AXA 2017 Net Profit Rises on Lower Costs

22 Febbraio 2018 - 7:39AM

Dow Jones News

By Pietro Lombardi

AXA SA (CS.FR) said Thursday that its net profit rose about 6.5%

in 2017, supported by growing adjusted earnings and lower

restructuring costs.

The French insurer reported a net profit of 6.21 billion euros

($7.65 billion), compared with EUR5.83 billion a year earlier.

Revenue fell 1.6% to EUR98.55 billion, it said.

Adjusted earnings in the period grew 5.8% to EUR6.46 billion,

while integration and restructuring costs fell 67% to EUR148

million, the company said.

Revenue at its life-and-savings division fell 3% to EUR49.91

billion, the company said.

Axa said the property-and-casualty business saw revenue of

EUR31.76 billion, a roughly 1% increase, while revenue from asset

management rose 9% to EUR3.98 billion.

Life and savings annual premium equivalent, known as APE,

declined by 2% in the period, AXA said. APE measures new business

growth for life insurance by combining the value of payments on new

regular-premium policies, and 10% of the value of payments made on

one-time, single-premium products.

AXA's solvency ratio--a key measure of financial strength for

insurance companies --stood at 205% at the end of December,

compared with 197% a year earlier.

The company said that its board would propose a dividend of

EUR1.26 per share, up from the EUR1.16 it paid in 2016.

"AXA's underlying earnings and net income both crossed the EUR6

billion mark for the first time in the company's history, with all

major geographies contributing to this achievement," Chief

Executive Thomas Buber said.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

February 22, 2018 01:24 ET (06:24 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

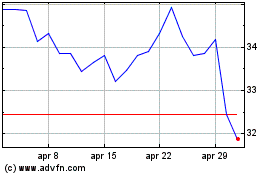

Grafico Azioni Axa (EU:CS)

Storico

Da Mar 2024 a Apr 2024

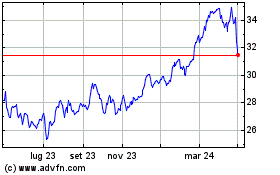

Grafico Azioni Axa (EU:CS)

Storico

Da Apr 2023 a Apr 2024