Pound Climbs Amid Risk Appetite

26 Marzo 2018 - 7:16AM

RTTF2

The pound strengthened against its major counterparts in early

European deals on Monday amid risk appetite, as fears over a trade

war eased after news that United States and China have began talks

for refining access of American goods to China.

The Wall Street Journal reported that U.S. Treasury Secretary

Steven Mnuchin and U.S. trade representative Robert Lighthizer are

engaged in talks with Liu He, China's economic czar in Beijing, for

vast areas from financial services to manufacturing.

Investors now expect the U.S. trade policy to be more selective

and tactical than first feared to give Washington leverage in

pushing for big changes.

Survey data from the latest Confederation of British Industry

and PricewaterhouseCoopers showed that optimism in the financial

services sector fell for the fourth consecutive quarter at the

start of 2018.

About 7 percent of firms said they were more optimistic about

the overall business situation compared with three months ago,

whilst 24 percent were less optimistic, giving a balance of -17

percent, the Financial Services Survey revealed.

The currency rose against its major counterparts in the Asian

session, with the exception of the euro.

The pound firmed to 0.8722 against the euro, from a low of

0.8742 hit at 8:45 pm ET. The next possible resistance for the

pound is seen around the 0.86 level.

The pound hit 4-day highs of 1.3446 against the Swiss franc and

149.18 against the yen, reversing from early lows of 1.3371 and

147.88, respectively. If the pound rises further, 1.37 and 153.00

are likely seen as its next resistance levels against the Swiss

franc and the yen, respectively.

The pound rose to a 4-day high of 1.4199 against the greenback,

off an early low of 1.4131. The pound is seen finding resistance

around the 1.43 region.

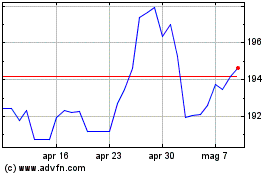

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Mar 2024 a Apr 2024

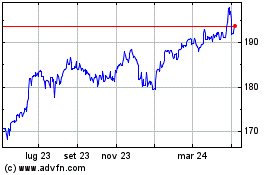

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Apr 2023 a Apr 2024