Luxembourg, January 30,

2018

| Highlights |

|

|

-

Steel Shipments of 1,936 thousand tonnes

in 2017, a 1% increase compared to steel shipments of 1,917

thousand tonnes in 2016.

-

EBITDA of USD 619 million, including an

exceptional charge2 of USD 10 million, in 2017, compared to EBITDA

of USD 492 million, including an exceptional charge3 of USD 11

million, in 2016.

|

|

Aperam (referred to as "Aperam" or the "Company")

(Amsterdam, Luxembourg, Paris, Brussels: APAM

and NYRS: APEMY), announced today results for the three months and

full year periods ending December 31, 2017

Timoteo Di Maulo, CEO of Aperam, commented:

"In 2017, despite challenges in its environment, Aperam continued

to significantly increase its performance and profitability,

delivering once again record yearly EBITDA and Net

Income.

Looking ahead and with the strength of a net cash Company, we

continue to maintain strong cash returns to shareholders while also

focusing on further transforming our footprint with new state of

the art investments." |

| |

|

| Prospects |

|

|

|

|

Financial Policy - Cash Deployment |

|

In coherence

to its Financial Policy, Aperam is announcing two actions regarding

cash deployment:

|

|

|

|

|

Financial Highlights

(on the basis of financial information prepared under IFRS)

| (USDm) unless otherwise stated |

Q4 17 |

Q3 17 |

Q4 16 |

12M 2017 |

12M 2016 |

| Sales |

1,303 |

1,204 |

1,053 |

5,051 |

4,265 |

| EBITDA |

154 |

125 |

133 |

619 |

492 |

| Operating income |

104 |

82 |

83 |

447 |

317 |

| Net income |

121 |

62 |

58 |

361 |

214 |

| Free cash flow before dividend and share buy-back |

157 |

50 |

125 |

255 |

288 |

| |

| Steel shipments (000t) |

495 |

477 |

457 |

1,936 |

1,917 |

| EBITDA/tonne (USD) |

311 |

262 |

291 |

320 |

257 |

| Basic earnings per share (USD) |

1.45 |

0.76 |

0.75 |

4.51 |

2.75 |

| Diluted earnings per share (USD) |

1.29 |

0.75 |

0.70 |

4.29 |

2.59 |

Health & Safety

results

Health and Safety

performance based on Aperam personnel figures and contractors' lost

time injury frequency rate was 1.3x in the fourth quarter of 2017

compared to 0.8x in the third quarter of 2017.

Financial results

analysis for full year period ending December 31, 2017

Sales for the year ended

December 31, 2017 increased by 18%, at USD 5,051 million compared

to USD 4,265 million for the year ended December 31, 2016, mainly

due to higher stainless steel selling prices. Steel shipments in

2017 increased by 1% at 1,936 thousand tonnes compared to 1,917

thousand tonnes in 2016.

EBITDA reached USD 619

million for the year ended December 31, 2017 compared to EBITDA of

USD 492 million for the year ended December 31, 2016. Despite

challenging market conditions in South America and a technical

outage at Châtelet hot strip mill (Belgium) in the first semester,

the Company significantly increased its EBITDA level in the year

primarily due to the Leadership Journey® 4, the Top Line strategy

and favorable conditions of the market, in particular in Europe.

The first two phases of Leadership Journey® have been successfully

realized contributing a total of USD 573 million to EBITDA by the

end of 2017 since the beginning of 2011.

Depreciation and

amortization was USD 172 million for the year ended December 31,

2017.

Aperam had an operating

income for the year ended December 31, 2017 of USD 447 million

compared to an operating income of USD 317 million for the year

ended December 31, 2016.

Net interest expense and

other financing costs for the year ended December 31, 2017 were USD

45 million, including cash cost of financing of USD 12 million.

Income tax result for

the year ended December 31, 2017 was an income tax expense of USD

37 million, including USD 47 million one-off deferred tax income

due to accounting consequences of changes in tax rates in some

jurisdictions

The Company recorded a

net income of USD 361 million for the year ended December 31,

2017.

Cash flows from

operations for the year ended December 31, 2017 were positive at

USD 440 million, including a working capital increase of USD 161

million. CAPEX for the year ended December 31, 2017 was USD 186

million.

Free cash flow before

dividend and share buy-back for the year 2017 amounted to USD 255

million.

As of December 31, 2017,

shareholders' equity was USD 3,050 million and net financial debt

turned to positive net cash position of USD 75 million (gross

financial debt as of December 31, 2017 was USD 292 million and cash

and cash equivalents were USD 367 million).

During the fourth

quarter of 2017, the cash returns to shareholders amounted to USD

32 million, consisting fully of dividend. Total cash returns to

shareholders in 2017 amounted to USD 219 million consisting of USD

98 million of share buy-back and USD 121 million of dividend.

The Company had

liquidity of USD 787 million as of December 31, 2017, consisting of

cash and cash equivalents of USD 367 million and undrawn credit

lines5 of USD 420 million.

Financial results

analysis for the three-month period ending December 31,

2017

Sales for the fourth

quarter of 2017 increased by 8% to USD 1,303 million compared to

USD 1,204 million for the third quarter of 2017. Steel shipments

increased from 477 thousand tonnes in the third quarter of 2017, to

495 thousand tonnes in the fourth quarter of 2017.

EBITDA has increased

over the quarter from USD 125 million for the third quarter of

2017, which included a non-recurring charge of USD 10 million, to

USD 154 million for the fourth quarter of 2017. The seasonality in

Brazil was more than offset by the seasonal recovery in Europe, the

absence of non recurring charge in Brazil and the good contribution

of the Leadership Journey®.

Depreciation and

amortization was USD 50 million for the fourth quarter of 2017.

Aperam had an operating

income for the fourth quarter of 2017 of USD 104 million compared

to an operating income of USD 82 million for the previous

quarter.

Net interest expense and

other financing costs for the fourth quarter of 2017 were USD 10

million, including cash cost of financing of USD 2 million.

Income tax result for

the fourth quarter of 2017 was an income tax benefit of USD 30

million, including USD 47 million one-off deferred tax income due

to accounting consequences of changes in tax rates in some

jurisdictions.

The Company recorded a

net income of USD 121 million for the fourth quarter of 2017.

Cash flows from

operations for the fourth quarter of 2017 were positive at USD 231

million, with a working capital decrease of USD 88 million. CAPEX

for the fourth quarter was USD 74 million.

Free cash flow before

dividend and share buy-back for the fourth quarter of 2017 amounted

to USD 157 million.

Operating segment

results analysis

Stainless & Electrical Steel

The Stainless &

Electrical Steel segment had sales of USD 1.12 billion for the

fourth quarter of 2017. This represents a 17% increase compared to

sales of USD 962 million for the third quarter of 2017. Steel

shipments during the fourth quarter were 499 thousand tonnes. This

is an increase of 11% compared to shipments of 451 thousand tonnes

during the previous quarter. The volume increase was mainly due to

the traditional seasonal recovery in Europe following the summer

seasonal effect. Overall, average selling prices for the Stainless

& Electrical Steel segment increased compared to the previous

quarter.

The segment had EBITDA

of USD 518 million (of which USD 395 million from Europe and USD

123 million from South America) for the year 2017 compared to USD

410 million (of which USD 286 million from Europe and USD 124

million from South America) for the year 2016. The Brazilian market

continued to be challenging over 2017 due to macro-economic

environment, leading to some decrease in volumes which have been

fully mitigated thanks to the Top Line strategy and Leadership

Journey®. The strong performance of Europe over 2017 is mainly due

to the continuous contribution of the Leadership Journey®, healthy

demand in Europe and some stainless steel prices recovery during

the first half of the year.

The segment had EBITDA

of USD 139 million for the fourth quarter of 2017 compared to USD

92 million for the third quarter of 2017. The seasonality in Brazil

was more than offset by the seasonal recovery in Europe, the

absence of non recurring charge in Brazil and the continuous

contribution of the Leadership Journey® and the Top Line

strategy.

Depreciation and

amortisation expense was USD 44 million for the fourth quarter of

2017.

The Stainless &

Electrical Steel segment had an operating income of USD 95 million

for the fourth quarter of 2017 compared to an operating income of

USD 53 million for the third quarter of 2017.

Services & Solutions

The Services &

Solutions segment had sales of USD 559 million for the fourth

quarter of 2017, representing a decrease of 1% compared to USD 565

million for the third quarter of 2017. For the fourth quarter of

2017, steel shipments were 195 thousand tonnes compared to 203

thousand tonnes during the previous quarter. The Services &

Solutions segment had higher average selling prices during the

period compared to the previous period.

The segment had EBITDA

of USD 78 million for the year 2017 compared to USD 82 million for

the year 2016. The impacts from technical outage of Châtelet hot

strip mill during the first half of the year were mostly

compensated by slightly higher volumes and positive contribution of

the Top Line strategy.

The segment had EBITDA

for the fourth quarter of 2017 of USD 25 million compared to EBITDA

of USD 8 million for the third quarter of 2017. EBITDA increased

mainly due to some positive stock effects in fourth quarter

compared to negative stock effects in third quarter.

Depreciation and

amortisation was USD 4 million for the fourth quarter of 2017.

The Services &

Solutions segment had an operating income of USD 21 million for the

fourth quarter of 2017 compared to an operating income of USD 5

million for the third quarter of 2017.

Alloys

& Specialties

The Alloys &

Specialties segment had sales of USD 142 million for the fourth

quarter of 2017, representing an increase of 16% compared to USD

122 million for the third quarter of 2017. Steel shipments were

higher during the fourth quarter of 2017 at 9 thousand tonnes

compared to 7 thousand tonnes during the third quarter of 2017.

Average selling prices decreased over the quarter.

The segment had EBITDA

of USD 52 million for the year 2017 compared to USD 30 million for

the year 2016. This is mainly due to the continuous recovery of

market demand over the year as well as the contribution of the Top

Line strategy.

The Alloys &

Specialties segment achieved EBITDA of USD 12 million for the

fourth quarter of 2017 compared to USD 15 million for the third

quarter of 2017. The decrease in EBITDA was mainly due to the

seasonality and product mix.

Depreciation and

amortisation expense for the fourth quarter of 2017 was USD 1

million.

The Alloys &

Specialties segment had an operating income of USD 11 million for

the fourth quarter of 2017 compared to an operating income of USD

14 million for the third quarter of 2017.

Recent

developments

-

On January 19, 2018

Aperam announced its financial calendar for 2018. The financial

calendar is available on the Company's website www.aperam.com,

section Investors & shareholders, Financial calendars.

New

developments

-

On January 30, 2018

Aperam announced its detailed dividend payment schedule for 2018.

The Company also proposes to increase its base dividend from USD

1.50 per share to USD 1.80, subject to shareholder approval at the

2018 Annual General Meeting, as the Company continues to improve

its sustainable profitability benefiting from its strategic

actions. The schedule is available on Aperam's website

www.aperam.com, section Investors & shareholders, Equity

Investors, Dividends.

-

On January 30, 2018,

Aperam announced a share buyback program of up to USD 100 million,

and a maximum of 1.8 million shares under the authorization given

by the Annual General Meeting of shareholders held on May 5, 2015.

The details of the program are available in a separate Press

Release.

-

On January 30, 2018,

Aperam announced a new investment project in its Genk plant

(Belgium) consisting in a new Cold Rolling and Annealing and

Pickling Line. The investment project targets to further facilitate

transformation of our business with state of the art modern lines

using latest technology, to enlarge our product range to the most

demanding applications, to improve lead-time and flexibility

to the market demand, to increase efficiency and cost

competitiveness of our assets, and to continuously enhance our

health, safety and environmental impact. Further details regarding

the project are to be provided with the next quarterly earnings

release.

-

On January 30, 2018,

Aperam announced an investment to transfer its German Service

Center from Duisburg to Haan. The investment will enable to further

improve our supply chain, reduce working capital and decrease our

costs while continuously improving our health and safety

environment. Further details regarding the project are to be

provided with the next quarterly earnings release.

-

On January 30, 2018,

Aperam announced that the Company will report its financial results

in EURO starting from its Q1 2018 Earnings Release. As indicative

information and to support investors and analysts in this change,

an unaudited Aperam Model in EURO is available on the Company's

website www.aperam.com, section Investors & shareholders,

Earnings.

Investor conference

call

Aperam management will

host a conference call for members of the investment community to

discuss the fourth quarter 2017 financial performance at the

following time:

| Date |

New York |

London |

Luxembourg |

Tuesday,

January 30, 2018 |

12:30

pm |

5:30

pm |

6:30

pm |

The dial-in numbers for the call are:

France (+33 (0)1 76 77 22 74); USA (+1 646 828 8193); and

international (+44 (0)330 336 9105). The participant access code

is: 4562691#.

A replay of the conference call will be available until February

05, 2018: France (+33 (0) 1 70 48 00 94); USA (+1 719-457-0820) and

international (+44 (0) 207 984 7568). The participant access code

is 4562691#.

Contacts

Corporate Communications / Laurent

Beauloye: +352 27 36 27 103

Investor Relations / Romain Grandsart: +352 27 36 27 36

About Aperam

Aperam is a global

player in stainless, electrical and specialty steel, with customers

in over 40 countries. The business is organised in three primary

operating segments: Stainless & Electrical Steel, Services

& Solutions and Alloys & Specialties.

Aperam has 2.5 million

tonnes of flat Stainless and Electrical steel capacity in Brazil

and Europe and is a leader in high value specialty products. Aperam

has a highly integrated distribution, processing and services

network and a unique capability to produce stainless and specialty

from low cost biomass (charcoal). Its industrial network is

concentrated in six production facilities located in Brazil,

Belgium and France.

In 2017, Aperam had

sales of USD 5.1 billion and steel shipments of 1.94 million

tonnes.

For further information,

please refer to our website at www.aperam.com

Forward-looking statements

This document may

contain forward-looking information and statements about Aperam and

its subsidiaries. These statements include financial projections

and estimates and their underlying assumptions, statements

regarding plans, objectives and expectations with respect to future

operations, products and services, and statements regarding future

performance. Forward-looking statements may be identified by the

words "believe," "expect," "anticipate," "target" or similar

expressions. Although Aperam's management believes that the

expectations reflected in such forward-looking statements are

reasonable, investors and holders of Aperam's securities are

cautioned that forward-looking information and statements are

subject to numerous risks and uncertainties, many of which are

difficult to predict and generally beyond the control of Aperam,

that could cause actual results and developments to differ

materially and adversely from those expressed in, or implied or

projected by, the forward-looking information and statements. These

risks and uncertainties include those discussed or identified in

Aperam's filings with the Luxembourg Stock Market Authority for the

Financial Markets (Commission de Surveillance du Secteur

Financier). Aperam undertakes no obligation to publicly update its

forward-looking statements or information, whether as a result of

new information, future events, or otherwise.

APERAM CONDENSED

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

| (in million of U.S. dollars) |

December 31,

2017 |

September 30,

2017 |

December 31,

2016 |

| Non current assets |

2,972 |

2,944 |

2,773 |

| Goodwill and intangible assets |

610 |

609 |

565 |

| Property, plant and equipments (incl. Biological

assets) |

1,887 |

1,814 |

1,691 |

| Investments & Other |

475 |

521 |

517 |

| |

|

|

|

| Current assets & working

capital6 |

1,188 |

1,174 |

955 |

| Inventories, trade receivables and trade

payables6 |

723 |

815 |

517 |

| Prepaid expenses and other current assets6 |

98 |

114 |

89 |

| Cash and cash equivalents (C) |

367 |

245 |

325 |

| Assets held for sale |

- |

- |

24 |

| |

|

|

|

| Shareholders' equity |

3,050 |

2,874 |

2,485 |

| Group share |

3,046 |

2,870 |

2,481 |

| Non-controlling interest |

4 |

4 |

4 |

| |

|

|

|

| Non current liabilities |

809 |

855 |

768 |

| Long-term debt, net of current portion (A) |

286 |

284 |

275 |

| Deferred employee benefits |

191 |

189 |

173 |

| Provisions and other |

332 |

382 |

320 |

| |

|

|

|

| Current liabilities (excluding

trade payables)6 |

301 |

389 |

475 |

| Short-term debt and current portion of long-term

debt (B) |

6 |

77 |

204 |

| Accrued expenses and other current

liabilities6 |

295 |

312 |

247 |

| Liabilities held for sale |

- |

- |

24 |

| |

|

|

|

| Net Financial Debt / (Net cash) (D

= A+B+C) |

(75) |

116 |

154 |

APERAM CONDENSED

CONSOLIDATED STATEMENT OF OPERATIONS

|

(in million of U.S. dollars) |

Three Months Ended |

|

Year Ended |

| December 31, 2017 |

September 30, 2017 |

December 31, 2016 |

|

December 31, 2017 |

December 31, 2016 |

| Sales |

1,303 |

1,204 |

1,053 |

|

5,051 |

4,265 |

| Adjusted EBITDA (E = C-D) |

154 |

135 |

144 |

|

629 |

503 |

| Adjusted EBITDA margin

(%) |

11.8% |

11.2% |

13.7% |

|

12.5% |

11.8% |

| Exceptional items (D) |

- |

(10) |

(11) |

|

(10) |

(11) |

| EBITDA (C = A-B) |

154 |

125 |

133 |

|

619 |

492 |

| EBITDA margin (%) |

11.8% |

10.4% |

12.6% |

|

12.3% |

11.5% |

| Depreciation, amortisation and impairment (B) |

(50) |

(43) |

(50) |

|

(172) |

(175) |

| Operating income (A) |

104 |

82 |

83 |

|

447 |

317 |

| Operating margin (%) |

8.0% |

6.8% |

7.9% |

|

8.8% |

7.4% |

| Loss from other investments |

(4) |

- |

- |

|

(4) |

- |

| Net interest expense and other net financing

costs |

(10) |

(10) |

(9) |

|

(45) |

(43) |

| Foreign exchange and derivative gains |

1 |

4 |

4 |

|

- |

3 |

| Income before taxes |

91 |

76 |

78 |

|

398 |

277 |

| Income tax benefit (expense) |

30 |

(14) |

(20) |

|

(37) |

(63) |

| Effective tax rate % |

(34.1)% |

19.1% |

25.6% |

|

9.1% |

22.8% |

| Net income |

121 |

62 |

58 |

|

361 |

214 |

APERAM CONDENSED

CONSOLIDATED STATEMENT OF CASH FLOWS

|

(in million of U.S. dollars) |

Three Months Ended |

|

Year Ended |

| December 31, 2017 |

September 30, 2017 |

December 31, 2016 |

|

December 31, 2017 |

December 31, 2016 |

| Net income |

121 |

62 |

58 |

|

361 |

214 |

| Depreciation, amortisation and impairment |

50 |

43 |

50 |

|

172 |

175 |

| Change in working capital6 |

88 |

(41) |

65 |

|

(161) |

(39) |

| Other operating activities (net)6 |

(28) |

18 |

(10) |

|

68 |

67 |

| Net cash provided by operating

activities (A) |

231 |

82 |

163 |

|

440 |

417 |

| Purchase of PPE, intangible and biological assets

(CAPEX) |

(74) |

(31) |

(39) |

|

(186) |

(130) |

| Other investing activities (net) |

- |

(1) |

1 |

|

1 |

1 |

| Net cash used in investing

activities (B) |

(74) |

(32) |

(38) |

|

(185) |

(129) |

| Net payments to banks and long term debt |

(5) |

(2) |

(3) |

|

(12) |

(12) |

| Purchase of treasury stock |

- |

- |

- |

|

(98) |

- |

| Dividend paid |

(32) |

(31) |

(24) |

|

(121) |

(97) |

| Other financing activities (net) |

- |

(1) |

- |

|

(1) |

(1) |

| Net cash used in financing

activities |

(37) |

(34) |

(27) |

|

(232) |

(110) |

| Effect of exchange rate changes on cash |

2 |

4 |

(7) |

|

19 |

(1) |

| Change in cash and cash

equivalent |

122 |

20 |

91 |

|

42 |

177 |

| |

|

|

|

|

|

|

| Free cash flow before dividend and

share buy-back (C = A+B) |

157 |

50 |

125 |

|

255 |

288 |

Appendix 1a - Health

& Safety statistics

|

Health & Safety Statistics |

Three Months Ended |

Year Ended |

| December 31, 2017 |

September 30, 2017 |

December 31, 2016 |

December 31, 2017 |

December 31, 2016 |

| Frequency

Rate |

1.3 |

2.0 |

0.8 |

1.4 |

1.4 |

Lost time injury frequency rate equals

lost time injuries per 1,000,000 worked hours, based on own

personnel and contractors.

Appendix 1b - Key

operational and financial information

Year Ended

December 31, 2017 |

Stainless & Electrical Steela,b |

Services & Solutions |

Alloys & Specialties |

Others & Eliminations |

Total |

| Operational information |

|

|

|

|

|

| Steel Shipment (000t) |

1,882 |

818 |

33 |

(797) |

1,936 |

| Average steel selling price (USD/t) |

2,162 |

2,699 |

14,984 |

|

2,525 |

| |

|

|

|

|

|

| Financial information

(USDm) |

|

|

|

|

|

| Sales |

4,198 |

2,299 |

517 |

(1,963) |

5,051 |

| Adjusted EBITDA |

528 |

78 |

52 |

(29) |

629 |

| EBITDA |

518 |

78 |

52 |

(29) |

619 |

| Depreciation, amortisation and impairment |

(152) |

(12) |

(6) |

(2) |

(172) |

| Operating income / (loss) |

366 |

66 |

46 |

(31) |

447 |

Note a: Stainless & Electrical Steel

shipments of 1,882kt of which 629kt were from South America and

1,253kt were from Europe

Note b: Stainless & Electrical Steel Adjusted EBITDA of USD

528m of which USD 133m were from South America and USD 395m were

from Europe

Year Ended

December 31, 2016 |

Stainless & Electrical Steela,b |

Services & Solutions |

Alloys & Specialties |

Others & Eliminations |

Total |

| Operational information |

|

|

|

|

|

| Steel Shipment (000t) |

1,880 |

799 |

30 |

(792) |

1,917 |

| Average steel selling price (USD/t) |

1,817 |

2,366 |

13,046 |

|

2,162 |

| |

|

|

|

|

|

| Financial information

(USDm) |

|

|

|

|

|

| Sales |

3,510 |

1,964 |

415 |

(1,624) |

4,265 |

| Adjusted EBITDA |

410 |

93 |

30 |

(30) |

503 |

| EBITDA |

410 |

82 |

30 |

(30) |

492 |

| Depreciation, amortisation and impairment |

(145) |

(22) |

(6) |

(2) |

(175) |

| Operating income / (loss) |

265 |

60 |

24 |

(32) |

317 |

Note a: Stainless & Electrical Steel

shipments of 1,880kt of which 639kt were from South America and

1,241kt were from Europe

Note b: Stainless & Electrical Steel Adjusted EBITDA of USD

410m of which USD 124m were from South America and USD 286m were

from Europe

Quarter Ended

December 31, 2017 |

Stainless & Electrical Steel |

Services & Solutions |

Alloys & Specialties |

Others & Eliminations |

Total |

| Operational information |

|

|

|

|

|

| Steel Shipment (000t) |

499 |

195 |

9 |

(208) |

495 |

| Average steel selling price (USD/t) |

2,175 |

2,729 |

15,646 |

|

2,538 |

| |

|

|

|

|

|

| Financial information

(USDm) |

|

|

|

|

|

| Sales |

1,123 |

559 |

142 |

(521) |

1,303 |

| Adjusted EBITDA |

139 |

25 |

12 |

(22) |

154 |

| EBITDA |

139 |

25 |

12 |

(22) |

154 |

| Depreciation, amortisation and impairment |

(44) |

(4) |

(1) |

(1) |

(50) |

| Operating income / (loss) |

95 |

21 |

11 |

(23) |

104 |

Quarter Ended

September 30, 2017 |

Stainless & Electrical Steel |

Services & Solutions |

Alloys & Specialties |

Others & Eliminations |

Total |

| Operational information |

|

|

|

|

|

| Steel Shipment (000t) |

451 |

203 |

7 |

(184) |

477 |

| Average steel selling price (USD/t) |

2,058 |

2,693 |

15,890 |

|

2,444 |

| |

|

|

|

|

|

| Financial information

(USDm) |

|

|

|

|

|

| Sales |

962 |

565 |

122 |

(445) |

1,204 |

| Adjusted EBITDA |

102 |

8 |

15 |

10 |

135 |

| EBITDA |

92 |

8 |

15 |

10 |

125 |

| Depreciation, amortisation and impairment |

(39) |

(3) |

(1) |

- |

(43) |

| Operating income / (loss) |

53 |

5 |

14 |

10 |

82 |

Appendix 2 - Terms and

definitions

Unless indicated otherwise, or the

context otherwise requires, references in this earnings release

report to the following terms have the meanings set out next to

them below:

Adjusted EBITDA:

operating income before depreciation, amortization and impairment

expenses and exceptional items.

Average steel selling prices: calculated as

steel sales divided by steel shipments.

Cash and cash equivalents: represents cash and

cash equivalents, restricted cash and short-term

investments.

CAPEX: relates to capital expenditures and is

defined as purchase of tangible assets, intangible assets and

biological assets.

EBITDA: operating income before depreciation,

amortisation and impairment expenses.

EBITDA/tonne: calculated as EBITDA divided by

total steel shipments.

Exceptional items: consists of (i) inventory

write-downs equal to or exceeding 10% of total related inventories

values before write-down at the considered quarter end (ii)

restructuring (charges)/gains equal to or exceeding USD 10 million

for the considered quarter, (iii) capital (loss)/gain on asset

disposals equal to or exceeding USD 10 million for the considered

quarter or (iv) other non-recurring items equal to or exceeding USD

10 million for the considered quarter.

Free cash flow before dividend and share

buy-back: net cash provided by operating activities less net

cash used in investing activities.

Gross financial debt: long-term debt plus

short-term debt.

Liquidity: Cash and cash equivalent and

undrawn credit lines.

LTI frequency rate: Lost time injury frequency

rate equals lost time injuries per 1,000,000 worked hours, based on

own personnel and contractors.

Net financial debt and / or Net cash:

long-term debt, plus short-term debt less cash and cash

equivalents.

Net financial debt/EBITDA or Gearing: Refers

to Net financial debt divided by last twelve months EBITDA

calculation.

Shipments: information at segment and group

level eliminates inter-segment shipments (which are primarily

between Stainless & Electrical Steel and Services &

Solutions) and intra-segment shipments, respectively.

Working capital: trade accounts receivable

plus inventories less trade accounts payable.

1 The financial

information in this press release and Appendix 1 has been prepared

in accordance with the measurement and recognition criteria of

International Financial Reporting Standards ("IFRS") as adopted in

the European Union. While the interim financial information

included in this announcement has been prepared in accordance with

IFRS applicable to interim periods, this announcement does not

contain sufficient information to constitute an interim financial

report as defined in International Accounting Standard 34, "Interim

Financial Reporting". Unless otherwise noted the numbers and

information in the press release have not been audited. The

financial information and certain other information presented in a

number of tables in this press release have been rounded to the

nearest whole number or the nearest decimal. Therefore, the sum of

the numbers in a column may not conform exactly to the total figure

given for that column. In addition, certain percentages presented

in the tables in this press release reflect calculations based upon

the underlying information prior to rounding and, accordingly, may

not conform exactly to the percentages that would be derived if the

relevant calculations were based upon the rounded numbers. This

press release also includes Alternative Performance Measures ("APM"

hereafter). The Company believes that these APMs are relevant to

enhance the understanding of its financial position and provides

additional information to investors and management with respect to

the Company's financial performance, capital structure and credit

assessment. These non-GAAP financial measures should be read in

conjunction with and not as an alternative for, Aperam's financial

information prepared in accordance with IFRS. Such non-GAAP

measures may not be comparable to similarly titled measures applied

by other companies. The APM's used are defined under Appendix 2

"Terms & definitions".

2 Exceptional charge of USD 10 million in 2017 mainly related to

indirect taxes amnesty settlements in Brazil.

3 Exceptional charge of USD 11 million in 2016 related to

non-recurring and non-cash charge related to the announced

intention of divestment of the French Tubes units of Services &

Solutions division.

4 The Leadership Journey® is an initiative launched on December 16,

2010, and subsequently accelerated and increased, to target

management gains and profit enhancement. Aperam targets a

contribution to EBITDA of a total amount of USD 575 million by end

of 2017. On June 7, 2017, Aperam announced the third phase of the

Leadership Journey® - the Transformation Program - targeting USD

150 million of additional EBITDA gains per year by end of

2020.

5 Includes revolving credit facility of EUR 300 million and EIB

financing of EUR 50 million.

6 Effective Q1 2017, the Company modified the presentation of

assets and liabilities related to the TSR programs to more

appropriately reflect the nature of these items. The comparative

amount in the condensed consolidated statement of financial

position was reclassified for consistency, which resulted in a net

amount of USD 42 million being reclassified from "prepaid expenses

and other current assets/accrued expenses and other current

liabilities" to "inventories, trade receivables and trade payables"

as of December 31, 2016. In addition, amounts in the condensed

consolidated statement of cash flows were similarly reclassified,

which resulted in USD 56 million and USD (13)million being

reclassified from "other operating activities (net)" to "change in

working capital" for the three months period ended December 31,

2016 and year ended December 31, 2016, respectively.

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Aperam via Globenewswire

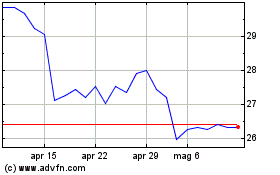

Grafico Azioni Aperam (EU:APAM)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Aperam (EU:APAM)

Storico

Da Apr 2023 a Apr 2024