TIDMZOO

RNS Number : 0618S

Zoo Digital Group PLC

04 November 2019

4 November 2019

ZOO DIGITAL GROUP PLC

("ZOO" the "Group" or the "Company")

INTERIM RESULTS FOR THE SIX MONTHSED 30 SEPTEMBER 2019

ZOO Digital Group plc (LON: ZOO), the provider of cloud-based

localisation and digital distribution services for the global

entertainment industry, today announces its unaudited financial

results for the six months ended 30 September 2019.

HIGHLIGHTS

Key Financials

-- Revenues decreased by 4% to $14.2 million (H1 FY19: $14.9

million) driven by a 75% drop in legacy DVD and Blu-ray services,

which now make up 3% of overall Group revenue; excluding

DVD/Blu-ray services revenues were up 7% to $13.8 million (H1 FY19:

$12.9 million) with strong demand for digital packaging and

subtitling

-- Gross profit up at $5.8 million (H1 FY19: $4.9 million) explained by a favourable sales mix

-- Adjusted EBITDA(1) of $1.8 million (including $0.6 million

due to IFRS 16 reclassification of leases) (H1 FY19: $0.5 million),

the improvement reflects the positive gross profit variance

-- Operating profit of $0.4 million (H1 FY19: $0.3 million loss)

-- Cash balance of $0.6 million at period end (H1 FY19: $0.9 million)

Operational Highlights

-- Selected as a primary vendor of localisation and digital

packaging services for a major Over-The-Top (OTT) platform

-- ZOOstudio adopted by a major media company to manage its

localisation operations for OTT production

-- Received a Product of the Year award at the National

Association of Broadcasters (NAB) Show 2019 for ZOOstudio and the

Broadcast Tech Innovation Award 2019 for excellence in localisation

for a global TV project

-- Launch of ZOO Localisation Ecosystem

-- Appointment of Gillian Wilmot as Non-Executive Chairman

Outlook

-- On-going market changes and OTT platform launches offer significant opportunity for growth

-- Recently established customer relationships provide the scope

for significant repeating revenue over multiple years

-- Innovative, technology-led approach to address specific needs

of OTT market provides ZOO with distinct competitive advantage over

traditional localisation vendors

-- The value of the order book at the period end is stronger

than the same period last year and positions ZOO well to meet

market expectations for the full year

(1) adjusted for share-based payments.

Stuart Green, CEO of ZOO Digital, commented,

"We are pleased with the progress we have made during the

period, having met all operational targets in respect of our

strategic priorities. We are now a primary vendor of localisation

and digital packaging services for a major new OTT platform and

have achieved the first customer deployment of ZOOstudio, our

localisation management platform.

"The OTT consumer video market is about to undergo a step change

due to the forthcoming launches of several Direct-to-Consumer

services from major media companies. These provide an exciting

growth opportunity in media localisation and digital packaging

given the increased demand for these services to enable

international distribution. We believe that ZOO is well placed to

capitalise on this opportunity given the benefits and competitive

advantages of our cloud-powered services."

For further enquiries please contact:

ZOO Digital Group plc 0114 241 3700

Stuart Green - Chief Executive Officer

Phillip Blundell - Chief Finance Officer

finnCap Ltd

Henrik Persson / Kate Washington (corporate

finance)

Camille Gochez / Andrew Burdis (corporate

broking) 020 7220 0500

Alma PR

Josh Royston / Hilary Buchanan / Helena

Bogle 020 3405 0205

The Company further wishes to draw attention to the posting on

its website (www.zoodigital.com) of a presentation to shareholders

regarding its interim results.

Overview

In the first half of FY2020 our focus has been on securing

primary vendor status with a major global media content provider.

We are pleased with the progression of this relationship - our

first major strategic customer for our cloud-based dubbing service

- which we expect will bring better quality and visibility to our

future revenues. Our work with this partner has enhanced our

reputation in the market and is helping in our goal to become the

leading next generation media localisation business.

The financial results for the first half of the year are in line

with expectations. Revenue fell by 4% to $14.2 million (H1 FY19:

$14.9 million) due to an anticipated decline in legacy services:

despite DVD/Blu-ray sales falling by 75%, excluding these revenues

we achieved a 7% growth. Digital packaging revenues for OTT

platform launches tripled in the period. This delivered a

substantial increase in our gross profit from 33% to 41% and a more

than doubling of EBITDA before IFRS 16 adjustments to $1.2 million

(H1 FY19: $0.5 million).

We have continued to invest in our cloud-based platforms,

enhancing their functionality to make both subtitling and dubbing

more efficient and scalable, and building on the early successes of

our localisation management platform, ZOOstudio and the ZOO

Localisation Ecosystem. We have developed further modules to track

the full range of localisation services which have been

instrumental in the decision by one of our customers to adopt the

platform to manage its OTT localisation operations.

This focus on innovation is gaining traction as more owners of

media content are placing orders to assess our cloud-based dubbing

service. We have signed up more in-territory partners to our

ZOO-Enabled Dubbing Studio (ZEDS) programme, delivering on our

promise to offer more flexibility, capacity and languages to our

customers that require dubbing services. Further enhancing our

localisation capacity, we opened a post-production studio in London

during the period, offering voice capture facilities, training

services and audio mixing, key for some of our customers who

require final mixing of localisation services in-territory. Already

this has led to significant orders from one global media content

provider. Our freelancer network has grown from 5,400 people this

time last year to 7,100 today, further evidence of our ability to

scale the business, and we continue to monitor the quality and

capacity of our network to ensure that this scalability can happen

seamlessly.

The market dynamics continue to favour ZOO, with major US

content owners Disney, NBC Universal and Warner Media confirming

the launches of their own direct-to-consumer OTT services in the

next six months. This, coupled with Netflix, Apple and Amazon

announcing significant increases in their budgets for original

content, demonstrates a growing market for exactly the type of

services offered by ZOO. This is a long-term opportunity as our

technology-based approach to media localisation is still in its

adoption phase and we need to ensure that our proposition is fully

understood by the market, while demonstrating that our approach is

reliable, scalable and of sufficient quality to meet the market's

increasingly high standards.

Operations

Subscription Video on Demand, the largest segment of the OTT

market by value, continues its rapid global expansion. According to

a recent report from Allied Market Research, the global OTT market

was valued at $97 billion in 2017 and is projected to reach $333

billion by 2025, a CAGR of 17%, with the Asia-Pacific region

registering the fastest growth rate of 21%. In the past year,

several media companies have each committed to spending billions of

dollars on content, with the global output of TV production being

at an all-time high.

Growth in global consumer video markets is creating greater

demand for professional localisation services to adapt content for

international audiences. According to recent research from MESA

Europe, the EMEA market for media localisation is expected to reach

$2.3 billion in 2019, up from $2.0 billion a year earlier. This

creates opportunity for providers like ZOO that deliver the breadth

of services needed to repurpose content produced in one language

into tens of other languages.

In recent months the industry has seen significant shifts in the

competitive landscape for media localisation. The largest

incumbents in the market, established during the DVD era, operate

capital intensive bricks-and-mortar businesses and have been slow

to innovate. In contrast, ZOO's approach is built on proprietary

technology designed specifically to address efficiently the scale

and diversity of customer requirements for OTT distribution.

Consequently, the Board believes that ZOO is well placed to capture

market share as leading buyers seek new relationships with vendors

that are better placed to meet their evolving requirements for

quality, scalability, language coverage and turnaround time.

The Board has considered the consequence that Brexit may have on

the business and does not anticipate any significant impact on its

operations as a result of the UK leaving the European Union.

The Group continues to make good progress in the execution of

its differentiated strategy that is characterised by four pillars:

innovation, scalability, collaboration and building long-term

client partnerships.

Innovation

ZOO's localisation services are delivered using proprietary

cloud computing technology that affords significant benefit to the

company and its customers, delivering competitive advantage.

Following a period of investment in our platforms that commenced

with our first software-enabled localisation service in 2006, the

Company launched its Localisation Ecosystem during the period. This

offers a complete end-to-end approach to media localisation by

bringing together all of the workflows, components, service

providers and creative talent into a single environment. We were

pleased to receive recognition for excellence in localisation for a

global TV product at the 2019 Broadcast Tech Awards for our work on

the Netflix series "The Bletchley Circle: San Francisco".

The ecosystem is built up of interconnected, cloud-based

ordering, production and management platforms supporting and

encapsulating every aspect of media localisation. Each platform

manages an element of content localisation and digital packaging,

and seamlessly interconnects with the rest of the ecosystem to

deliver clear benefits for ZOO's localisation services.

Our R&D resource has been focused primarily on continuing

the development of a key component of the ZOO Localisation

Ecosystem: ZOOstudio. This is our overarching localisation

management platform that offers a single, centralised system for

scenario planning, ordering, tracking and managing all of the

components required to create a localised content package.

Uniquely in the media localisation industry, ZOO has adopted a

collaborative approach through our Localisation Ecosystem. For the

first time, content owners can place all of their orders and manage

their multiple localisation service providers through a single

vendor-agnostic system - with the ability to assign a vendor on an

order-by-order basis.

ZOOstudio is making excellent progress in the market, having

received during the period a Product of the Year award at the

National Association of Broadcasters (NAB) Show 2019. ZOOstudio has

recently been adopted by a major media company to manage the

production of all OTT deliverables required for a forthcoming

launch of its direct-to-consumer service. Consequently, ZOO's

Localisation Ecosystem will be employed to adapt original content

using both subtitling and dubbing into multiple languages covering

the Americas, Europe and Asia. We expect that this will cement a

long-term strategic partnership with a leading industry player that

represents a significant endorsement of ZOO's services and

technologies.

We have also continued to invest in ZOOdubs, our cloud platform

that enables the delivery of dubbing services. Here the focus has

been on further enhancements and features to strengthen our

competitive advantage in areas that are seen as being the greatest

vulnerabilities amongst traditional dubbing studios, namely

security, reliable audio quality and scalable capacity across

multiple languages, particularly those in emerging markets.

Scalability

ZOO's strategy enables capital-efficient scalability of

operations through access to a network of qualified and experienced

specialists in media localisation, including screen translators,

script adapters, voice artists, dubbing directors and audio mixing

engineers. Our on-going rigorous programme of search,

qualification, selection and on-boarding has increased the number

of participants to 7,100, up from 5,400 in the prior year

period.

With several emerging regions and countries being targeted by

OTT services due to their rapidly expanding audience of

internet-connected consumers, ZOO is taking steps to progress its

geographical expansion in strategic locations. Over the coming

period, we expect to commence a process to establish points of

presence in locations that will provide us with the means to

accelerate the deployment of our Localisation Ecosystem and so

further strengthen our competitive advantage.

Collaboration

ZOO adopts a collaborative approach wherever possible to provide

scalability and extend its geographical reach without incurring

significant capital investment. In the prior period we launched our

ZOO-Enabled Dubbing Studio (ZEDS) programme to further enhance our

service offering and respond to customer challenges in dubbing

content for OTT distribution.

ZEDS partners are highly reputable independent dubbing studios

in key territories. Experienced, trusted and carefully selected,

ZEDS are home to some of the creative talent content owners want.

ZOO is training each one to use ZOOdubs to record and manage the

dubbing process.

A key benefit of our dubbing service is that our platforms

support multi-location recording for each language, enabling

significant capacity and scalability while ensuring security,

consistency and high quality. ZOO's unique approach means that we

can work with any studio with the right credentials. It enables

greater coverage with a wider and more diversified talent pool than

relying solely on owner-operated studios.

We have continued to develop relationships with ZEDS across 22

languages as we build the largest collaborative network of studios

in the industry, unified through the use of our cloud

platforms.

Building long-term client partnerships

It is our goal to be selected as a preferred vendor of

localisation and digital packaging services for all of the leading

content producers and global OTT service providers, thereby

enabling a significant repeating revenue opportunity with each of

them.

In the past year a number of major media companies have

initiated a process to select partners for localisation. As

previously noted, ZOO has been successful in one of these

exercises, having been selected as one of three vendors to support

the localisation of content for a forthcoming major OTT service

launch. Other exercises have been either delayed or aborted due, in

part, to the evolving nature of the go-to-market strategies of the

associated companies. Based on feedback received, we believe that

ZOO is well placed to be chosen in these selection processes when

they eventually complete or resume. During the coming period, we

expect to be operating as a vendor for additional top tier OTT

services.

Board Changes

On 19 June we announced the appointment of Gillian Wilmot to the

Board as Non-Executive Chairman with effect from 1 July 2019.

Gillian, who also chairs the Remuneration Committee and acts as a

member of the Audit Committee, replaced Roger Jeynes who stepped

down from the Board on 1 July 2019 after serving a nine-year

tenure. We are very grateful to Roger for the experience and wisdom

he has brought to the Company during a key period in its

growth.

Along with extensive board level leadership roles in both

private and public company environments, Gillian brings a wealth of

relevant industry experience across B2B, technology, advertising

and communication sectors. Gillian's skillset shows particular

strengths in value creation, operational insight and corporate

governance, for which she was recognised in the 2014 UK NED

awards.

Outlook

Our first half has been marked by securing the role of a primary

vendor for a major media company. At the end of the period there

were a significant number of projects in the order book from this

customer to deliver an end-to-end localisation and digital

packaging service across multiple new titles into several

languages. We believe that this relationship will result in

improved visibility and a reliable source of orders for the periods

ahead, including meeting full year market expectations.

The endorsement of our Localisation Ecosystem through the

adoption of ZOOstudio by a major media customer provides further

confidence that our proposition meets the demanding requirements of

the industry. We expect that this arrangement will not only result

in a long-term strategic relationship with this customer but will

also raise visibility and awareness of ZOO and our differentiated

services and encourage similar arrangements with other leading

industry players.

The industry changes and new OTT service introductions that are

expected in the next six months provide a backdrop of enlarged

opportunity for media localisation providers in general, and for

ZOO in particular due to the differentiated features of our

proposition. We expect that during our second half we will be

working on projects for further major providers of OTT services

that may provide sources of repeatable revenue for several years to

come.

Financial Results

Revenues of $14.2 million were 4% below the same period last

year (H1 FY19: $14.9 million). This is explained by the decline of

a legacy offering - a previously flagged major client curtailed the

publishing of DVD and Blu-ray box sets as it prepared for the

launch of its OTT service. The impact on our revenues was a drop of

$1.4 million.

Sales excluding these legacy DVD/Blu-ray services increased from

$13.0 million to $13.8 million, an increase of 7%, driven by strong

digital packaging sales to support OTT distribution and a recovery

in subtitling sales offsetting the exceptionally high level of

dubbing revenues last year that were not repeated in this period.

Dubbing orders already received for delivery in the second half of

the year are expected to more than compensate for the H1

shortfall.

Gross profit is significantly ahead of last year at $5.8 million

(H1 FY19: $4.9 million). The gross profit margin increased from 33%

to 41% as a result of the favourable sales mix with high margin

digital packaging and subtitling replacing currently lower dubbing

margins. In addition, we maintained our direct staff cost at the

same rate as last year, which gives us capacity to support the

anticipated increase in revenues in the second half of the

year.

Operating expenses have increased marginally to $5.5 million (H1

FY19: $5.3 million) which is due to the higher property costs as we

grew our facilities, both in Los Angeles and London, to support the

expansion in digital packaging and dubbing services required to

achieve our full year revenue targets. We continued to invest in

product development, spending roughly $0.6 million in the period

and capitalising a further $0.4 million, the latter figure being

similar to the same period last year.

As a consequence of the increase in gross profit and the $0.6

million positive impact of adopting IFRS 16, the business achieved

EBITDA of $1.8 million (H1 FY19: $0.5 million). The business

achieved an operating profit of $0.4 million, compared to an

operating loss of $0.3 million for the same period last year, again

driven by the improved gross profit.

The cash balance at 30 September was $0.6 million (H1 FY19: $0.9

million) and is down from $1.8 million at 31 March 2019. The cash

outflow of $1.2 million includes investment in new products of $0.4

million, reduction in trade creditors of $1.5 million and financing

costs of $0.9 million offset by operating cashflow of $1.6 million.

The second half of the financial year is expected to show a return

to a positive cash flow.

The Group has no short-term debt and no borrowings other than

its unsecured convertible loan note of GBP2.6 million ($3.0

million), maturing in October 2020 with a conversion price of 48p,

and lease commitments of $4.4 million (post IFRS 16

reclassification). Should they be required, the Group has unused

credit facilities. With regard to the convertible loan notes, as

the current share price is above the conversion price, a non-cash

provision of $2.0 million was created in the March 2019 financial

statements reflecting the embedded derivative and is also shown in

non-current liabilities at 30 September.

New IFRS implementation

The Company has adopted IFRS 16 - Leases for the financial year

ending 31 March 2020, and it has chosen to use the modified

retrospective approach to adoption which means there are no

restatements to the prior year figures.

IFRS 16 introduces a single lessee accounting model, whereby the

Group now recognises a lease liability and a right of use asset at

1 April 2019 for leases previously classified as operating leases.

Within the income statement, operating lease charges, which

previously were included in administrative expenses, have been

replaced by depreciation and interest expenses.

The adoption of IFRS 16 resulted in a right of use asset of $4.2

million, with a corresponding liability of $4.2 million, being

recognised as at 1 April 2019 which was depreciated to a value of

$3.7 million as at 30 September 2019.

In order to see how the impact of IFRS 16 has affected Adjusted

EBITDA*, a reconciliation is presented below:

6 months 6 months

ended 30 ended

September 30 September

2019 2018

$'000 $'000

========================================= =========== ==============

Adjusted EBITDA* - consistent with 2018

presentation and accounting policy 1,205 491

changes due to new accounting policy -

IFRS 16 605 -

========================================= =========== ==============

Adjusted EBITDA* - consistent with 2019

presentation and accounting policy 1,810 491

========================================= =========== ==============

* before share based charges.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

(UNAUDITED)

for the six months ended 30 September 2019

6 months 6 months

to to Year ended

30 Sep 2019 30 Sep 2018 31 Mar 2019

$000 $000 $000

======================================= ============ ============ ============

Revenue 14,242 14,895 28,818

Cost of sales (8,452) (9,949) (19,624)

--------------------------------------- ------------ ------------ ------------

Gross Profit 5,790 4,946 9,194

Other operating income 115 47 157

Operating expenses (5,461) (5,292) (10,671)

--------------------------------------- ------------ ------------ ------------

Operating profit/(loss) 444 (299) (1,320)

--------------------------------------- ------------ ------------ ------------

Analysed as

EBITDA before share-based payments 1,810 491 409

Share based payments (142) (81) (286)

Depreciation (755) (258) (539)

Amortisation and impairment (469) (451) (904)

--------------------------------------- ------------ ------------ ------------

444 (299) (1,320)

--------------------------------------- ------------ ------------ ------------

Exchange gain/(loss) on borrowings 297 332 275

Fair value movement on embedded

derivative - - 2,701

Finance cost (367) (192) (392)

--------------------------------------- ------------ ------------ ------------

Total finance cost (70) 140 2,584

--------------------------------------- ------------ ------------ ------------

Profit/(loss) before taxation 374 (159) 1,264

Tax on profit/(loss) (13) (66) 368

--------------------------------------- ------------ ------------ ------------

Profit/(loss) and total comprehensive

income for the period attributable

to equity holders of the parent 361 (225) 1,632

--------------------------------------- ------------ ------------ ------------

Profit per ordinary share

--------------------------------------- ------------ ------------ ------------

(0.30)

- basic 0.48 cents cents 2.19 cents

--------------------------------------- ------------ ------------ ------------

(0.30)

- diluted 0.45 cents cents 2.02 cents

--------------------------------------- ------------ ------------ ------------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(UNAUDITED)

As at 30 September 2019

As at As at As at

30 Sep 2019 30 Sep 2018 31 Mar 2019

$000 $000 $000

--------------------------------------- ------------ ------------ --------------

ASSETS

Non-current assets

Property, plant and equipment 4,463 1,186 944

Intangible assets 6,585 6,518 6,624

Deferred income tax assets 486 486 486

--------------------------------------- ------------ ------------ --------------

11,534 8,190 8,054

--------------------------------------- ------------ ------------ --------------

Current assets

Trade and other receivables 8,227 8,077 8,103

Cash and cash equivalents 607 910 1,828

--------------------------------------- ------------ ------------ --------------

8,834 8,987 9,931

--------------------------------------- ------------ ------------ --------------

Total assets 20,368 17,177 17,985

--------------------------------------- ------------ ------------ --------------

LIABILITIES

Current liabilities

Trade and other payables (5,729) (5,697) (7,189)

Borrowings (1,364) (240) (248)

--------------------------------------- ------------ ------------ --------------

(7,093) (5,937) (7,437)

--------------------------------------- ------------ ------------ --------------

Non-current liabilities

Borrowings (6,107) (3,957) (3,899)

Separable embedded derivative (1,965) (4,666) (1,965)

--------------------------------------- ------------ ------------ --------------

(8,072) (8,623) (5,864)

--------------------------------------- ------------ ------------ --------------

Total liabilities (15,165) (14,560) (13,301)

--------------------------------------- ------------ ------------ --------------

Net assets 5,203 2,617 4,684

--------------------------------------- ------------ ------------ --------------

EQUITY

Equity attributable to equity holders

of the parent

Called up share capital 1,011 1,016 1,010

Share premium reserve 41,018 41,103 41,003

Other reserves 12,320 12,320 12,320

Share option reserve 1,227 769 1085

Capital redemption reserve 6,753 6,753 6,753

Convertible loan note reserve 42 42 42

Foreign exchange translation reserve (992) (992) (992)

Accumulated losses (56,123) (58,341) (56,484)

--------------------------------------- ------------ ------------ --------------

5,256 2,670 4,737

--------------------------------------- ------------ ------------ --------------

Interest in own shares (53) (53) (53)

--------------------------------------- ------------

Attributable to equity holders 5,203 2,617 4,684

--------------------------------------- ------------ ------------ --------------

CONSOLIDATED STATEMENT OF CHANGES

IN EQUITY

(UNAUDITED)

for the six months ended 30 September

2019

Foreign

Share exchange Convertible Share Capital Interest

Ordinary premium translation loan note option redemption Other Accumu-lated in own

shares reserve reserve reserve reserve reserve reserves losses shares Total

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

--------------- --------- -------- ------------- -------------- -------- ----------- --------- ------------- --------- ------

Balance at

1 April 2018 1,010 41,003 (992) 42 688 6,753 12,320 (58,116) (53) 2,655

Issue of

share capital 6 100 106

Share-based

payments 81 81

=============== ========= ======== ============= ============== ======== =========== ========= ============= ========= ======

Transactions

with owners 6 100 - - 81 - - - - 187

=============== ========= ======== ============= ============== ======== =========== ========= ============= ========= ======

Loss for

the period (225) (225)

=============== ========= ======== ============= ============== ======== =========== ========= ============= ========= ======

Total

comprehensive

income for

the period - - - - - - - (225) - (225)

=============== ========= ======== ============= ============== ======== =========== ========= ============= ========= ======

Balance at

30 September

2018 1,016 41,103 (992) 42 769 6,753 12,320 (58,341) (53) 2,617

Share-based

payments 316 316

Issue of

share capital (6) (100) (106)

=============== ========= ======== ============= ============== ======== =========== ========= ============= ========= ======

Transactions

with owners (6) (100) - - 316 - - - - 210

=============== ========= ======== ============= ============== ======== =========== ========= ============= ========= ======

Profit for

the period 1,857 1,857

=============== ========= ======== ============= ============== ======== =========== ========= ============= ========= ======

Total

comprehensive

income for

the period - - - - - - - 1,857 - 1,857

=============== ========= ======== ============= ============== ======== =========== ========= ============= ========= ======

Balance at

31 March

2019 1,010 41,003 (992) 42 1,085 6,753 12,320 (56,484) (53) 4,684

Share based

payments 142 142

Issue of

share capital 1 15 16

=============== ========= ======== ============= ============== ======== =========== ========= ============= ========= ======

Transactions

with owners 1 15 - - 142 - - - - 158

=============== ========= ======== ============= ============== ======== =========== ========= ============= ========= ======

profit for

the period 361 361

=============== ========= ======== ============= ============== ======== =========== ========= ============= ========= ======

Total

comprehensive

income for

the period - - - - - - - 361 - 361

=============== ========= ======== ============= ============== ======== =========== ========= ============= ========= ======

Balance at

30 September

2019 1,011 41,018 (992) 42 1,227 6,753 12,320 (56,123) (53) 5,203

=============== ========= ======== ============= ============== ======== =========== ========= ============= ========= ======

CONSOLIDATED STATEMENT OF CASH FLOWS

(UNAUDITED)

for the six months ended 30 September 2019

6 months 6 months

to to Year ended

31 Mar

30 Sep 2019 30 Sep 2018 2019

$000 $000 $000

========================================== ============ ============ ===========

Cash flows from operating activities

Operating profit/(loss) for the

period 444 (299) (1,320)

Depreciation 755 258 553

Amortisation and impairment 469 451 904

Share based payments 142 81 397

Changes in working capital:

Increases in trade and other receivables (124) (665) (691)

(Decreases)/increases in trade

and other payables (1,460) (409) 1,082

------------------------------------------ ------------ ------------ -----------

Cash flow from operations 226 (583) 925

Tax (paid)/received (13) (66) 368

------------------------------------------ ------------

Net cash flow from operating activities 213 (649) 1,293

------------------------------------------ ------------ ------------ -----------

Investing Activities

Purchase of intangible assets (430) (428) (987)

Purchase of property, plant and

equipment (123) (555) (310)

------------------------------------------ ------------

Net cash flow from investing activities (553) (983) (1,297)

------------------------------------------ ------------ ------------ -----------

Cash flows from financing activities

Repayment of borrowings (532) (172) (228)

Proceeds from borrowings - 354 -

Finance cost (365) (155) (349)

Issue of Share Capital (net of

costs of issue) 16 106 -

------------------------------------------

Net cash flow from financing (881) 133 (577)

------------------------------------------ ------------ ------------ -----------

Net (decrease)/increase in cash

and cash equivalents (1,221) (1,499) (581)

------------------------------------------ ------------ ------------ -----------

Cash and cash equivalents at the

beginning of the period 1,828 2,409 2,409

------------------------------------------ ------------ ------------ -----------

Cash and cash equivalents at the

end of the period 607 910 1,828

------------------------------------------ ------------ ------------ -----------

NOTES

General information

ZOO Digital Group plc ('the Company') and its subsidiaries

(together 'the Group') provide productivity tools and services for

digital content authoring, video post-production and localisation

for entertainment and packaging markets and continue with on-going

research and development in those areas. The Group has operations

in both the UK and US.

The Company is a public limited company which is listed on the

Alternative Investment Market and is incorporated and domiciled in

the UK. The address of the registered office is 7(th) Floor, City

Gate, 8 St Mary's Gate, Sheffield. The registered number of the

Company is 3858881.

This condensed consolidated financial information is presented

in US dollars, the currency of the primary economic environment in

which the Company operates.

The interim accounts were approved by the board of directors on

1 November 2019.

This consolidated interim financial information has not been

audited.

Basis of preparation

The consolidated financial statements of ZOO Digital Group plc

and its subsidiary undertakings for the period ended 31 March 2020

will be prepared in accordance with International Financial

Reporting Standards ("IFRS"), as adopted by the European Union, and

with those parts of the Companies Act 2006 applicable to companies

reporting under IFRS.

This Interim Report has been prepared in accordance with UK AIM

listing rules which require it to be presented and prepared in a

form consistent with that which will be adopted in the annual

accounts having regard to the accounting standards applicable to

such accounts. It has not been prepared in accordance with IAS 34

"Interim Financial Reporting".

The policies applied are consistent with those set out in the

annual report for the year ended 31 March 2019, and have been

consistently applied, unless stated otherwise.

This condensed consolidated financial information is for the six

months ended 30 September 2019. It has been prepared with regard to

the requirements of IFRS. It does not constitute statutory accounts

as defined in S343 of the Companies Act 2006. It does not include

all of the information required for full annual financial

statements, and should be read in conjunction with the consolidated

financial statements of the Group for the year ended 31 March 2019

which contained an unqualified audit report and have been filed

with the Registrar of Companies. They did not contain statements

under s498 of the Companies Act 2006.

The Group has applied the same accounting policies and methods

of computation in its interim consolidated financial statements as

in its 2019 annual financial statements, except for those that

relate to new standards and interpretations effective for the first

time for periods beginning on (or after) 1 April 2019 and will be

adopted in the 2020 financial statements. The only standard

impacting the Group that will be adopted in the annual financial

statements for the year ended 31 March 2020, and which has given

rise to a change in the Group's accounting policies is:

-- IFRS 16 leases

Details of the impact of this standard are given below. Other

new and amended standards and interpretations issued by the IASB

that will apply for the first time in the next annual financial

statements are not expected to have a material impact on the

Group.

IFRS 16 Leases

The Group has adopted IFRS 16 on a modified retrospective basis.

As disclosed in the Financial Review, upon transition, a lease

liability has been recognised based on future lease payments

discounted at an appropriate borrowing rate. Additionally, a right

of use asset has been recognised along with a related lease

liability. Within the income statement, the operating lease charge

($605k) has been replaced by depreciation ($496k) and interest

expense ($182k). This has resulted in a decrease in operating

expenses and an increase in finance costs.

6 months 6 months

ended 30 ended

September 30 September

2019 2018

$'000 $'000

================================================== =========== ==============

Non-current assets

Property, plant and equipment - consistent

with 2018 presentation and accounting policy 808 1,186

Changes due to new accounting policy -

IFRS 16 - Right of use asset 3,655 -

================================================== =========== ==============

Property, plant and equipment - consistent

with 2019 presentation and accounting policy 4,463 1,186

================================================== =========== ==============

Current liabilities

Borrowings - consistent with 2018 presentation

and accounting policy 246 240

Changes due to new accounting policy -

IFRS 16 - Short term leases 1,118 -

================================================== =========== ==============

Borrowings - consistent with 2019 presentation

and accounting policy 1,364 240

================================================== =========== ==============

Non-current liabilities

Borrowings - consistent with 2018 presentation

and accounting policy 3,497 3,957

Changes due to new accounting policy -

IFRS 16 - Long term leases 2,610 -

================================================== =========== ==============

Adjusted EBITDA* - consistent with 2019

presentation and accounting policy 6,107 3,957

================================================== =========== ==============

The adjustments above reflect the impact of IFRS 16 on the

property leases for the Los Angeles, London and Sheffield offices.

All new leases will be treated accordingly. A discount rate of

8.25% has been applied.

Basis of Consolidation

The consolidated financial statements of ZOO Digital Group plc

include the results of the Company and its subsidiaries. Subsidiary

accounting policies are amended where necessary to ensure

consistency within the Group and intra group transactions are

eliminated on consolidation.

Segment reporting

Operating segments are reported in a manner consistent with the

internal reporting regularly reviewed by the group's chief

operating decision maker to make decisions about resource

allocation to the segments and to assess their performance.

Localisation Digital Packaging Software Licensing Total

FY20 FY19 FY20 FY19 FY20 FY19 FY20 FY19

H1 H1 H1 H1 H1 H1 H1 H1

$000 $000 $000 $000 $000 $000 $000 $000

===================== ======= ======= ========== ========= ========== =============== ======= =======

Revenue 9,057 11,039 4,166 2,888 1,019 968 14,242 14,895

Segment contribution 2,798 2,926 2,751 1,767 974 904 6,523 5,597

Unallocated cost of

sales (733) (651)

============================== ======= ========== ========= ========== =============== ======= =======

Gross profit 5,790 4,946

============================== ======= ========== ========= ========== =============== ======= =======

31% 27% 66% 61% 96% 93% 41% 33%

Foreign currency translation

Functional and presentation currency

Items included in the financial statements of each of the

Group's entities are measured using the currency of the primary

economic environment in which the entity operates ('the functional

currency'). The consolidated financial statements are presented in

US Dollars which is the Company's functional and presentation

currency.

Transactions and balances

Transactions in foreign currencies are recorded at the

prevailing rate of exchange in the month of the transaction.

Foreign exchange gains or losses resulting from the settlement of

such transactions and from the translation of monetary assets and

liabilities denominated in foreign currencies at the year-end

exchange rates are recognised in the income statement.

Group companies

The results and financial positions of all Group entities that

use a functional currency different from the presentation currency

are translated into the presentation currency as follows:

-- assets and liabilities for each entity are translated at the

closing rate at the period end date;

-- income and expenses for each Statement of Comprehensive

Income item are translated at the prevailing monthly exchange rate

for the month in which the income or expense arose and all

resulting exchange rate differences are recognised in other

comprehensive income with the foreign exchange translation

reserve.

Earnings per share

Earnings per share is calculated based upon the profit or loss

on ordinary activities after tax for each period divided by the

weighted average number of shares in issue during the period.

Weighted average number of

shares for basic & diluted

profit per share 30 Sep 2019 30 Sep 2018 31 Mar 2019

============================

No. of shares No. of shares No. of shares

============================ ============== ============== ==============

Basic 74,512,271 74,462,725 74,356,016

Diluted 81,084,168 86,720,202 80,725,841

Where the Group has recorded a loss, diluted earnings per share

is equal to basic earnings per share.

Further Copies

Copies of the Interim Report for the six months ended 30

September 2019 will be available, free of charge, for a period of

one month from the registered office of the Company at 7(th) Floor,

City Gate, 8 St Mary's Gate, Sheffield, S1 4LW or from the Group's

website: www.zoodigital.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR CKNDPOBDDFDK

(END) Dow Jones Newswires

November 04, 2019 02:00 ET (07:00 GMT)

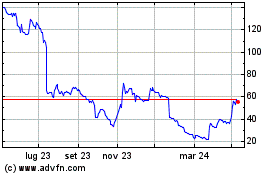

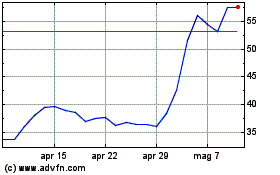

Grafico Azioni Zoo Digital (LSE:ZOO)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Zoo Digital (LSE:ZOO)

Storico

Da Apr 2023 a Apr 2024