Boeing Takes Up Brazil's Concerns -- WSJ

06 Gennaio 2018 - 9:02AM

Dow Jones News

By Dana Mattioli and Dana Cimilluca

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 6, 2018).

Boeing Co. is in talks with Embraer SA and Brazil's government

on ways to address the government's concerns about the U.S.

planemaker's potential takeover of its Brazilian rival, according

to people familiar with the matter.

Boeing and Embraer had informally agreed to terms that would

value the Brazilian company at $28 per U.S. share, the people said.

But after The Wall Street Journal reported on the talks last month,

some Brazilian officials came out against a deal.

President Michel Temer said the government would welcome a new

investment in Embraer but wouldn't permit a change in control of

the company. A government spokesman said Friday that the country's

position hasn't changed.

The companies are now trying to overcome the government's

resistance, which centers largely on Embraer's defense business.

Boeing is sensitive to those concerns and is proactively trying to

address them, one of the people said.

The American company is considering whether to allow Brazil's

government to retain a golden share in Embraer's defense business,

the people said. The government now has a golden share in the whole

company, giving it veto power over any transaction that would

transfer control of the former state-owned business, which is

considered a jewel of Brazilian industry. Embraer still has close

ties to the country's military establishment.

Boeing is also willing to take steps to protect Embraer's brand,

management and jobs, people familiar with the matter have said.

As of Friday morning, Embraer's U.S. shares were trading at just

under $27, nearly 35% more than their price just before the talks

surfaced. That gave the company a market value of about $5 billion.

The stock dropped by roughly 5% Friday afternoon after the Journal

reported on the state of the talks, as some investors were

disappointed that the potential price isn't higher. The shares

closed down 4.2% at $25.76. Boeing closed 4.1% higher at a record

$308.84.

It's uncertain whether the two sides will find a mutually

agreeable arrangement. But any deal would likely take between nine

months and a year to close, one of the people said.

The talks have drawn a rebuke from Bombardier Inc., Embraer's

Canadian rival.

Bombardier faces potential U.S. tariffs after Boeing lodged a

complaint over alleged state subsidies and unfair pricing. The U.S.

company has also objected to a proposed joint venture between

Bombardier and Airbus SE. People familiar with the deal see that

venture as a catalyst for Boeing's bid in Brazil.

"Boeing's acquisition of Embraer undercuts everything it said to

the U.S. government in the trade cases," a Bombardier spokesman on

said Friday.

Embraer, based in the city of São José dos Campos in the state

of São Paulo, is the world's third-largest commercial-jet

manufacturer by revenue and has some 18,000 employees. It's best

known for making regional jets in the 70- to 100-seat range, which

are heavily used on routes where demand doesn't warrant use of

larger Boeing or Airbus planes.

Boeing is the world's largest aerospace company with a market

value of about $180 billion. It makes commercial jetliners and

defense, space and security systems as well as military aircraft,

weapons, satellites and helicopters.

--Luciana Magalhaes in São Paulo and Doug Cameron in Chicago

contributed to this article.

Write to Dana Mattioli at dana.mattioli@wsj.com and Dana

Cimilluca at dana.cimilluca@wsj.com

(END) Dow Jones Newswires

January 06, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

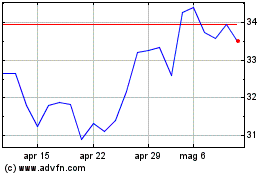

Grafico Azioni EMBRAER ON (BOV:EMBR3)

Storico

Da Mar 2024 a Apr 2024

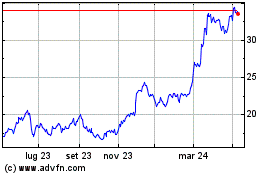

Grafico Azioni EMBRAER ON (BOV:EMBR3)

Storico

Da Apr 2023 a Apr 2024