Glencore Sees Benefit From Growing Electric Vehicle Demand -- Commodity Comment

21 Febbraio 2018 - 4:51PM

Dow Jones News

By David Hodari

Global mining giant Glencore reported its 2017 annual results

Wednesday, more than quadrupling its full-year net income to $5.8

billion, revealing a dividend of $0.20 a share. Here are remarks on

metals from the company's earnings report:

On its operating environment:

"...positive momentum continued through 2017, resulting in

prolonged outperformance of Glencore's key commodities versus the

broader markets. Concerns of tightening financial conditions in

China during the second quarter proved to be short-lived, with

commodities rallying once again through the second half of the

year. Strong economic performance in both major developing and

developed markets has underpinned supportive commodity demand

conditions. The electric vehicle upheaval continues to unfold, with

the scale of market penetration and investment, by battery and

automotive manufacturers and infrastructure players, adjusting

progressively upwards..."

On electric vehicles:

"Accelerating electric-vehicle adoption requires an energy and

mobility transformation that is forecast to unlock material new

sources of demand for the enabling underlying commodities including

copper, nickel and cobalt. We recently commissioned an independent

study to gauge the potential incremental demand for these

commodities under the Electric Vehicles Initiative scenario of 30%

electric vehicle market share by 2030. The findings suggest an

additional 4.1 million tons of copper, 1.1 million tons of nickel

and 314,000 tons of cobalt supply will be required by 2030. These

potentially significant new demand sources offer compelling

fundamentals, particularly when coupled with persistent supply

challenges."

On copper:

"In 2017, the copper price [increased] 27% year-over-year. The

rally was most apparent in the second half, with a 2017 high of

$7,254/t in late December marking levels last seen in early 2014.

Over the year, synchronised global growth fuelled healthy demand in

major copper consuming regions. Mine supply challenges continued to

exceed market expectations, resulting in a c.2% contraction in

mined volumes year-on-year, the first decline in over 15 years.

Copper scrap flows played an important role in the first half of

the year, as higher prices triggered the release of stockpiled

scrap into the market and contributed to a short period of apparent

demand weakness. Combined with misplaced fears of tightening

financial conditions in China, this resulted in a temporary

pullback in the price rally. Copper scrap inventory reverted to

normalised levels by mid-year, with drawdowns in copper units

across the value chain through to year-end.

...the copper market is likely to remain in substantial supply

deficit, which, if it occurs, will in turn result in further

inventory drawdowns."

On zinc:

"In 2017, the zinc price recorded a 38% year-over-year

increase... Going forward, higher prices will incentivize higher

concentrate production, easing TCs in the mid-term and eventually

resulting in higher metal production. However, the environmental

constraints in China and the slower-than-anticipated pace of mine

restarts (or new mines) means that the current zinc tightness may

remain for some time. As there is also a time lag before

concentrates units convert into metal units, we expect the current

strong pricing environment to be supported in the near to

mid-term."

On nickel:

In 2017, a record supply deficit was evident in the nickel

market, as strong synchronised demand growth across all regions and

industry segments offset supply gains. Such positive fundamentals,

backed by strong physical activity and significant draws in global

inventory, drove nickel premiums to record highs... Consequently,

the nickel market remained in material supply deficit for a second

year running, enabling global stocks to draw down quickly despite

headline LME inventory suggesting otherwise. Even with a

conservative forecast for 2018 demand, the outlook is for continued

sizeable deficits and further draws in primary nickel stocks.

Forecast supply increases are based on Indonesia exporting more

nickel units in ore or NPI, with production elsewhere expected to

be flat or fall."

On agricultural commodities markets:

"The grain and oilseed markets were again well supplied, low

priced and lacked volatility, which in turn limited arbitrage

opportunities. Despite a brief U.S. weather concern in late June,

impacting primarily spring wheat, which proved to be less

significant than initially thought, global crops were problem free

with Russia, Australia (basis late 2016 harvest carried over) and

Brazil all recording historically high production."

Write to David Hodari at david.hodari@wsj.com

(END) Dow Jones Newswires

February 21, 2018 10:36 ET (15:36 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

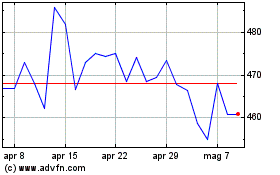

Grafico Azioni Glencore (LSE:GLEN)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Glencore (LSE:GLEN)

Storico

Da Apr 2023 a Apr 2024