Wintrust Financial Corporation Announces Purchase of $570 Million Loan Portfolio From Allstate and Agrees to Become the Preferred National Lender to Allstate Agents

01 Novembre 2021 - 9:01PM

Wintrust Financial Corporation ("Wintrust") (Nasdaq: WTFC) and its

wholly-owned subsidiary, Lake Forest Bank & Trust Company,

N.A., today announced they have agreed to purchase approximately

$570 million of loans from The Allstate Corporation (NYSE: ALL).

The portfolio is comprised of approximately 1,800 loans to Allstate

agents nationally, which agents use to establish and grow their

businesses, as well as meet other working capital needs.

In addition to acquiring the loans, Wintrust has

agreed to become the national preferred provider of loans to

Allstate agents. Allstate agents will have expanded lending options

and services through Wintrust and be supported with its

award-winning lending services. A team of Allstate agency lending

specialists will join the Wintrust team, to augment and expand

Wintrust’s existing insurance agency finance business.

The transaction is expected to close in November

2021.

Edward J. Wehmer, Founder & Chief Executive

Officer of Wintrust, commented, “Wintrust is excited to work with

Allstate to acquire the agency loans and looks forward to serving

Allstate agents going forward. This portfolio and the related

ongoing opportunity is a great fit with our existing insurance

finance business. It’s also an example of two great Chicago

companies coming together to serve the needs of their

stakeholders.”

In addition to the traditional agency term loan

and revolving credit financing, Wintrust will be able to offer SBA

and real estate-related financing, as well as other banking

services to Allstate agents, including wealth management and

mortgage services. Allstate agents also will have access to

Wintrust’s digital banking services.

“Wintrust’s strong market position and lending

solutions tailored to small businesses empower Allstate agents with

an excellent suite of financial options,” said Terrance Williams,

executive vice president and general manager of Allstate agency

distribution. “We will partner closely with Wintrust to ensure a

superb experience for those interested in new lending products and

services.”

Wintrust is a recognized national leader in

insurance finance through its existing FIRST Insurance Funding and

Wintrust Life Finance premium finance insurance businesses, as well

as its agency lending business, collectively contributing

outstanding loans in excess of $10 billion as of September 30,

2021.

The terms of the transaction were not

disclosed.

About Wintrust

Wintrust is a financial holding company with assets of

approximately $48 billion whose common stock is traded on the

NASDAQ Global Select Market. Built on the "HAVE IT ALL" model,

Wintrust offers sophisticated technology and resources of a large

bank while focusing on providing service-based community banking to

each and every customer. Wintrust operates fifteen community bank

subsidiaries, with over 170 banking locations located in the

greater Chicago and southern Wisconsin market areas. Additionally,

Wintrust operates various non-bank business units including

business units which provide commercial and life insurance premium

financing in the United States, a premium finance company operating

in Canada, a company providing short-term accounts receivable

financing and value-added out-sourced administrative services to

the temporary staffing services industry, a business unit engaging

primarily in the origination and purchase of residential mortgages

for sale into the secondary market throughout the United States,

and companies providing wealth management services and qualified

intermediary services for tax-deferred exchanges.

Forward-Looking Information

This press release contains forward-looking statements within

the meaning of the federal securities laws. Investors are cautioned

that such statements are predictions and that actual events or

results may differ materially. Wintrust's expected financial

results or other plans are subject to a number of risks and

uncertainties. For a discussion of such risks and uncertainties,

which could cause actual results to differ from those contained in

the forward-looking statements, see "Risk Factors" and the

forward-looking statement disclosure contained in Wintrust's Annual

Report on Form 10-K for the most recently ended fiscal year and in

Wintrust’s subsequent Quarterly Reports on Form 10-Q.

Forward-looking statements speak only as of the date made and

Wintrust undertakes no duty to update the information.

FOR MORE INFORMATION CONTACT:

Edward J. Wehmer, Founder & Chief Executive Officer, Wintrust Financial Corporation

David A. Dykstra, Vice Chairman & Chief Operating Officer, Wintrust Financial Corporation

(847) 939-9000

Website address: www.wintrust.com

Nick Nottoli, Allstate Media Relations

(847) 402-5600

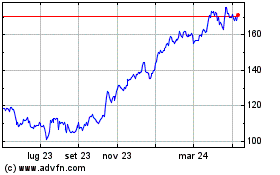

Grafico Azioni Allstate (NYSE:ALL)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Allstate (NYSE:ALL)

Storico

Da Apr 2023 a Apr 2024