Schneider Raises Guidance After 'Good Momentum' in Third Quarter

26 Ottobre 2017 - 8:44AM

Dow Jones News

By Nathan Allen

France's Schneider Electric SE (SU.FR) said Thursday it has

raised its 2017 objectives, following what it called "good

momentum" in the third quarter.

Schneider now expects organic revenue growth of around 4% for

2017, excluding its infrastructure division, compared with an

earlier prediction of a 1%-3% rise. The company also expects its

organic adjusted margin on earnings before interest, taxes and

amortization to improve by 50-70 basis points, compared with an

earlier forecast of a 20-50 basis points improvement.

Revenue at the power-equipment supplier was 5.9 billion euros

($6.95 billion) for the quarter, down from EUR6.1 billion a year

earlier on a reported basis, but 2.7% higher on an organic basis,

which excludes acquisitions. Schneider agreed to buy a majority

stake in U.K. software company Aveva Group PLC (AVV.LN) in the

quarter.

The figure compares with a consensus provided by FactSet of

EUR6.03 billion.

Revenue from the Asia-Pacific region, which accounted for around

29% of total quarterly revenue, grew by 5% on the year, driven by a

double-digit rise in China across all business segments, the

company said.

Schneider also said that depreciation in the U.S. dollar and the

Chinese yuan reduced total revenues by around EUR206 million, while

acquisitions had a negative impact of around EUR59 million.

Write to Nathan Allen at nathan.allen@dowjones.com

(END) Dow Jones Newswires

October 26, 2017 02:29 ET (06:29 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

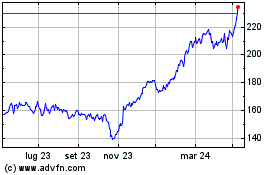

Grafico Azioni Schneider Electric (EU:SU)

Storico

Da Mar 2024 a Apr 2024

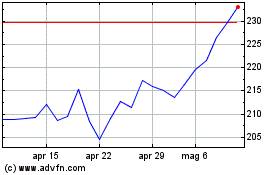

Grafico Azioni Schneider Electric (EU:SU)

Storico

Da Apr 2023 a Apr 2024