TIDMVLG

RNS Number : 9541A

Venture Life Group PLC

07 June 2021

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 which is part of UK law

by virtue of the European Union (Withdrawal) Act 2018.

For immediate release

Venture Life Group PLC

("VLG" or the "Company")

Acquisition of BBI Healthcare Limited

Venture Life Group PLC (AIM: VLG), a leader in developing,

manufacturing and commercialising products for the international

self-care market, announces that is has acquired BBI Healthcare

Limited ("BBIH"), a global market leading Women's Health and Energy

Management/Diabetes company, for a total consideration of up to

GBP36.0m. The acquisition of BBIH, which is expected to be

immediately earnings enhancing, is from BBI Diagnostics Group

Limited (the "Seller"), a company ultimately majority owned by

Exponent Private Equity.

The Board consider the acquisition of BBIH is one of high

strategic value for VLG. BBIH joins the VLG Group as a growing and

profitable business in its own right as well as presenting the

opportunity for meaningful cost and revenue synergies to be

realised. Furthermore, and of significant strategic value to VLG,

the acquisition of BBIH establishes VLG in two new high interest

areas of Women's Health and Diabetes/Energy Management.

BBIH and its subsidiaries, headquartered in Crumlin, South

Wales, has a manufacturing facility in Gnesta, Sweden, employs 21

people across the UK and Sweden and benefits from a strong

management team, the majority of whom will transition to VLG as

part of the acquisition.

BBIH produces and markets products within two key consumer

healthcare segments of Women's Health and Diabetes/Energy

Management. In Women's Health, BBIH has the Balance Activ (â) brand

for the treatment of bacterial vaginosis ("BV") and also sells this

product under customer brand names through a number of

international partners. In Diabetes/Energy Management BBIH has two

brands of glucose supplements: Glucogel (â) , which is prescribed

for hypoglycemia and Lift (â) , which is a range of glucose gels,

shots and chewable tables.

Balance Activ is the leading UK brand for the BV indication by

volume and Glucogel is the number one glucose gel prescribed in the

UK for hypoglycemia. Balance Activ and Lift are sold directly to

retailers in the UK, including Boots, Superdrug and Tesco, as well

as being available for purchase on Amazon UK. Glucogel is primarily

sold through pharmacy chains and independent pharmacies throughout

the UK. BBIH owns all the IP associated with these brands and its

products are currently sold or partnered across 27 countries. The

BV product has historically been sold as a gel but BBIH has

recently developed and launched a nascent patented pessary

formulation of the product.

Balance Activ is also sold through a number of well-known

partners internationally under customers' brand names, where the

product is currently marketed in 25 countries. In addition, BBIH

recently developed a new Women's Health product, and in April 2021

signed a new agreement with a prominent international partner for

the distribution of this product to be launched under their own

well-known brand in a number of countries (in Europe, USA &

China). The first orders for this product have already been shipped

in H1 2021.

For the year ended 31 December 2020, BBIH generated adjusted

EBITDA of GBP2.6m (reported EBITDA GBP2.3m) on revenues of

GBP10.2m. Net assets at 31 December 2020 were GBP2.4m. During the

last quarter of 2020 and the first half of 2021, a number of areas

of new business were put in place at BBIH that, whilst not

impacting the 2020 numbers, the Board of VLG expects to deliver

meaningful impact during 2021 through revenue growth and a

corresponding material positive impact on 2021 profitability.

Amongst other things, this revenue growth is expected to be

generated from the nascent BV patented pessary product and the new

Women's Health product, as they launch with partners in new

territories. In addition to these recent product initiatives, the

VLG Board has identified a number of immediate post acquisition

cost synergies that are expected to further enhance BBIH's

profitability as part of VLG. The Board also expects the Group to

benefit from future cross selling opportunities between BBIH and

the existing VLG products and customers.

The Board of VLG considers that BBIH is highly complementary to

VLG's strategy, fits well with VLG's stage of development and will

propel VLG to a leader in the Women's Health and Energy

Management/Diabetes categories. The Board believes that VLG will be

able to derive significant benefits from applying the operating

leverage it has within the Company to BBIH and that the acquisition

is consistent with the Group's long held strategy of growth by both

organic and acquired means.

The total consideration payable is up to GBP36m made up of

GBP35m in cash on completion (being GBP25.4m in respect of the BBIH

shares and the balance by way of payment of amounts due to the

Seller), and deferred consideration of a further GBP1m, payable to

the Seller on receipt of FDA approval for the new Women's Health

product for the US market. The consideration will be funded from

VLG's existing cash resources. The Company expects to have a

revolving credit facility in place shortly after completion of the

transaction.

Jerry Randall, CEO commented : 'I am delighted to announce the

acquisition of BBIH. This is a strong and significant strategic

acquisition, and is expected to be immediately earnings enhancing

for VLG.

BBIH is a well-established, growing and profitable consumer

healthcare business, with a strong offering both of its own brands

and also customer brands. Products are currently sold or partnered

in 27 countries, with a significant direct-to-retail presence in

the UK, which will add to the already significant direct-to-retail

presence VLG has in the UK.

We are conscious that the headline purchase multiple against

BBIH's 2020 EBITDA appears higher than our normal target, however,

this is a strategic acquisition for us, and both I and the Board

believe we have achieved value for money; we have acquired a

growing business with multiple new revenue initiatives that are

already impacting 2021 as well as a business where we have

identified immediate cost savings to derive further value and one

that soundly establishes us in two new verticals. In addition to

this, we expect to realise attractive revenue synergies. It is,

therefore, our expectation that adjusted for a full year effect of

immediate cost savings (and before we have achieved any revenue

synergies), the acquisition would represent a high single digit

EV/EBITDA multiple for FY21 and we expect further revenue growth in

2022 and beyond.

The business comes with its own manufacturing facility in Gnesta

(near Stockholm), Sweden, which manufactures the BV gel product.

This facility has been heavily invested in by the Seller and

possesses fully automated production machinery that is currently

running at circa 20% capacity. This facility has significant

capacity for volume growth and provides VLG the opportunity to

increase output to meet and generate new business.

The acquisition will initially utilise the cash raised in

December 2020 and afterwards we intend to put in place a revolving

credit facility to repatriate some of the cash back onto our

balance sheet, which will still leave significant firepower in our

resources for further acquisitions, such as Project Vulcan, which

is still in progress and we expect to update the market on soon. We

are very grateful for the support shown by both our existing and

new shareholders in our placing in December 2020, which, by virtue

of the cash it put in our balance sheet, enabled VLG to enter into

discussions to acquire this exciting business, which we otherwise

would have been precluded from. This is validation of our strategy

that, armed with cash on our balance sheet, we can be successful in

acquiring attractive assets. This exciting and growing business is

primed for more growth in our hands."

For further information, please contact:

+44 (0) 1344

Venture Life Group PLC 578004

Jerry Randall, Chief Executive Officer

+44 (0) 20 7397

Cenkos Securities plc (Nomad and Joint Broker) 8900

Michael Johnson / Russell Kerr (Sales)

Stephen Keys / Camilla Hume (Corporate Finance)

+44 (0) 20 7496

N+1 Singer (Joint Broker) 3000

Jonathan Dighe (Sales)

Shaun Dobson / Steven Pearce (Corporate Finance)

FTI Consulting

Kit Dunford |+44 (0)7717 417 038 | kit.dunford@fticonsulting.com

Katherine Bell | +44 (0)7976 870 961 | katherine.bell@fticonsulting.com

About Venture Life ( www.venture-life.com )

Venture Life is an international consumer self-care company

focused on developing, manufacturing and commercialising products

for the global self-care market. With operations in the UK, The

Netherlands and Italy, the Group's product portfolio includes some

key products such as the UltraDEX and Dentyl oral care product

ranges, food supplements for maintaining brain function, medical

devices for women's intimate healthcare, fungal infections and

proctology, and dermo-cosmetics for addressing the signs of

ageing.

The products, which are typically recommended by pharmacists or

healthcare practitioners, are available primarily through

pharmacies and grocery multiples. In the UK and The Netherlands

these are supplied direct by the company to retailers, elsewhere

they are supplied by the Group's international distribution

partners.

Through its Development & Manufacturing business in Italy,

Biokosmes, the Group also provides development and manufacturing

services to companies in the medical devices and cosmetic

sectors.

Forward-looking Statements

This news release contains forward -- looking information. The

statements are based on reasonable assumptions and expectations of

management and VLG provides no assurance that actual events will

meet management's expectations. In certain cases, forward --

looking information may be identified by such terms as

"anticipates", "believes", "could", "estimates", "expects", "may",

"shall", "will", or "would". Although VLG believes the expectations

expressed in such forward -- looking statements are based on

reasonable assumptions, such statements are not guarantees of

future performance and actual results or developments may differ

materially from those projected.

Company website

Neither the content of VLG's website nor any website accessible

by hyperlinks on VLG's website is incorporated in, or forms part

of, this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQVQLFBFQLFBBV

(END) Dow Jones Newswires

June 07, 2021 02:00 ET (06:00 GMT)

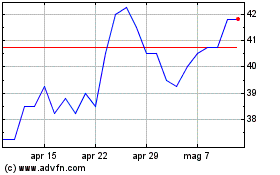

Grafico Azioni Venture Life (LSE:VLG)

Storico

Da Mar 2024 a Apr 2024

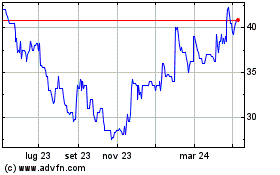

Grafico Azioni Venture Life (LSE:VLG)

Storico

Da Apr 2023 a Apr 2024