Consolidated sales: €196.1m (up 7.5% at

constant exchange rates)

Net income Group share: €15.1m (7.7% of

sales)

Regulatory News:

At its meeting on July 29, 2020, the Vetoquinol S.A.

(Paris:VETO) Board of Directors reviewed the Group results and

approved the first half 2020 financial statements. The auditors

have completed their audit of the financial statements and will

shortly issue their report thereon.

Vetoquinol H1 2020 sales amounted to €196.1 million, up from

€183.8 million in H1 2019, up 6.7% as reported and up 6.2%

like-for-like. Changes in exchange rates had a negative impact

of 0.8% on business in the first half, mainly due to the BRICS

currencies and more specifically the sharp decline in the Brazilian

real, partly offset by the US dollar.

H1 2020 KEY FIGURES

Total sales €196.1m +7.5%

at constant exchange rates

Total Essentials sales

€99.2m +10.7% at constant exchange rates

EBIT before depreciation of

acquired assets €28.0m

Net income - Group share

€15.1m (up €2.1m)

Net cash €91.3m

Sales growth in the first half of 2020 was driven by

Essentials products, which posted organic growth

of10.7%. Essentials products accounted for 50.6% of

Vetoquinol’s sales in the first half of 2020, up from 49.4% in H1

2019.

Sales of companion animal products came to €114.0 million and

accounted for 58.1% of total Vetoquinol sales, up 6.8% at constant

exchange rates. Sales of livestock products came to €82.1 million,

up 8.5% at constant exchange rates. The purchase of Clarion

Biociencias in Brazil on April 15, 2019 contributed €2.5m to H1

2020 growth.

At constant exchange rates, all of the Vetoquinol Group’s

strategic territories posted growth in the first half: the Americas

recorded an increase of 6.5%, while growth of 4.6% in Europe was

mainly driven by France and Spain. Asia-Pacific and export

territories posted growth of 18.7%, driven by the launch of

Essential Boarbetter® in China, offset by a decline in sales in

India due to the challenges presented by the health crisis.

The Vetoquinol Group posted Q2 2020 sales of €92.7m, stable

compared to the reported figure Q2 2019, with organic growth of

1.9%. Europe and the Americas fell 3.3% and 9.5% respectively, as

reported. Sales in Brazil and the US also declined in the second

quarter, reflecting the impact of Covid-19. Asia-Pacific remains on

an upward trajectory, posting solid growth of 31.7% driven by

export markets and China.

The gross margin on purchases came to 72.2%, up 2.8

percentage points compared to H1 2019 (69.4%) due to an increase in

production in the first half of 2020 compared to usual levels, and

a favorable 2019 comparison reference.

External expenses fell €2.5m, primarily due to a decrease in

costs relating to Covid-19 (reduction in marketing and advertising

costs, travel expenses, etc.). Personnel expenses rose 6.5% (€4m),

due to a change in consolidation scope (creation of a subsidiary in

New Zealand and acquisition of Clarion in Brazil), an increase in

wages and the provision for profit-sharing and incentive

schemes.

EBIT before depreciation of acquired assets, a new Vetoquinol

Group performance indicator, amounted to €28.0m in the first

half of 2020, up from €19.2m in the same period in 2019, resulting

in a 4 points increase.

Depreciation of acquired assets amounted to €3.7m, compared to

€1.3m in H1 2019. H1 2020 depreciation includes a €2.2m

depreciation charge as from April 15, 2019 on fixed assets, a

consequence of the purchase price allocation of Clarion.

Vetoquinol Group’s EBIT rose to €24.4m, up from

€17.9m in H1 2019.

In H1 2020, Vetoquinol recorded a net € 1.4m non-recurring

expenses related to goodwill impairment of the FarmVet Systems CGU

(€2.2m), partially offset by a reduction in liabilities owed to

minority shareholders, (non-recurring income of €0.8m).

The apparent tax rate was 33.8% (vs 27.6% in H1 2019) due to the

negative effects recorded in the first half of 2020, primarily due

to an adjustment on India tax carried forward losses, and a

reversal of FarmVet Systems deferred tax assets as well as country

mix effect. The increase of this tax rate combined with the growth

of the EBIT before tax triggers an additional €2.7m income tax

charge.

Vetoquinol posted an €11.8m increase in EBITDA

year-on-year in the first half at €38.0m, resulting from the

increase in sales and gross margin, as well as a reduction in

expenses during Covid-19. H1 2020 EBITDA expressed as a percentage

of sales amounted to 19.4% versus 14.3% in H1 2019.

After non-recurring expenses, Vetoquinol net income amounted

to €15.1m, up from €13.0m in H1 2019.

Total Group net cash stood at €91.3m at June 30, 2020.

Vetoquinol is backed by a sound financial structure to further

its growth strategy and has the funds to pursue its targets for

acquisitions and development, as well as to face the impact of the

Covid-19 health crisis. The Vetoquinol Group was free of financial

debt as of June 30, 2020.

Covid-19

The Group has ensured its staff stay healthy and safe, while

delivering on its production, distribution and service commitments.

The Vetoquinol Group has also introduced a number of measures as

issued by the World Health Organization and governments in

countries where it operates.

The Group will continue to keep its stakeholders regularly

informed of how Covid-19 developments impact its business.

Acquisition of Profender® and Drontal®

The acquisition in Europe and the United Kingdom of these two

de-wormers for cats and dogs is expected to be finalized on Monday

August 3, following the acquisition of Bayer’s animal health

division by Elanco Animal Health.

Vetoquinol CEO Matthieu Frechin said: “The performances recorded

in the first half of 2020 reflect the merits of our development

strategy, which is based on a balance between our strategic

territories and concentrating our efforts on our portfolio of

Essentials products. Since the lockdown at the start of the year,

our top priority has been to ensure the health and safety of our

staff. Our teams are hard at work supporting our vet and breeder

customers, ensuring that the most hygienic conditions possible are

in place wherever we operate. This unprecedented health crisis has

also highlighted the agility and flexibility of our laboratory. Our

portfolio of Essentials products, solid financial structure and

expert teams are what will ensure we overcome this challenging

period. Finally, we are delighted to be finalizing the acquisition

of Profender® and Drontal® next week, which is entirely in line

with our strategy.”

The analyst presentation is scheduled for Thursday, July 30,

2020 and its recording will be available on the Company’s

website.

Next update: Q3 2020 sales, October 15, 2020 after market

close

About Vetoquinol

Vetoquinol is a leading global animal health company that

supplies drugs and non-medicinal products for the livestock (cattle

and pigs) and pet (dogs and cats) markets.

As an independent pure player, Vetoquinol designs, develops and

sells veterinary drugs and non-medicinal products in Europe, the

Americas and the Asia Pacific region.

Since its foundation in 1933, Vetoquinol has pursued a strategy

combining innovation with geographical diversification. The Group's

hybrid growth is driven by the reinforcement of its product

portfolio coupled with acquisitions in high potential growth

markets. At June 30th 2020, Vetoquinol employs 2,401 people.

Vetoquinol has been listed on Euronext Paris since 2006 (symbol:

VETO).

For further information, go to: www.vetoquinol.com.

ANNEX

Summary income statement

€m

06/30/2020

06/30/2019

Change

Total sales

of which Essentials

196.1

99.2

183.8

89.9

+6.7%

+10.3%

EBIT before depreciation of assets arising

from acquisitions

% of total sales

28.0

14.3%

19.2

10.4%

+46.1%

Net income Group share

% of total sales

15.1

7.7%

13.0

7.1%

+15.8%

EBITDA

% of total sales

38.0

19.4%

26.2

14.3%

+44.9%

Calculation of EBITDA

€m

06/30/2020

06/30/2019

Net income before equity method

14.8

12.8

Income tax expense

7.6

4.9

Net financial income/(expense)

0.5

0.3

Provisions recorded under non-recurring

operating income and expenses

2.1

(0.2)

Provisions and write-backs

0.3

(0.3)

Depreciation

10.2

6.7

Depreciation - IFRS

2.4

2.1

EBITDA

38.0

26.2

ALTERNATIVE PERFORMANCE INDICATORS

Vetoquinol Group management considers that these indicators,

which are not defined by IFRS, provide additional information that

is relevant for shareholders seeking to analyze underlying trends

and Group performance and financial position. They are used by

management for performance analysis.

Essentials products: The products referred to as

“Essentials” comprise veterinary drugs and non-medical products

sold by the Vetoquinol Group. They are existing or potential

market-leading products designed to meet the daily requirements of

vets in the companion animal or livestock sector. They are intended

for sale worldwide and their scale effect improves their economic

performance.

Constant exchange rates: Application of the previous

period’s exchange rates to the current financial year, all other

things remaining equal.

Like-for-like growth: Year-on-year sales growth in terms

of volume and/or price at constant exchange rates.

EBIT before depreciation of assets arising from

acquisitions: This KPI isolates the non-cash impact of

amortization charges which result from merger and acquisitions

operations.

Net cash: Cash and cash equivalents less bank overdrafts

and borrowings, pursuant to IFRS 16.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200730005743/en/

VETOQUINOL Investor

Relations Fanny Toillon Tel.: +33 (0)3 84 62 59 88

relations.investisseurs@vetoquinol.com

KEIMA Communication Investor and

Media Relations Emmanuel Dovergne Tel.: +33 (0)1 56 43 44 63

emmanuel.dovergne@keima.fr

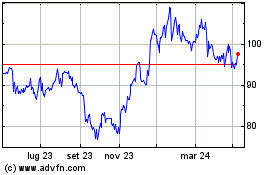

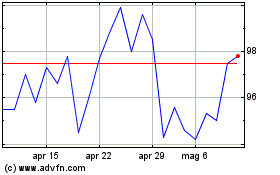

Grafico Azioni Vetoquinol (EU:VETO)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Vetoquinol (EU:VETO)

Storico

Da Apr 2023 a Apr 2024