Pound Climbs Amid Risk Appetite

01 Febbraio 2018 - 6:50AM

RTTF2

The pound strengthened against its major counterparts in early

European deals on Thursday amid risk appetite, as banking shares

rallied after the U.S. Federal Reserve left its key rate unchanged,

as widely expected, but set the stage for a rate hike at its next

meeting in March.

The Fed acknowledged stronger growth and indicated confidence

about inflation, warranting case for "further gradual" rate

hikes.

Solid factory data from the euro area underpinned risk

sentiment.

Survey data from IHS Markit showed that Eurozone manufacturing

activity expanded markedly at the start of the year, driven by

solid expansions of both production and new orders.

The final factory Purchasing Managers' Index dropped to a

three-month low of 59.6 in January from December's record high of

60.6.

Data from the IHS Markit/CIPS showed that UK manufacturing

logged further easing at the start of 2018, falling to its lowest

level since June last year, but sustained its robust momentum.

The manufacturing PMI fell to 55.3 from 56.2 in December.

Economists had predicted a score of 56.5.

In other economic releases, U.K. house price inflation

accelerated to its highest level in 10 months in January, defying

expectations for a slowdown, results of a survey by the Nationwide

Building Society showed.

The house price index rose 3.2 percent year-on-year after a 2.6

percent increase in December. Economists had expected 2.5 percent

gain.

The currency fell against its major rivals in the Asian session,

with the exception of the franc.

The pound advanced to a 6-day high of 1.3301 against the Swiss

franc, from a low of 1.3203 hit at 5:00 pm ET. The next possible

resistance for the pound is seen around the 1.34 area.

Preliminary data from the Federal Statistical Office showed that

Swiss retail sales rose for a second straight month in

December.

Retail sales rose a calendar adjusted 0.6 percent year-on-year

after a 0.3 percent increase in the previous month. In October,

sales fell 2.3 percent.

Having fallen to 1.4160 against the greenback at 2:15 am ET, the

pound firmed to a 6-day high of 1.4275. The pound is seen finding

resistance around the 1.44 level.

The pound rallied to 156.45 against the yen, a level unseen

since June 20, 2016. If the pound rises further, it may target

resistance around the 158.00 region.

The latest survey from Nikkei showed that Japan manufacturing

sector continued to expand in January, and at a faster rate, with a

Manufacturing PMI score of 54.8.

That's up from 54.0 in December, and it moves further above the

boom-or-bust line of 50 that separates expansion from

contraction.

The pound hit a weekly high of 0.8717 against the euro,

following a decline to 0.8757 at 1:30 am ET. On the upside, 0.86 is

possibly seen as the next resistance level for the pound.

Looking ahead, U.S. weekly jobless claims for the week ended

January 27, construction spending for December and ISM

manufacturing index for January are set for release in the New York

session.

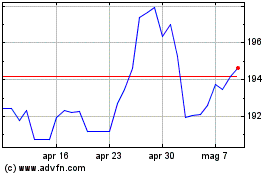

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Mar 2024 a Apr 2024

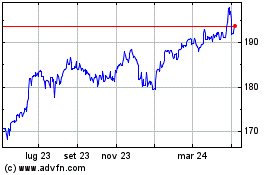

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Apr 2023 a Apr 2024