LONDON MARKETS: FTSE 100 Ends Lower, Pulling Back Further From Record

16 Gennaio 2018 - 6:18PM

Dow Jones News

By Carla Mozee and Victor Reklaitis, MarketWatch

BP, mining stocks help lead the way down

British blue-chip stocks finished lower Tuesday, pulled down in

part by a fall in shares of BP PLC after the energy heavyweight

said it will take a $1.7 billion charge related to the Deepwater

Horizon disaster.

A selloff for miners also weighed on the main equity

benchmark.

How markets are moving: The FTSE 100 index fell 0.2% to close at

7,755.93, building on Monday's 0.1% decline

(http://www.marketwatch.com/story/ftse-100-steps-back-from-record-with-carillion-collapse-in-focus-2018-01-15).

The London benchmark still stands near it all-time closing high

of 7,778.64, hit Friday.

The pound traded at $1.3775, slipping from $1.3782 ahead of the

release of inflation data. Sterling was at $1.3794 late Monday in

New York, after breaking above $1.38 earlier in that session.

What's driving markets: Before finishing lower, the FTSE 100

wobbled in early trading, with the decline for BP shares and the

drop in pound pulling in different directions.

The energy giant said it expects to book a $1.7 billion charge

(http://www.marketwatch.com/story/bp-to-book-17-billion-deepwater-horizon-charge-2018-01-16-34853027)

in its 2017 fourth-quarter results for claims related to the 2010

Deepwater Horizon oil spill. The company has already said it is

likely to take a $1.5 billion accounting charge related to U.S. tax

reform. BP shares have a weighting of 5.1% on the FTSE 100, the

fourth-highest of any individual company, according to FactSet

data.

Stock movers: BP PLC (BP.LN) (BP.LN) lost 2.7% after the

announcement of the Deepwater Horizon charge.

Rio Tinto PLC (RIO) (RIO) (RIO) said it continues to expect

shipments of iron ore from its Western Australia mines

(http://www.marketwatch.com/story/rio-tinto-sees-record-quarterly-iron-ore-shipments-2018-01-16)

will likely rise this year, after record exports in the last

quarter allowed it to hit a target for 2017.

But the miner's shares closed down by 3%, as a downgrade may

have hurt. HSBC analysts cut their ratings on Rio and Anglo

American PLC to hold from buy, saying a recent rally has eroded the

stocks' potential for further growth.

Anglo (AAL.LN) lost 1.6%, and Antofagasta PLC (ANTO.LN) fell

2.8%.

On the upside, shares in Associated British Foods (ABF.LN) added

2.2% following a ratings upgrade to overweight from equal weight at

Barclays.

Advancers also included supermarket chain Tesco PLC (TSCO.LN) ,

higher by 1.9%.

Economic data: U.K. inflation came in at 3% in December

(http://www.marketwatch.com/story/uk-inflation-eases-but-stays-above-boe-target-2018-01-16),

the Office for National Statistics reported, meeting a consensus

estimate from FactSet. The rate compares with a reading of 3.1% in

November.

Average house prices in the U.K. rose 5.1% in November, the ONS

said.

What strategists are saying: "The [inflation] data is unlikely

to greatly sway the Bank of England MPC's current views, although

it is sure to be monitoring the current [pound] rally, continuing

to erode the Brexit inflation of the last 18 months" said Mike van

Dulken and Henry Croft at Accendo Markets.

"More of this could see the U.K. central bank in a position to

hike interest rates sooner than markets are perhaps pricing in,"

the analysts said in a note.

(END) Dow Jones Newswires

January 16, 2018 12:03 ET (17:03 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

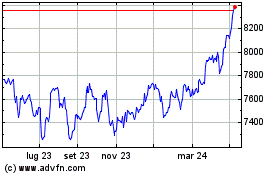

Grafico Indice FTSE 100

Da Mar 2024 a Apr 2024

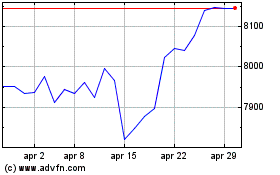

Grafico Indice FTSE 100

Da Apr 2023 a Apr 2024