Clichy, 8 February 2018 at 6.00 p.m.

2017 Annual Results Growth acceleration:

+5.5%[1] in 4th quarter

Sales exceeding €10 bn in the New Markets

Record operating margin: 18%

-

Sales: 26.02 billion

euros

-

Operating profit: 4.68 billion

euros, representing 18.0% of sales

-

Earnings per share[3]: 6.65

euros, an increase of +3.0%

-

Net profit after

non-controlling interests: 3.58 billion euros, an increase of

+15.3%

-

Net cash flow[4]: 3.97 billion euros, an increase of +19.6%

-

Dividend[5]:

+7.6% at 3.55 euros

The Board of Directors of L'Oréal

met on 8 February 2018, under the chairmanship of Jean-Paul Agon

and in the presence of the Statutory Auditors. The Board closed the

consolidated financial statements and the financial statements for

2017.

Commenting on the annual results,

Jean-Paul Agon, Chairman and CEO of L'Oréal, said:

"In a beauty

market that pursued its steady growth in 2017, L'Oréal had a good

year with sustained sales growth momentum, and robust profits. As

announced, the second half accelerated compared with the first,

particularly in the fourth quarter with +5.5% like-for-like

growth.

All the

Divisions recorded sales growth, especially

L'Oréal Luxe which is delivering spectacular growth, particularly

in Asia. The Active Cosmetics Division achieved more than 2 billion

euros of sales for the first time. Growth in the Consumer Products

Division is being slowed by the continuing difficulties of the

American and French markets, while sales in the Professional

Products Division improved at the end of the year.

Today more than ever, L'Oréal can rely on its

unique portfolio of powerful and complementary brands, eight of

which now have sales above one billion euros.

As for the geographic Zones, the New Markets

exceeded more than 10 billion euros of sales for the first time

ever, thanks especially to the dynamism of the Asia Pacific Zone.

Performance in Western Europe remained

solid.

2017 was especially notable for the accentuation

of our digital edge and the strengthening of our positions in two

strategic channels. Firstly in e-commerce [6], where our

sales accelerated to reach 2 billion euros, an increase of +33.6%.

Secondly in Travel Retail, a channel with strong potential, in

which L'Oréal celebrated 40 years of presence by strengthening its

number one position.

In terms of

results, as announced, operating margin has reached the record

level of 18% of sales, while increasing research expenses and

business drivers. There were improvements in all our operating

parameters; the quality of the results is also reflected in the

record cash flow.

And finally, in

2017, L'Oréal was recognised for its leadership in corporate social

responsibility with, for the second year running, the best score

awarded by the CDP [7], three

"A"s, and L'Oréal has been ranked number 1 in all sectors by

Vigeo Eiris. L'Oréal has also obtained first place in the world

ranking by Equileap for gender equality.

As for 2018, in a

market that should remain dynamic and contrasted, L'Oréal more than

ever before has the best advantages in terms of innovation, brand

power, digital prowess, and the quality of its teams all over the

world, to win market share and strengthen its Beauty leadership. We

are therefore confident that, this year once again, we will

outperform the market and achieve significant growth in

like-for-like[1] sales

and an increase in profitability."

The Board of Directors will

propose to the Annual General Meeting of 17 April 2018 the renewal

of the tenure as Director of Mr. Jean-Paul Agon and Mrs. Belén

Garijo for a term of four years.

Mr. Xavier Fontanet did not wish

to renew his tenure as Director, which expires at the end of the

2018 Annual General Meeting. The Board has expressed its deep

gratitude to Mr. Fontanet for his active participation in the work

of the Board and of the Committees over the last 16 years.

The Board will propose to the

Annual General Meeting the candidacy as a new independent director

of Mr. Axel Dumas, Chief Executive Officer of Hermès.

Furthermore, the Board of

Directors at its meeting on 8 February 2018 noted the resignation

of Mr. Charles-Henri Filippi, as a result of his appointment at

Lazard as Managing Director, effective from March 2018, in view of

the nature of the business relationships existing between Lazard

and L'Oréal. Mr. Filippi's tenure as director ended on 8 February

2018.

The Board wished to warmly thank

Mr. Filippi for his contribution to the work of the Board and of

the three Committees of which he has been Member or Chairman (Audit

Committee, Appointments & Governance Committee, and Human

Resources & Remuneration Committee).

The Board will propose to the

Annual General Meeting the candidacy as a new independent director

of Mr. Patrice Caine, Chairman and Chief Executive Officer of

the Thales Group.

As the appointments and renewals

presented have an impact on the composition of the Committees, the

composition is set out in detail in the table hereafter, subject to

the approval of the resolutions relating to the renewals of tenure

and appointments at the Annual General Meeting of Shareholders on

17 April 2018.

Projected

composition of Committees at the end of the Annual General Meeting

of Shareholders of

17 April 2018*

| |

Independence |

Expiry Date of Current Tenure |

Board Committees |

| Strategy & Sustainable

Development |

Audit |

HR

& Remuneration |

Appointments & Governance |

| Mr.

Jean-Paul Agon* |

|

2022 |

Ch |

|

|

|

|

Mrs. Françoise Bettencourt Meyers |

|

2021 |

° |

|

|

|

| Mr. Paul

Bulcke |

|

2021 |

° |

|

° |

° |

| Mr.

Jean-Pierre Meyers |

|

2020 |

° |

|

° |

° |

|

Mrs. Ana Sofia Amaral** |

Employee

Dir. |

2022 |

|

|

° |

|

|

Mrs. Sophie Bellon |

* |

2019 |

|

° |

Ch |

Ch |

| Mr.

Patrice Caine* |

* |

2022 |

|

|

|

° |

| Mr. Axel

Dumas* |

* |

2022 |

|

° |

|

|

|

Mrs. Belén Garijo* |

* |

2022 |

|

|

° |

|

|

Mrs. Béatrice Guillaume-Grabisch |

2020 |

|

° |

|

|

| Mr.

Bernard Kasriel |

* |

2020 |

° |

|

|

|

| Mr.

Georges Liarokapis*** |

Employee

Dir. |

2022 |

|

° |

|

|

| Mr.

Jean-Victor Meyers |

|

2020 |

|

° |

|

|

|

Mrs. Virginie Morgon |

* |

2021 |

|

Ch |

|

|

|

Mrs. Eileen Naughton |

* |

2020 |

|

|

° |

|

* Independence within the meaning of the criteria of the

AFEP-MEDEF Code as assessed by the Board of Directors

Ch Committee

Chairman/Chairwoman

° Committee Member |

* Subject to

approval of the resolutions relating to the renewals of tenure and

appointments of directors at the Annual General Meeting of

Shareholders of 17 April 2018.

** The tenure as employee director of Mrs. Ana

Sofia Amaral expires on 17 April 2018. It is the responsibility of

the Instance Européenne de Dialogue Social (European Works Council) to renew the tenure of Mrs. Amaral

or to designate another employee director for a new term of four

years.

***The tenure as employee director of Mr. Georges

Liarokapis expires on 17 April 2018. It is the responsibility of

the CFE-CGC, the most representative trade union organisation at

L'Oréal in France, to renew the tenure of Mr. Liarokapis or to

designate another employee director for a new term of four

years.

2017 Sales

Like-for-like, i.e. based on

a comparable scope of consolidation and constant exchange rates,

the sales trend of the L'Oréal Group was +4.8%.

The net impact of changes in the scope of

consolidation amounted to -2.8%:

Currency fluctuations had a

negative impact of -1.3%.

Growth at constant exchange rates was +2.0%.

Based on reported figures, the Group's sales,

at 31 December 2017, amounted to 26.02 billion euros, an increase

of +0.7%.

Sales by Operational Division and Geographic

Zone

The finalisation,

on 7 September 2017, of the disposal of The Body Shop leads to

account for the businesses sold, for 2017, in accordance with the

IFRS 5 accounting rule on discontinued operations.

| |

4th quarter

2017 |

At 31 December 2017 |

| |

|

Growth |

|

Growth |

| |

€m |

Like-for-like |

Reported |

€m |

Like-for-like |

Reported |

| By Operational Division |

|

|

|

|

|

|

|

Professional Products |

831.8 |

+2.0% |

-4.0% |

3,350.4 |

+0.2% |

-1.4% |

| Consumer

Products |

2,910.7 |

+3.0% |

-2.3% |

12,118.7 |

+2.2% |

+1.0% |

| L'Oréal

Luxe |

2,298.9 |

+9.8% |

+4.1% |

8,471.7 |

+10.5% |

+10.6% |

| Active

Cosmetics |

472.3 |

+8.4% |

+14.2% |

2,082.9 |

+5.8% |

+11.9% |

| Cosmetics Divisions total |

6,513.8 |

+5.5% |

+0.7% |

26,023.7 |

+4.8% |

+4.4% |

| By Geographic Zone |

|

|

|

|

|

|

| Western

Europe[8] |

2,048.8 |

+1.9% |

+1.1% |

8,125.3 |

+2.6% |

+1.5% |

| North

America |

1,761.4 |

-0.8% |

-6.5% |

7,350.5 |

+1.7% |

+3.5% |

| New

Markets, of which: |

2,703.6 |

+13.2% |

+5.7% |

10,547.8 |

+8.9% |

+7.5% |

| - Asia Pacific 8 |

1,595.1 |

+18.8% |

+10.3% |

6,151.8 |

+12.3% |

+9.2% |

| - Latin America |

488.5 |

+7.2% |

-1.0% |

1,952.9 |

+5.6% |

+6.2% |

| - Eastern Europe |

449.8 |

+8.0% |

+5.0% |

1,750.8 |

+8.6% |

+11.4% |

| - Africa, Middle East |

170.2 |

-1.1% |

-10.2% |

692.4 |

-7.1% |

-9.4% |

| Cosmetics Divisions total |

6,513.8 |

+5.5% |

+0.7% |

26,023.7 |

+4.8% |

+4.4% |

| Group total |

6,513.8 |

+5.5% |

-4.1% |

26,023.7 |

+4.8% |

+0.7% |

In the fourth quarter of 2016 and

in the full-year 2016, reported Group sales included the sales of

The Body Shop in amounts of 321.3 million euros and 920.8 million

euros respectively.

PROFESSIONAL PRODUCTS

The Professional

Products Division ended the year at +0.2% like-for-like and -1.4%

reported.

After declining in the first half, the Division's sales increased

in the second half, reflecting a significant recovery in the United

States and the Asia Pacific Zone. Eastern Europe and Latin America

are maintaining their momentum.

Shades EQ, the core hair colour franchise at

Redken, is growing strongly. In haircare, the

revamping of the Série Expert ranges by

L'Oréal Professionnel is energising the

category, while on the trend of naturalness, Aura

Botanica by Kérastase and Biolage R.A.W. are continuing to prove highly

successful.

CONSUMER PRODUCTS

The Consumer

Products Division recorded fourth quarter growth of +3.0%

like-for-like, and ended the year at +2.2% like-for-like and +1.0%

reported.

Make-up growth is continuing: NYX Professional

Makeup is growing fast and extending its global expansion;

L'Oréal Paris is holding up well, with

Lash Paradise mascara proving particularly

successful, and ended the year at number two in the United States,

just behind the market leader Maybelline New

York. The good momentum in skincare continued, both at

L'Oréal Paris with the global roll-out of clay

masks, and at Garnier with the ongoing

Micellar Cleansing Waters saga. Hair colour is

growing, driven by the impetus of Magic

Retouch and Colorista by L'Oréal Paris.

The Division is growing in Western Europe, where it is winning

market share, and in Eastern Europe and Spanish-speaking America.

Its acceleration in Asia continued in the fourth quarter, thanks to

China. Growth in North America slowed in a difficult

market.

Lastly, e-commerce is continuing to act as a growth catalyst,

driven by China where it already accounts for more than one-third

of sales.

L'ORÉAL LUXE

L'Oréal Luxe

posted growth of +10.5% like-for-like and +10.6% reported. The

Division is outperforming its market and confirming its success in

make-up and facial skincare.

Lancôme had a very good year with double-digit

growth, fuelled by make-up successes with Monsieur

Big mascara, L'Absolu Rouge and Teint Idole Ultra, and by the acceleration of the

Génifique skincare range. La

Vie est Belle has confirmed its European number one position,

despite stiffer competition. Yves Saint

Laurent is breaking more records thanks to its successes in

fragrances, with the good start of new men's fragrance Y, and in make-up with the achievements of its

Tatouage Couture lip products. Giorgio Armani and Kiehl's both

exceeded the one billion euro mark in sales. The rapid growth of

IT Cosmetics is

continuing.

L'Oréal Luxe is posting double-digit growth in Asia Pacific, with

particularly good figures in China and in Travel Retail. Western

Europe is performing well. E-commerce growth is also very

strong.

ACTIVE COSMETICS

With growth of

+5.8% like-for-like and +11.9% reported, 2017 was a historic year

for the Active Cosmetics Division, which saw its sales break the 2

billion euro barrier, while further increasing its leadership of

the dermocosmetics market worldwide.

La Roche-Posay, the world number one

dermocosmetics brand, is maintaining its strong growth momentum,

thanks in particular to its franchises Effaclar, Lipikar and Cicaplast.

Vichy performed well in the fourth quarter,

especially in Western Europe and Asia, thanks to Minéral 89, and its anti-ageing launch Neovadiol Rose Platinium.

For the eighth year running, SkinCeuticals

posted double-digit growth and confirmed the success of H.A. Intensifier.

The strong acceleration in e-commerce is continuing.

The Division's global expansion continues: thanks to the successful

integration of CeraVe, which is growing

strongly in the American market, and the good momentum of SkinCeuticals and La Roche-Posay,

the United States is the largest contributor to growth and has

become the Division's number one country.

Multi-division summary by

Geographic Zone

WESTERN EUROPE

In 2017, Western Europe posted

growth of +2.6% like-for-like and +1.5% reported.

Growth was particularly robust in Great Britain, Spain and Germany,

fuelled by the make-up and skincare categories. Sales in France

continued to be held back by a slightly contracting

market.

The two main Divisions, Consumer Products and L'Oréal Luxe,

outperformed their respective markets, and the Active Cosmetics

Division's growth accelerated in the second part of the year.

NORTH AMERICA

The Zone posted growth of +1.7%

like-for-like and +3.5% reported.

The American market is continuing to grow, but is facing a slowdown

in some historical distribution channels. Performance in make-up is

being further increased by the brands NYX

Professional Makeup and L'Oréal Paris, but

haircare is proving less dynamic. The L'Oréal Luxe Division has

slowed, against a background of inventory reductions. Yves Saint Laurent and IT

Cosmetics however have continued to record double-digit growth.

In the fourth quarter, the Professional Products Division saw sales

increase, thanks particularly to its partner brands. The Active

Cosmetics Division performed well last year, bolstered by the

recent acquisition of CeraVe and by the

emblematic SkinCeuticals and La Roche-Posay brands.

NEW MARKETS

Asia Pacific:

this Zone recorded growth of +12.3% like-for-like and +9.2%

reported. In Northern Asia, Chinese consumers are driving growth,

particularly for the L'Oréal Luxe Division in China and Hong Kong.

China's strong growth is continuing, fuelled by very good

e-commerce results across all Divisions. In Southern Asia, India is

very dynamic. Thailand and Malaysia are also growing very

strongly.

Latin

America: the Zone posted growth of +5.6% like-for-like and

+6.2% reported. Mexico and Argentina recorded double-digit growth,

while the economic environment remains difficult in Brazil. The

L'Oréal Luxe and Active Cosmetics Divisions have achieved

double-digit growth, thanks respectively to the Lancôme and La Roche-Posay brands.

The Consumer Products Division is growing in the make-up category,

reflecting the expansion of the NYX Professional

Makeup brand and the continuing growth of Maybelline New York.

Eastern

Europe: the Zone posted growth of +8.6% like-for-like and

+11.4% reported. Turkey and Central Europe were the growth drivers,

and sales in Russia were satisfactory.

All the Divisions made market share gains.

In this Zone, e-commerce now accounts for more than 5% of

sales.

Africa, Middle

East: this Zone is at -7.1% like-for-like and -9.4% reported,

with a clear improvement in the second half. Despite substantial

declines in markets, the situation is stabilising in the Gulf

states. Egypt's growth was dynamic.

Important events during the period 1/10/17 to

31/12/17

-

On 9 October 2017, the OECD (Organisation for

Economic Co-operation and Development) announced that it had

accepted two new methods, developed by L'Oréal's Research

laboratories, which can be used in place of animal testing to

assess skin allergy and eye irritation.

-

On 20 October 2017, L'Oréal announced a

strategic partnership with STATION F, the world's largest start-up

campus, to support the development of early stage digital beauty

start-ups.

-

On 20 November 2017, at the 5th

edition of the "Palmarès de la féminisation des

instances dirigeantes" organised by Ethics & Boards,

L'Oréal's commitment to both gender equality and professional

equality was recognised, and L'Oréal received the Award for Gender

Equality at Top Management Level.

-

On 21 November 2017, at the CDP7

Europe Awards in Brussels, L'Oréal obtained for the second year

running the best possible score, an "A" rating, in each of the

three fields of combating climate change, sustainable water

stewardship and protecting forests.

2017 Results

Audited financial statements, certification in

progress.

Operating profitability at 18.0% of

sales

Consolidated profit and loss accounts: from sales to operating

profit.

The finalisation,

on 7 September 2017, of the disposal of The Body Shop leads to

account for the businesses sold, for 2017, in accordance with the

IFRS 5 accounting rule on discontinued operations. See the compared consolidated profit and loss accounts in

the appendix.

|

|

2016 |

2017 |

|

|

€m Reported2 |

% sales |

€m |

% sales |

| Sales |

25,837.1 |

100.0% |

26,023.7 |

100.0% |

| Cost of sales |

-7,341.7 |

28.4% |

-7,359.2 |

28.3% |

| Gross profit |

18,495.4 |

71.6% |

18,664.5 |

71.7% |

| R&D expenses |

-849.8 |

3.3% |

-877.1 |

3.4% |

| Advertising and promotion expenses |

-7,498.7 |

29.0% |

-7,650.6 |

29.4% |

| Selling, general and administrative expenses |

-5,607.0 |

21.7% |

-5,460.5 |

21.0% |

| Operating profit |

4,539.9 |

17.6% |

4,676.3 |

18.0% |

Gross profit,

at 18,664 million euros, came out at 71.7% of sales, compared with

71.6% in 2016, that is an increase of 10 basis points.

Research and

Development expenses, at 3.4% of sales, have increased slightly

in relative value.

As announced, Advertising and promotion expenses increased to 29.4%

of sales, representing an increase of 40 basis points.

Selling, general

and administrative expenses, at 21.0% of sales, have reduced by

70 basis points, mainly due to the impact of the sale of The Body

Shop.

Overall, operating profit, at 4,676 million euros, has grown by

3.0%, and amounts to 18.0% of sales, representing an increase of 40

basis points. Excluding exchange rates, operating profit grew by

+4.4%.

Operating profit by Operational Division

The finalisation,

on 7 September 2017, of the disposal of The Body Shop leads to

account for the businesses sold, for 2017, in accordance with the

IFRS 5 accounting rule on discontinued operations. See the compared consolidated profit and loss accounts in

the appendix.

|

|

2016 |

2017 |

|

|

€m Reported2 |

% sales |

€m |

% sales |

| By Operational Division |

|

|

|

|

|

Professional Products |

688.6 |

20.3% |

669.4 |

20.0% |

| Consumer

Products |

2,417.1 |

20.2% |

2,419.0 |

20.0% |

| L'Oréal

Luxe |

1,622.8 |

21.2% |

1,855.8 |

21.9% |

| Active

Cosmetics |

431.5 |

23.2% |

471.2 |

22.6% |

| Cosmetics Divisions total |

5,160.0 |

20.7% |

5,415.4 |

20.8% |

| Non-allocated[9] |

-653.9 |

-2.6% |

-739.1 |

- 2.8% |

| The Body

Shop |

33.8 |

3.7% |

|

- |

| Group |

4,539.9 |

17.6% |

4,676.3 |

18.0% |

After a difficult 2017, the

profitability of the Professional Products

Division came out at 20.0%.

The profitability of the Consumer Products Division came out at 20.0%,

representing a slight decrease of 20 basis points compared with

2016.

The profitability of L'Oréal Luxe, at 21.9%, strongly increased in 2017,

which is an increase of 70 basis points.

At Active

Cosmetics Division, profitability came out

at 22.6%.

Non-allocated

expenses increased by 2.8% of sales, mainly due to the increase

in digital costs.

Profitability by Geographic Zone

The finalisation,

on 7 September 2017, of the disposal of The Body Shop leads to

account for the businesses sold, for 2017, in accordance with the

IFRS 5 accounting rule on discontinued operations. See the compared consolidated profit and loss accounts in

the appendix.

| Operating profit |

2016 |

2017 |

| €m |

% sales |

€m |

% sales |

| Western

Europe[10] |

1,831.5 |

22.9% |

1,860.4 |

22.9% |

| North

America |

1,392.3 |

19.6% |

1,411.3 |

19.2% |

| New

Markets10 |

1,936.2 |

19.7% |

2,143.6 |

20.3% |

| Geographic Zones total[11] |

5,160.0 |

20.7% |

5,415.4 |

20.8% |

Profitability in Western Europe at 22.9%, is at an

identical level to that of 2016.

In North

America, profitability came out at 19.2%, slightly lower than

2016.

And in the New

Markets, profitability strongly increased and exceeded, for the

first time, 20% of sales.

Net profit

Consolidated profit and loss accounts: from operating profit to net

profit excluding non-recurring items.

The finalisation,

on 7 September 2017, of the disposal of The Body Shop leads to

account for the businesses sold, for 2017, in accordance with the

IFRS 5 accounting rule on discontinued operations. See the compared consolidated profit and loss accounts in

the appendix.

| €m |

2016 Reported2 |

2017 |

Growth |

| Operating profit |

4,539.9 |

4,676.3 |

+3.0% |

Financial revenues and expenses

excluding dividends received |

-19.3 |

-22.9 |

|

| Sanofi dividends |

346.5 |

350.0 |

|

| Profit

before tax excluding non-recurring items |

4,867.1 |

5,003.3 |

+2.8% |

| Income tax excluding non-recurring items |

-1,216.8 |

-1,250.5 |

|

| Net profit excluding non-recurring items of equity

consolidated companies |

-0.1 |

-0.1 |

|

| Non-controlling interests |

-3.0 |

-3.9 |

|

Net profit excluding non-recurring items

after non-controlling interests[12] |

3,647.2 |

3,748.7[13] |

+2.8% |

| |

|

|

|

| EPS[14]

(€) |

6.46 |

6.65 |

+3.0% |

| Net profit after non-controlling interests |

3,105.8 |

3,581.4 |

+15.3% |

| Diluted

EPS after non-controlling interests (€) |

5.50 |

6.36 |

|

| Diluted average number of shares |

564,509,135 |

563,528,502 |

|

Finance

expenses came out at 23 million euros.

Sanofi

dividends amounted to 350 million euros.

Income tax

excluding non-recurring items amounted to 1,250 million euros.

This represents a tax rate of 25.0%.

Net profit

excluding non-recurring items after non-controlling interests from

continuing operations amounted to 3,749 million euros, an

increase of +2.8% and +4.1% at constant exchange rates.

Earnings per

Share, at 6.65 euros, is up by +3.0%, and +4.3% at constant

exchange rates.

Non-recurring

items after non-controlling interests amounted to -167 million

euros net of tax, mainly due to the disposal of The Body Shop, to

the impact of the reimbursement of taxes on dividends, and to the

positive impact of the American tax reform on differed tax

liabilities.

Net profit

came out at 3,581 million euros, strongly increasing by 15.3%.

Cash flow statement, Balance sheet and Cash

position

Gross cash

flow amounted to 4,972 million euros, an increase of 5.4%.

The working

capital requirement decreased by 261 million euros.

Investments

amounted to 1,263 million euros, representing 4.9% of sales.

The net cash

flow4 came out at

3,969 million euros, a strong increase of +19.6%.

The balance

sheet remains particularly solid with shareholders' equity

amounting to 24.8 billion euros, and net cash

at 1,872 million euros at 31 December 2017.

Proposed dividend at the Annual General Meeting of

17 April 2018

The Board of Directors has decided

to propose to the Shareholders' Annual General Meeting of 17 April

2018 a dividend of 3.55 euros per share, an increase of +7.6%

compared with the dividend paid in 2017. The dividend will be paid

on 27 April 2018 (ex-dividend date 25 April 2018 at 0:00 a.m.,

Paris time).

Share capital

As of 31 December 2017, the

capital of the company is formed by 560,519,088 shares, each with one voting right.

"This news

release does not constitute an offer to sell, or a solicitation of

an offer to buy L'Oréal shares. If you wish to obtain more

comprehensive information about L'Oréal, please refer to the public

documents registered in France with the Autorité des Marchés

Financiers, also available in English on our Internet site

www.loreal-finance.com.

This news release may contain some forward-looking

statements. Although the Company considers that these statements

are based on reasonable hypotheses at the date of publication of

this release, they are by their nature subject to risks and

uncertainties which could cause actual results to differ materially

from those indicated or projected in these statements."

This is a free

translation into English of the 2017 Annual

Results news release issued in the French

language and is provided solely for the convenience of English

speaking readers. In case of discrepancy, the French version

prevails.

Contacts at L'Oréal

(switchboard: +33 1 47 56 70 00)

Individual shareholders and

market authorities

Mr Jean Régis CAROF

Tel: +33 1 47 56 83 02

jean-regis.carof@loreal.com

Financial analysts and

Institutional investors

Mrs Françoise LAUVIN

Tel: +33 1 47 56 86 82

francoise.lauvin@loreal.com

Journalists

Mrs Stephanie CARSON-PARKER

Tel: +33 1 47 56 76 71

stephanie.carsonparker@loreal.com

For more information, please

contact your bank, broker or financial institution (I.S.I.N. code:

FR0000120321), and consult your usual newspapers, the Internet site

for shareholders and investors, www.loreal-finance.com or the

L'Oréal Finance app, alternatively, call +33 1 40 14 80 50.

www.loreal-finance.com -

Follow us on Twitter @loreal

Appendices

Appendix 1: L'Oréal Group

sales 2016/2017 (€ millions)

| |

2016[15] |

2017[16] |

| First

quarter: |

|

|

|

Operational Divisions |

6,352.4 |

6,847.8 |

| The Body

Shop |

200.1 |

197.2 |

| First quarter total |

6,552.4 |

7,045.0 |

| Second

quarter: |

|

|

|

Operational Divisions |

6,143.6 |

6,564.2 |

| The Body

Shop |

198.5 |

|

| Second quarter total |

6,342.2 |

6,564.2 |

| First

half: |

|

|

|

Operational Divisions |

12,496.0 |

13,411.9 |

| The Body

Shop |

398.6 |

|

| First half total |

12,894.6 |

13,411.9 |

| Third

quarter: |

|

|

|

Operational Divisions |

5,952.2 |

6,097.9 |

| The Body

Shop |

200.9 |

|

| Third quarter total |

6,153.2 |

6,097.9 |

| Nine

months: |

|

|

|

Operational Divisions |

18,448.2 |

19,509.9 |

| The Body

Shop |

599.5 |

|

| Nine months total |

19,047.8 |

19,509.9 |

| Fourth

quarter: |

|

|

|

Operational Divisions |

6,468.1 |

6,513.8 |

| The Body

Shop |

321.3 |

|

| Fourth quarter total |

6,789.3 |

6,513.8 |

| Full

year: |

|

|

|

Operational Divisions |

24,916.3 |

26,023.7 |

| The Body

Shop |

920.8 |

|

| Full year total |

25,837.1 |

26,023.7 |

Appendix 2: Compared consolidated income statements

|

|

|

|

|

|

REMINDER *

2016 Published data |

| € millions |

2017 |

2016

(1) |

2015

(1) |

|

2016 |

2015 |

| Net sales |

26,023.7 |

24,916.3 |

24,290.2 |

|

25,837.1 |

25,257.4 |

| Cost of

sales |

-7,359.2 |

-7,068.6 |

-6,994.2 |

|

-7,341.7 |

-7,277.4 |

| Gross profit |

18,664.5 |

17,847.7 |

17,295.9 |

|

18,495.4 |

17,980.0 |

| Research

and development |

-877.1 |

-841.2 |

-787.4 |

|

-849.8 |

-794.1 |

| Advertising

and promotion |

-7,650.6 |

-7,264.4 |

-7,132.8 |

|

-7,498.7 |

-7,359.6 |

| Selling,

general and administrative expenses |

-5,460.5 |

-5,236.0 |

-5,042.9 |

|

-5,607.0 |

-5,438.6 |

| Operating profit |

4,676.3 |

4,506.1 |

4,332.9 |

|

4,539.9 |

4,387.7 |

| Other

income and expenses |

-276.3 |

-541.3 |

-188.5 |

|

-543.8 |

-193.4 |

| Operational profit |

4,400.0 |

3,964.8 |

4,144.4 |

|

3,996.1 |

4,194.3 |

| Finance

costs on gross debt |

-35.5 |

-27.4 |

-20.3 |

|

-32.6 |

-23.7 |

| Finance

income on cash and cash equivalents |

38.5 |

39.0 |

59.4 |

|

39.1 |

55.6 |

| Finance costs, net |

3.1 |

11.6 |

39.1 |

|

6.5 |

31.9 |

| Other

financial income (expenses) |

-26.0 |

-25.8 |

-43.3 |

|

-25.8 |

-45.7 |

| Sanofi

dividends |

350.0 |

346.5 |

336.9 |

|

346.5 |

336.9 |

| Profit before tax and associates |

4,727.0 |

4,297.1 |

4,477.2 |

|

4,323.4 |

4,517.4 |

| Income

tax |

-901.3 |

-1,213.7 |

-1,229.4 |

|

-1,214.6 |

-1,222.9 |

| Share of

profit in associates |

-0.1 |

-0.1 |

4.0 |

|

-0.1 |

4.0 |

| Net profit from continuing operations |

3,825.6 |

3,083.4 |

3,251.8 |

|

3,108.7 |

3,298.5 |

| Net profit from discontinued operations |

-240.1 |

25.3 |

46.8 |

|

- |

- |

| Net profit |

3,585.5 |

3,108.7 |

3,298.5 |

|

3,108.7 |

3,298.5 |

|

Attributable to: |

|

|

|

|

|

|

| - owners of

the company |

3,581.4 |

3,105.8 |

3,297.4 |

|

3,105.8 |

3,297.4 |

| -

non-controlling interests |

4.1 |

2.9 |

1.1 |

|

2.9 |

1.1 |

| Earnings

per share attributable to owners of the company (euros) |

6.40 |

5.55 |

5.92 |

|

5.55 |

5.92 |

| Diluted

earnings per share attributable to owners of the company (euros) |

6.36 |

5.50 |

5.84 |

|

5.50 |

5.84 |

Earnings

per share of continuing operations

attributable to owners of the company (euros) |

6.83 |

5.51 |

5.83 |

|

5.55 |

5.92 |

Diluted

earnings per share of continuing operations

attributable to owners of the company (euros) |

6.78 |

5.46 |

5.75 |

|

5.50 |

5.84 |

Earnings

per share of continuing operations attributable

to owners of the company, excluding non-recurring items (euros) |

6.70 |

6.47 |

6.17 |

|

6.52 |

6.26 |

Diluted

earnings per share of continuing operations attributable

to owners of the company, excluding non-recurring items (euros) |

6.65 |

6.41 |

6.08 |

|

6.46 |

6.18 |

(1) The consolidated income statements

for 2016 and 2015 are presented to reflect the impacts of IFRS 5

regarding discontinued operations, restating The Body Shop activity

on a single line "Net profit from discontinued

operations".

* For consistency

with the financial information provided outside of the financial

statements, we believed it useful to show the Group's financial

performance when The Body Shop was an integral part of its

continuing operations.

Appendix 3: Consolidated

statements of comprehensive income

| € millions |

2017** |

2016* |

2015* |

| Consolidated net profit for the period |

3,585.5 |

3,108.7 |

3,298.5 |

| Financial assets available-for-sale |

-597.1 |

-201.0 |

347.6 |

| Cash flow hedges |

88.9 |

-124.0 |

60.1 |

| Cumulative translation adjustments |

-824.8 |

19.6 |

373.7 |

| Income tax on items that may be reclassified to profit or

loss (1)

(2) |

4.5 |

86.3 |

-28.9 |

| Items that may be reclassified to profit or loss |

-1,328.5 |

-219.1 |

752.5 |

| Actuarial gains and losses |

280.0 |

-1.3 |

598.1 |

| Income tax on items that may not be reclassified to profit

or loss (1)

(2) |

-107.9 |

-39.3 |

-205.3 |

| Items that may not be reclassified to profit or

loss |

172.1 |

-40.6 |

392.8 |

| Other comprehensive income |

-1,156.5 |

-259.7 |

1,145.3 |

| Consolidated comprehensive income |

2,428.9 |

2,849.0 |

4,443.8 |

|

Attributable to: |

|

|

|

| - owners of the company |

2,424.8 |

2,845.6 |

4,443.1 |

| -

non-controlling interests |

4.1 |

3.4 |

0.7 |

* 2016 and

2015 as published including The Body Shop.

** Including The Body Shop for

eight months in 2017.

(1) The tax effect is as follows:

| € millions |

2017 |

2016 |

2015 |

| Financial assets available-for-sale |

37.3 |

41.7 |

-14.4 |

| Cash flow hedges |

-32.8 |

44.6 |

-14.4 |

| Items that may be reclassified to profit or loss |

4.5 |

86.3 |

-28.9 |

| Actuarial gains and losses |

-107.9 |

-39.3 |

-205.3 |

| Items that may not be reclassified to profit or

loss |

-107.9 |

-39.3 |

-205.3 |

| TOTAL |

-103.4 |

47.0 |

-234.1 |

(2)

Including in 2017, respectively €20.4 million and

-€21.5 million arising on the remeasurement of deferred tax in

France further to the planned change in the tax rate by 2022 and

the deferred tax in the United States further to the change in the

tax rate at 1 January 2018.

Appendix 4: Compared consolidated balance sheets

| ASSETS

| € millions |

31.12.2017 |

31.12.2016

(1) |

31.12.2015

(1) |

| Non-current assets |

24,320.1 |

25,584.6 |

24,457.6 |

|

Goodwill |

8,872.3 |

8,792.5 |

8,151.5 |

| Other

intangible assets |

2,579.1 |

3,179.4 |

2,942.9 |

| Property,

plant and equipment |

3,571.1 |

3,756.9 |

3,403.5 |

| Non-current

financial assets |

8,766.2 |

9,306.5 |

9,410.9 |

| Investments

in associates |

1.1 |

1.0 |

1.0 |

| Deferred

tax assets |

530.3 |

548.3 |

547.9 |

| Current assets |

11,019.0 |

10,045.6 |

9,253.7 |

|

Inventories |

2,494.6 |

2,698.6 |

2,440.7 |

| Trade

accounts receivable |

3,923.4 |

3,941.8 |

3,627.7 |

| Other

current assets |

1,393.8 |

1,420.4 |

1,486.9 |

| Current tax

assets |

160.6 |

238.8 |

298.6 |

| Cash and

cash equivalents |

3,046.6 |

1,746.0 |

1,399.8 |

| TOTAL |

35,339.1 |

35,630.2 |

33,711.3 |

(1)

2016 and 2015 balance sheets as published including The Body

Shop.

| EQUITY &

LIABILITIES

| € millions |

31.12.2017 |

31.12.2016

(1) |

31.12.2015

(1) |

| Equity |

24,818.5 |

24,504.0 |

23,617.0 |

| Share

capital |

112.1 |

112.4 |

112.6 |

| Additional

paid-in capital |

2,935.3 |

2,817.3 |

2,654.4 |

| Other

reserves |

14,752.2 |

13,951.6 |

12,873.4 |

| Other

comprehensive income |

3,904.7 |

4,237.6 |

4,517.5 |

| Cumulative

translation adjustments |

-413.5 |

410.9 |

391.9 |

| Treasury

stock |

-56.5 |

-133.6 |

-233.3 |

| Net profit

attributable to owners of the company |

3,581.4 |

3,105.8 |

3,297.4 |

| Equity attributable to owners of the company |

24,815.7 |

24,501.9 |

23,613.9 |

|

Non-controlling interests |

2.8 |

2.1 |

3.1 |

| Non-current liabilities |

1,347.2 |

1,918.9 |

1,920.6 |

| Provisions

for employee retirement obligations and related benefits |

301.9 |

711.8 |

807.2 |

| Provisions

for liabilities and charges |

434.9 |

333.3 |

195.9 |

| Deferred

tax liabilities |

597.0 |

842.9 |

876.8 |

| Non-current

borrowings and debt |

13.4 |

30.9 |

40.8 |

| Current liabilities |

9,173.4 |

9,207.3 |

8,173.7 |

| Trade

accounts payable |

4,140.8 |

4,135.3 |

3,929.0 |

| Provisions

for liabilities and charges |

889.2 |

810.7 |

754.6 |

| Other

current liabilities |

2,823.9 |

2,854.4 |

2,597.3 |

| Income

tax |

158.5 |

173.2 |

151.9 |

| Current

borrowings and debt |

1,161.0 |

1,233.7 |

741.0 |

| TOTAL |

35,339.1 |

35,630.2 |

33,711.3 |

(1)

2016 and 2015 balance sheets as published including The Body

Shop.

Appendix 5: Consolidated statements of changes in equity

| € millions |

Common

shares

outstanding |

Share capital |

Additional paid-in capital |

Retained

earnings

and net

profit |

Other

compre-

hensive

income |

Treasury stock |

Cumulative translation adjustments |

Equity

attributable

to owners

of the

company |

Non-control-

ling interests |

Total

equity |

| At 31.12.14 |

554,241,878 |

112.3 |

2,316.8 |

14,683.5 |

3,745.9 |

-683.0 |

17.8 |

20,193.3 |

3.6 |

20,196.9 |

|

Consolidated net profit for the period |

|

|

|

3,297.4 |

|

|

|

3,297.4 |

1.1 |

3,298.5 |

| Financial assets available-for-sale |

|

|

|

|

333.2 |

|

|

333.2 |

|

333.2 |

| Cash flow hedges |

|

|

|

|

45.6 |

|

|

45.6 |

|

45.6 |

| Cumulative translation adjustments |

|

|

|

|

|

|

374.1 |

374.1 |

-0.4 |

373.7 |

Other comprehensive income that may be

reclassified to profit and loss |

|

|

|

|

378.8 |

|

374.1 |

752.9 |

-0.4 |

752.5 |

| Actuarial gains and losses |

|

|

|

|

392.8 |

|

|

392.8 |

|

392.8 |

Other comprehensive income that may not

be reclassified to profit and loss |

|

|

|

|

392.8 |

|

|

392.8 |

- |

392.8 |

| Consolidated comprehensive income |

|

|

|

3,297.4 |

771.6 |

|

374.1 |

4,443.1 |

0.7 |

4,443.8 |

| Capital

increase |

4,657,959 |

0.9 |

337.6 |

|

|

|

|

338.5 |

|

338.5 |

|

Cancellation of Treasury stock |

|

-0.6 |

|

-362.8 |

|

363.4 |

|

- |

|

- |

| Dividends

paid (not paid on Treasury stock) |

|

|

|

-1,511.4 |

|

|

|

-1,511.4 |

-2.6 |

-1,514.0 |

| Share-based

payment |

|

|

|

117.6 |

|

|

|

117.6 |

|

117.6 |

| Net changes

in Treasury stock |

1,088,341 |

|

|

-77.1 |

|

86.3 |

|

9.2 |

|

9.2 |

| Purchase

commitments for non-controlling interests |

|

|

|

23.5 |

|

|

|

23.5 |

1.5 |

25.0 |

| Changes in

scope of consolidation |

|

|

|

|

|

|

|

- |

|

- |

| Other

movements |

|

|

|

0.1 |

|

|

|

0.1 |

-0.1 |

- |

| At 31.12.2015 |

559,988,178 |

112.6 |

2,654.4 |

16,170.8 |

4,517.5 |

-233.3 |

391.9 |

23,613.9 |

3.1 |

23,617.0 |

|

Consolidated net profit for the period |

|

|

|

3,105.8 |

|

|

|

3,105.8 |

2.9 |

3,108.7 |

| Financial assets available-for-sale |

|

|

|

|

-159.3 |

|

|

-159.3 |

|

-159.3 |

| Cash flow hedges |

|

|

|

|

-79.3 |

|

|

-79.3 |

-0.1 |

-79.4 |

| Cumulative translation adjustments |

|

|

|

|

|

|

19.0 |

19.0 |

0.6 |

19.6 |

Other comprehensive income that may be

reclassified to profit and loss |

|

|

|

|

-238.6 |

|

19.0 |

-219.6 |

0.5 |

-219.1 |

| Actuarial gains and losses |

|

|

|

|

-40.6 |

|

|

-40.6 |

|

-40.6 |

Other comprehensive income that may not

be reclassified to profit and loss |

|

|

|

|

-40.6 |

|

|

-40.6 |

- |

-40.6 |

| Consolidated comprehensive income |

|

|

|

3,105.8 |

-279.2 |

|

19.0 |

2,845.6 |

3.4 |

2,849.0 |

| Capital

increase |

2,074,893 |

0.4 |

162.8 |

|

|

|

|

163.2 |

|

163.2 |

|

Cancellation of Treasury stock |

|

-0.6 |

|

-498.9 |

|

499.5 |

|

- |

|

- |

| Dividends

paid (not paid on Treasury stock) |

|

|

|

-1,741.9 |

|

|

|

-1,741.9 |

-3.4 |

-1,745.2 |

| Share-based

payment |

|

|

|

120.4 |

|

|

|

120.4 |

|

120.4 |

| Net changes

in Treasury stock |

-1,964,675 |

|

|

-99.3 |

|

-399.8 |

|

-499.1 |

|

-499.1 |

| Purchase

commitments for non-controlling interests |

|

|

|

|

|

|

|

- |

-0.1 |

-0.1 |

| Changes in

scope of consolidation |

|

|

|

-0.8 |

|

|

|

-0.8 |

-0.9 |

-1.7 |

| Other

movements |

|

|

|

1.2 |

-0.7 |

|

|

0.6 |

-0.1 |

0.5 |

| At 31.12.2016 |

560,098,396 |

112.4 |

2,817.3 |

17,057.3 |

4,237.6 |

-133.6 |

410.9 |

24,501.9 |

2.1 |

24,504.0 |

| € millions |

Common

shares

outstanding |

Share capital |

Additional paid-in capital |

Retained

earnings

and net

profit |

Other

compre-

hensive

income |

Treasury stock |

Cumulative translation adjustments |

Equity

attributable

to owners

of the

company |

Non-control-

ling interests |

Total

equity |

| At 31.12.2016 |

560,098,396 |

112.4 |

2,817.3 |

17,057.3 |

4,237.6 |

-133.6 |

410.9 |

24,501.9 |

2.1 |

24,504.0 |

|

Consolidated net profit for the period |

|

|

|

3,581.4 |

|

|

|

3,581.4 |

4.1 |

3,585.5 |

| Financial assets available-for-sale |

|

|

|

|

-559.7 |

|

|

-559.7 |

|

-559.7 |

| Cash flow hedges |

|

|

|

|

55.5 |

|

|

55.5 |

0.4 |

55.9 |

| Cumulative translation adjustments |

|

|

|

|

|

|

-824.5 |

-824.5 |

-0.3 |

-824.8 |

Other comprehensive income that may

be reclassified to profit and loss |

|

|

|

|

-504.2 |

|

-824.5 |

-1,328.7 |

0.1 |

-1,328.6 |

| Actuarial gains and losses |

|

|

|

|

172.1 |

|

|

172.1 |

|

172.1 |

Other comprehensive income that may

not be reclassified to profit and loss |

|

|

|

|

172.1 |

|

|

172.1 |

- |

172.1 |

| Consolidated comprehensive income |

|

|

|

3,581.4 |

-332.2 |

|

-824.5 |

2,424.8 |

4.1 |

2,428.9 |

| Capital

increase |

1,509,951 |

0.3 |

118.0 |

|

|

|

|

118.3 |

|

118.3 |

|

Cancellation of Treasury stock |

|

-0.6 |

|

-498.6 |

|

499.2 |

|

- |

|

- |

| Dividends

paid (not paid on Treasury stock) |

|

|

|

-1,857.7 |

|

|

|

-1,857.7 |

-3.5 |

-1,861.2 |

| Share-based

payment |

|

|

|

128.8 |

|

|

|

128.8 |

|

128.8 |

| Net changes

in Treasury stock |

-1,860,384 |

|

|

-77.2 |

|

-422.0 |

|

-499.2 |

|

-499.2 |

| Changes in

scope of consolidation |

|

|

|

-1.3 |

|

|

|

-1.3 |

|

-1.3 |

| Other

movements |

|

|

|

1.0 |

-0.7 |

|

|

0.3 |

|

0.3 |

| AT 31.12.2017 |

559,747,963 |

112.1 |

2,935.3 |

18,333.7 |

3,904.7 |

-56.5 |

-413.5 |

24,815.7 |

2.8 |

24,818.5 |

Appendix 6: Compared consolidated statements of cash flows

|

|

|

|

|

|

REMINDER *

2016 Published data |

| € millions |

2017 |

2016

(1) |

2015

(1) |

|

2016 |

2015 |

| Cash flows from operating activities |

|

|

|

|

|

|

| Net profit

attributable to owners of the company |

3,581.4 |

3,105.8 |

3,297.4 |

|

3,105.8 |

3,297.4 |

|

Non-controlling interests |

4.1 |

2.9 |

1.1 |

|

2.9 |

1.1 |

| Elimination

of expenses and income with no impact on cash flows: |

|

|

|

|

|

|

| -

depreciation, amortisation and provisions |

1,218.5 |

1,382.3 |

908.2 |

|

1,424.5 |

933.8 |

| - changes

in deferred taxes |

-194.8 |

86.5 |

71.6 |

|

79.8 |

53.4 |

| -

share-based payment (including free shares) |

126.7 |

120.4 |

117.6 |

|

120.4 |

117.6 |

| - capital

gains and losses on disposals of assets |

-3.9 |

-16.2 |

0.2 |

|

-16.2 |

0.2 |

| Net profit

from discontinued operations |

240.1 |

-25.3 |

-46.8 |

|

- |

- |

| Share of

profit in associates net of dividends received |

0.1 |

0.1 |

-4.0 |

|

0.1 |

-4.0 |

| Gross cash flow |

4,972.2 |

4,656.4 |

4,345.4 |

|

4,717.3 |

4,399.5 |

| Changes in

working capital |

261.1 |

4.3 |

-217.5 |

|

-12.7 |

-196.4 |

| Net cash

provided by discontinued operations activities |

-36.7 |

43.9 |

75.2 |

|

- |

- |

| Net cash provided by operating activities (A) |

5,196.6 |

4,704.7 |

4,203.1 |

|

4,704.6 |

4,203.1 |

| Cash flows from investing activities |

|

|

|

|

|

|

| Purchases

of property, plant and equipment and intangible assets |

-1,263.5 |

-1,334.9 |

-1,132.1 |

|

-1,386.5 |

-1,172.1 |

| Disposals

of property, plant and equipment and intangible assets |

8.2 |

34.2 |

6.5 |

|

34.2 |

6.5 |

Changes in

other financial assets

(including investments in non-consolidated companies) |

-70.7 |

-42.9 |

-35.2 |

|

-42.9 |

-35.2 |

| Effect of

changes in the scope of consolidation |

-166.5 |

-1,209.0 |

-375.8 |

|

-1,209.3 |

-435.3 |

Net cash

(used in) from investing activities

from discontinued operations |

-24.4 |

-51.8 |

-99.5 |

|

- |

- |

| Net cash (used in) from investing activities (B) |

-1,516.9 |

-2,604.5 |

-1,636.1 |

|

-2,604.5 |

-1,636.1 |

| Cash flows from financing activities |

|

|

|

|

|

|

| Dividends

paid |

-1,870.7 |

-1,832.9 |

-1,534.8 |

|

-1,832.9 |

-1,534.8 |

| Capital

increase of the parent company |

118.3 |

163.2 |

338.6 |

|

163.2 |

338.6 |

| Disposal

(acquisition) of Treasury stock |

-499.2 |

-499.1 |

9.2 |

|

-499.1 |

9.2 |

| Purchase of

non-controlling interests |

-2.0 |

- |

- |

|

-6.1 |

- |

| Issuance

(repayment) of short-term loans |

-86.6 |

446.0 |

-1,840.2 |

|

449.8 |

-1,832.4 |

| Issuance of

long-term borrowings |

- |

1.8 |

1.1 |

|

1.8 |

1.1 |

| Repayment

of long-term borrowings |

-7.0 |

-16.4 |

-4.6 |

|

-17.5 |

-5.8 |

Net cash (used in)

from financing activities

from discontinued operations |

71.5 |

-3.5 |

6.5 |

|

- |

- |

| Net cash (used in) from financing activities (C) |

-2,275.7 |

-1,740.8 |

-3,024.1 |

|

-1,740.8 |

-3,024.1 |

| Net effect

of changes in exchange rates and fair value (D) |

-65.3 |

-13.1 |

-60.1 |

|

-13.1 |

-60.1 |

| Change in cash and cash equivalents (A+B+C+D) |

1,338.7 |

346.2 |

-517.2 |

|

346.2 |

-517.2 |

| Cash and cash equivalents at beginning of the year

(E) |

1,746.0 |

1,399.8 |

1,917.0 |

|

1,399.8 |

1,917.0 |

Net effect

of changes in cash and cash equivalents

of discontinued operations (F) |

-38.1 |

- |

- |

|

- |

- |

CASH AND CASH EQUIVALENTS

AT THE END OF THE YEAR (A+B+C+D+E+F) |

3,046.6 |

1,746.0 |

1,399.8 |

|

1,746.0 |

1,399.8 |

(1)

The consolidated statements of cash flows for 2016 and 2015 are

presented to reflect the impacts of IFRS 5 regarding discontinued

operations.

* For consistency with the

financial information provided outside of the financial statements,

we believed it useful to show the Group's financial performance

when The Body Shop was an integral part of its continuing

operations.

[1] Like-for-like sales growth:

based on a comparable scope of consolidation and identical exchange

rates. See details above.

[2] In the fourth quarter of 2016 and in the full-year 2016,

reported Group sales included the sales of The Body Shop in amounts

of 321.3 million euros and 920.8 million

euros respectively.

[3] Diluted earnings per share, based on net profit, excluding

non-recurring items, after non-controlling interests, from

continuing operations.

[4] Net cash flow = Gross cash flow + changes in working

capital - capital expenditure.

[5] Proposed at the Annual General Meeting of 17 April

2018.

[6] Sales achieved on our brands' own websites + estimated

sales achieved by our brands corresponding to sales through our

retailers' websites (non-audited data); like-for-like

growth.

[7] CDP is an independent international organisation which

assesses companies' environmental performance.

[8] As of 1 July 2016, the Asian Travel Retail business of the

Consumer Products Division, previously recorded under the Western

Europe Zone, was transferred to the Asia Pacific Zone. All figures

for earlier periods have been restated to allow for this

change.

[9] Non-allocated = Central Group expenses, fundamental

research expenses, stock options and free grant of shares expenses

and miscellaneous items. As a % of cosmetics sales.

[10] As of 1 July 2016, the Asian Travel Retail business of the

Consumer Products Division, previously recorded under the Western

Europe Zone, was transferred to the Asia Pacific Zone. All figures

for earlier periods have been restated to allow for this

change.

[11] Before non-allocated.

[12] Non-recurring items include impairment of

assets, net profit of discontinued operations,

restructuring costs and tax effects of non-recurring items.

[13] Net profit, excluding non-recurring items after

non-controlling interests, from continuing operations.

[14] Diluted earnings per share, based on net profit, excluding

non-recurring items, after non-controlling

interests.

[15] In the third quarter of 2016 and at 30 September 2016,

reported Group sales included The Body Shop sales in respective

amounts of 200.9 million euros and 599.5 million euros.

[16] In the first quarter 2017, reported Group sales included

The Body Shop sales, which amounted to 197.2 million euros.

Read the news release of 8

February

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: L'ORÉAL via Globenewswire

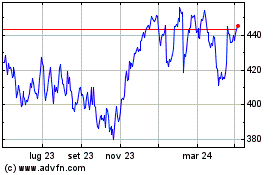

Grafico Azioni LOreal (EU:OR)

Storico

Da Mar 2024 a Apr 2024

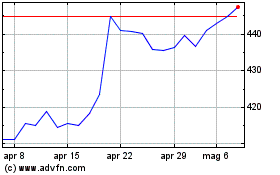

Grafico Azioni LOreal (EU:OR)

Storico

Da Apr 2023 a Apr 2024