Private Trades in Spotify Shares to Play Key Role in Upcoming Debut

19 Febbraio 2018 - 1:29PM

Dow Jones News

By Maureen Farrell

Spotify AB is counting on its surging private-market value to

bolster the music-streaming service's appeal to investors in an

unorthodox public debut that could be the biggest since Snap Inc.'s

$20 billion IPO last year.

The listing, expected as soon as the end of March, isn't an

initial public offering, in which underwriters set a price and

place shares with chosen investors before trading. Instead, the

Swedish company will simply float the shares on the New York Stock

Exchange and let the market find a price, in what is known as a

direct listing.

The unusual approach means Spotify must find novel ways to guide

the market to a price, and private trading is expected to be a key

part of that effort, people familiar with the matter said.

The so-called secondary markets in private technology stocks are

typically an afterthought in an IPO, in part because trading tends

to be thin and not always a reliable indicator of value. But

Spotify and its advisers at Goldman Sachs Group Inc., Morgan

Stanley and Allen & Co. are closely watching trades among

private investors and have taken steps to spur volume, the people

said. The company recently informed existing investors that it

waived its right to buy shares before they are offered to

others.

In recent months, Spotify's shares have traded at valuations

between $17 billion and $18 billion, according to people familiar

with the transactions. At those levels, Spotify's debut would be

the largest for a tech company since Snap went public.

There is another signpost for Spotify's value: Late last year

the company swapped stakes with Chinese internet giant Tencent

Holdings at a valuation of nearly $20 billion.

And one investment bank that is representing a potential new

investor recently approached some current shareholders and tested

their appetite for selling stock at a $20 billion valuation but

found no takers, a person familiar with the communications

said.

But there is little precedent for the kind of direct listing

Spotify is attempting and it is anyone's guess how the shares will

trade.

There is no formal system for trading Spotify shares and

transactions are facilitated on a case-by-case basis by a network

of investment banks, fund managers and others.

Trading in Spotify shares has been relatively robust, however.

The company puts fewer restrictions on stock sales by employees or

early investors than many other private tech startups, some of whom

heavily restrict trading. While Spotify previously had the right of

first refusal on shares for sale, people familiar with the matter

say the company rarely exercised it and typically let sellers

process transactions quickly -- in contrast to some private

companies notorious for taking days or months to approve or deny

trades.

Spotify's shares have been trending higher since late 2016,

according to people familiar with the private transactions. At that

time, the shares traded at levels valuing the company at $6 billion

to $7 billion, or about $1,670 apiece. That is below the $8.5

billion valuation the company received when it raised new money in

2015.

But by early 2017, the valuation had jumped to roughly $12

billion, these people said; by the second half of 2017, it was up

to $15 billion.

Two of the largest buyers of Spotify's shares in the private

markets in the past several years were Tiger Global Management LLC,

which has invested about $700 million since 2015, and DIG

Investment, a firm that invests on behalf of U.S. and Swedish

family offices.

Founders Fund, the venture-capital firm co-founded by PayPal

Holdings Inc. co-founder Peter Thiel, and DST Global, run by

Russian billionaire Yuri Milner, were also big investors. They

exited part or all of their stakes in 2016 when the valuation was

$6 billion to $7 billion, people familiar with the trades said. Mr.

Milner's firm first invested in Spotify in 2011 when it was valued

at $1 billion. It isn't clear at what price Mr. Thiel's firm

invested.

Meanwhile, a consortium including private-equity firm TPG, hedge

fund Dragoneer Investment Group and clients of Goldman, which lent

Spotify $1 billion, converted their debt to shares at a price that

valued the company at as much as $13 billion, people familiar with

the deal said.

That debt had been designed to convert into stock when the

company went public through a traditional IPO. Since Spotify

decided to list its shares directly, the debt wouldn't have

automatically converted, but Spotify let them do so at the highest

possible price, the people said.

Many of the investors in the consortium, including TPG and

Dragoneer, are expected to be buyers once Spotify is public, people

familiar with the matter said.

Write to Maureen Farrell at maureen.farrell@wsj.com

(END) Dow Jones Newswires

February 19, 2018 07:14 ET (12:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

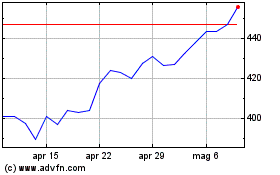

Grafico Azioni Goldman Sachs (NYSE:GS)

Storico

Da Mar 2024 a Apr 2024

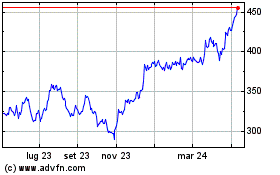

Grafico Azioni Goldman Sachs (NYSE:GS)

Storico

Da Apr 2023 a Apr 2024