Airbus Reaps Rewards of Rising Plane Production -- 3rd Update

15 Febbraio 2018 - 1:26PM

Dow Jones News

By Robert Wall

TOULOUSE, France -- Shares in Airbus SE soared 11% after the

European plane maker signaled it was starting to cash in on higher

plane production and joined rival Boeing Co. in promising to build

even more airliners.

The world's two biggest plane makers have benefited from a surge

in demand for commercial planes, with global economic growth

lifting passenger numbers, filling aircraft, and driving airlines'

appetite for expansion.

That has led to yearslong order backlogs at both companies and

burgeoning demand was underscored in earnings from Airbus on

Thursday.

Airbus delivered a record 718 planes in 2017, with both net and

underlying profit rising sharply. Investors were particular cheered

by a better-than-expected EUR2.95 billion ($3.68 billion) in free

cash flow before mergers, acquisitions and customer financing. It

had targeted about EUR1.4 billion, on par with the year-earlier

period. The rise signals Airbus is starting to turn higher plane

deliveries into stronger cash flow at a time when output is

rising.

To meet demand Airbus said it was raising output to around 800

airliners this year.

Airbus had already announced plans to boost single-aisle plane

production to 60 aircraft a month next year, from around 50 in

2017, and Chief Executive Tom Enders said demand could potentially

support production of more than 70 A320 type planes a month, though

the company hasn't yet committed to that output level.

Boeing last month said it planned to lift production to 810 to

815 planes this year from 763.

Boosting plane production hasn't been without its challenges for

Airbus. The company has been struggling with the supply of engines

on its popular A320neo plane and that has slowed deliveries. Last

week, Airbus said problems with one of the engines, made by United

Technologies Corp., were delaying some planes and put a hold on

deliveries. Airbus said it was still assessing the impact of the

problem on deliveries.

Rival engine supplier CFM International, a joint venture between

General Electric Co. and France's Safran SA, also has been behind

schedule on delivering its equipment.

Airbus said net profit rose sharply to EUR2.87 billion, compared

with EUR995 million last year, when earnings were hit by foreign

exchange and plane program accounting charges. Airbus's operating

earnings, which strip out some one-time items, were EUR4.25

billion, compared with EUR3.96 billion a year earlier.

Net profit was dented, though, by continued problems on the

beleaguered A400M military transport plane where Airbus has been

running behind. The company took a EUR1.3 billion charge on the

program, raising to more than EUR8 billion the combined charges the

company has taken on the project that has struggled with delays and

technical problems.

Mr. Enders said a recent agreement with governments to adjust

delivery timelines and technical content on the plane

"significantly reduce the remaining program risks."

The Toulouse-based company reported EUR66.8 billion in sales,

little changed from a year earlier, with stronger commercial

airliner revenue offset by weaker helicopter and defense and space

activities. Airbus also plans to increase it dividend by 11%.

Airbus also is wrestling with other issues. The company faces

regulatory probes in multiple jurisdictions, including the U.S.,

about the improper use of middlemen to win military contracts.

Airbus said it is cooperating with the probes.

Airbus said U.S. authorities have asked for information on

French and British probes about the use of unauthorized sales

agents to win commercial plane deals, widening the scope of the

U.S. investigation.

Airbus has warned any financial impact could be "material,"

though it was too early to judge what the consequences of the

investigations could be.

The investigations caused Airbus, almost two years ago, to lose

access to export credit financing support, which can be critical to

support deliveries to financially weaker customers. Chief Financial

Officer Harald Wilhelm said that under an agreement with European

governments limited customer financing backing would resume this

year.

Even so, Airbus is forecasting adjusted earnings this year to

increase 20% and said cash generation should be similar to 2017.

The engine disruptions mean, though, that Airbus faces another year

where it likely will have to rush to meet plane delivery and

earnings targets in the last few weeks of the year.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

February 15, 2018 07:11 ET (12:11 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

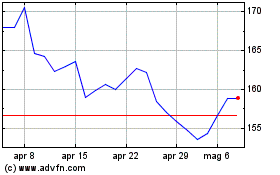

Grafico Azioni Airbus (EU:AIR)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Airbus (EU:AIR)

Storico

Da Apr 2023 a Apr 2024