitment of the

Ethereum team to the project and its community. “The party that’s

involved seems to be way more pragmatic,” said Gurley. “ They seem

to be more open to changes and are basically making several changes

which I think will bring down fees and will be very beneficial. The

developer community is clearly in the Ethereum cam.” Gurley also

explained that he was not making an argument for everyone being

involved in crypto. Neither did his current investments make him a

maximalist in any way. ETH price breaks three-month high | Source:

ETHUSD on TradingView.com “I think there’s a ESG (environmental,

social, and governance) benefit once they move to proof of stake

versus bitcoin. It seems to me to be the smarter way to play if

you’re going to have crypto exposure.” Gurley clarified that his

investment in Ether was a personal one and that it had nothing to

do with his venture firm. Furthermore, Gurley did not disclose how

much he had bought in ETH. Only that he had taken a personal

position in the asset. Robinhood Is More Like A Casino Bill Gurley

had some comments about Robinhood’s recent reveal. The trading

company had revealed earlier that more than half of revenue had

come from crypto trading. With 62% of its entire crypto trading

revenue coming from the meme coin Dogecoin alone. The venture

capitalist stressed that Robinhood’s current business model was not

a sound one. He likened the business model of Robinhood to that of

a casino rather than an investment platform. Related Reading

| Deloitte Survey Shows 76% Of Finance Execs Think Physical

Money Is Nearing Its End It is not clear how much Robinhood plans

to focus on crypto trading on the platform. While investors can

also invest in coins like Bitcoin and Ethereum on the platform,

most favor investing in Dogecoin. This has led to massive growth

for Robinhood. But the sustainability of this business model

remains to be seen. Featured image from Nasdaq, chart from

TradingView.com

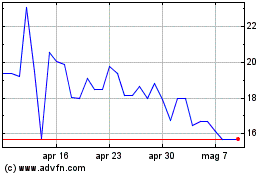

Grafico Azioni NEO (COIN:NEOUSD)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni NEO (COIN:NEOUSD)

Storico

Da Apr 2023 a Apr 2024

Notizie in Tempo Reale relative a NEO (Criptovaluta): 0 articoli recenti

Più NEO Articoli Notizie