HSBC Misses Profit Target as Bad Loan Charges Weigh on Results--2nd Update

20 Febbraio 2018 - 11:47AM

Dow Jones News

By Margot Patrick

LONDON -- HSBC Holdings PLC's full-year profit missed analyst

expectations after the bank was hit by the high-profile collapses

of two borrowers in the U.K. and South Africa.

Debt related to South African retailer Steinhoff International

Holdings NV and U.K. services and construction company Carillion

PLC helped push the bank's bad loan charges to $1.77 billion for

the year, more than expected. Steinhoff announced in December it

had found accounting irregularities and is restructuring. Carillion

went bust in January.

HSBC's shares were down 4% in morning trading in London after

the bank said it would put a share buyback program on hold while it

raises additional debt in the first half of the year. While

marketing the planned $5 billion to $7 billion in additional Tier 1

capital, listing rules prevent it from buying back shares. HSBC

bought back $3 billion in shares last year and incoming CEO John

Flint said Tuesday there has been "no change in our attitude" to

consider buying back more shares after the debt sale is

completed.

Tuesday's results are the last under Chief Executive Stuart

Gulliver, who is retiring from the role after 38 years with the

bank. Mr. Gulliver in an interview said his seven years as CEO

produced "satisfactory" outcomes for shareholders, in a period

marked by several damaging scandals for HSBC and broader shifts in

banking regulation and profitability.

HSBC said its 2017 net profit surged to $9.68 billion from $1.30

billion a year earlier, in part thanks to higher revenue from Asia.

Full-year revenue rose to $51.45 billion from $47.97 billion.

Pretax profit of $17.17 billion was less than the $19.55 billion

estimated in a poll of 20 analysts conducted by FactSet.

As CEO since 2011, Mr. Gulliver oversaw a dramatic reshaping of

153-year-old HSBC, pulling out of countries and exiting dozens of

businesses to improve profits and reduce risks from financial

crime.

The bank's reputation hit a low in 2012 when it agreed to pay

$1.9 billion to settle allowed drug traffickers and sanctioned

nations from moving money through the U.S. financial system. It

pledged to overhaul its compliance systems and entered a five-year

deferred-prosecution agreement with the U.S. Justice Department.

The agreement expired in December without any further action

required.

Mr. Gulliver previously said he would assess his success as CEO

by the bank's stock price at the time of his departure and the

state of HSBC's reputation, among other measures. The shares are up

17% from his start as CEO on Jan. 1, 2011, and 70% since February

2016.

On Tuesday, Mr. Gulliver said the bank has much better controls

and ability now to detect and prevent financial crime, helping to

safeguard its reputation. The bank has met eight of 10 targets Mr.

Gulliver set out in 2015, the two laggards being U.S. profitability

and revenues related to the internationalization of the Chinese

yuan.

Mr. Gulliver's successor, Mr. Flint, is also a career HSBC

banker, having joined in 1989 and most recently served as global

head of retail and wealth management.

--Chester Yung in Hong Kong contributed to this article

Write to Margot Patrick at margot.patrick@wsj.com

(END) Dow Jones Newswires

February 20, 2018 05:32 ET (10:32 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

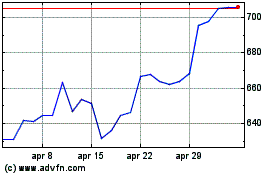

Grafico Azioni Hsbc (LSE:HSBA)

Storico

Da Mar 2024 a Apr 2024

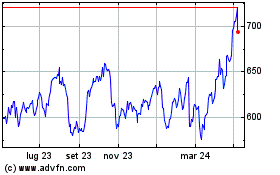

Grafico Azioni Hsbc (LSE:HSBA)

Storico

Da Apr 2023 a Apr 2024