Swiss Central Bank Keeps Negative Rates Unchanged; Cautious On Housing Market

15 Marzo 2018 - 9:16AM

RTTF2

The Swiss National Bank kept its expansionary monetary policy

unchanged at the first rate-setting meeting of the year, and

reiterated its stance on foreign exchange market intervention.

The bank also warned about the correction in the housing market

over the medium-term.

The interest rate on sight deposits at the SNB was retained at

-0.75 percent and the target range for the three-month Libor was

kept unchanged between -1.25 percent and -0.25 percent.

The bank observed that the Swiss franc has appreciated slightly

overall on the back of the weaker US dollar. The Swiss franc

remains "highly valued". The SNB assessed that the situation in the

foreign exchange market is still fragile and monetary conditions

may change rapidly.

Therefore, the SNB repeated that the negative interest rate and

its willingness to intervene in the foreign exchange market, as

necessary, remain essential.

The bank downgraded its inflation forecast for both this year

and next. Inflation for this year was seen at 0.6 percent instead

of 0.7 percent. For 2019, the SNB expects inflation of 0.9 percent

compared to 1.1 percent estimated initially. For 2020, the bank

projected 1.9 percent inflation.

A monthly report from the Federal Statistical Office showed that

producer and import prices rose 0.3 percent on month in February,

taking the annual growth to 2.3 percent.

The SNB continues to expect GDP growth of around 2 percent for

2018 and a further gradual decrease in unemployment.

The central bank cautioned that imbalances on the mortgage and

real estate markets persist. The bank said it will continue to

monitor developments on the mortgage and real estate markets

closely, and will regularly reassess the need for an adjustment of

the countercyclical capital buffer.

Jessica Hinds, an economist at Capital Economics, said the SNB

will be unwilling to raise interest rates until after the European

Central Bank has begun its process of policy normalization.

"The ECB looks set to be buying assets throughout 2018 and we

doubt that it will raise interest rates until September 2019,"

Hinds said. Therefore, the economist expects the SNB to see how the

ECB's tightening progresses and how the franc responds before

following suit.

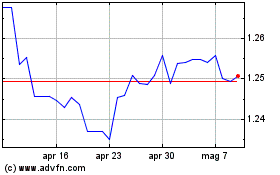

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Mar 2024 a Apr 2024

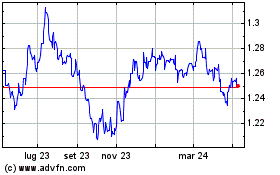

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Apr 2023 a Apr 2024