Australia Keeps Rate Unchanged

06 Febbraio 2018 - 3:33AM

RTTF2

Australia's central bank maintained its key interest rate at its

first meeting of the year and remained upbeat about growth

prospects despite slow household income growth.

The board of the Reserve Bank of Australia, governed by Philip

Lowe, maintained the cash rate at 1.50 percent, the bank said in a

statement on Tuesday. The bank had reduced the rate by 25-basis

points each in August and May last year.

Taking account of the available information, the RBA Board

judged that holding the stance of monetary policy unchanged at this

meeting would be consistent with sustainable growth in the economy

and achieving the inflation target over time.

The bank hinted that interest rates are unlikely to rise anytime

soon. The low level of interest rates is continuing to support the

Australian economy, RBA said.

Further progress in reducing unemployment and having inflation

return to target is expected, although this progress is likely to

be gradual, the bank observed.

Although the stronger economy is likely to lift wages, the bank

expects wages growth to remain low. "Notwithstanding the improving

labor market, wage growth remains low," the RBA said.

"This is likely to continue for a while yet," the bank

added.

The Bank's central forecast for the Australian economy is for

GDP growth to pick up, to average a bit above 3 percent over the

next couple of years. At the same time, CPI inflation is forecast

to be a bit above 2 percent in 2018.

The RBA pointed out the outlook for household consumption as one

continuing source of uncertainty. Household incomes are growing

slowly and debt levels are high.

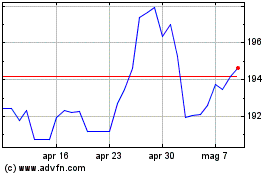

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Mar 2024 a Apr 2024

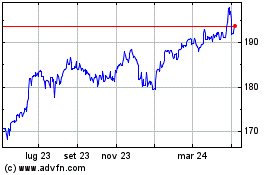

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Apr 2023 a Apr 2024