Akzo Unit Fetches $12.6 Billion -- WSJ

28 Marzo 2018 - 9:02AM

Dow Jones News

By Ben Dummett

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 28, 2018).

A consortium led by private-equity giant Carlyle Group LP agreed

Tuesday to buy the specialty chemicals business of Dutch paints

giant Akzo Nobel NV for EUR10.1 billion ($12.6 billion) including

debt, as competition among cash-rich buyout firms for bigger deals

heats up.

Akzo's chemicals are used in a wide range of products, from

plastic bags to solar panels. The sale fits into the

Amsterdam-based manufacturer's plan to boost its share price after

fending off a $27.6 billion takeover bid last year from U.S. rival

PPG Industries Inc. -- a stance that irked Elliott Management

Corp., the U.S. activist hedge fund, and other shareholders.

The chemicals deal "is a key milestone...to generate value for

all stakeholders," Thierry Vanlancker, Akzo's chief executive, said

in a statement.

U.S.-based Carlyle and partner GIC Pte. Ltd., Singapore's

sovereign-wealth fund, gain a business enjoying increased demand,

particularly in Europe, amid improving economic conditions. In

2017, revenue for Akzo's chemicals business rose 4% to almost EUR5

billion, while operating income gained 10% to EUR689 million.

The sector's momentum fueled competition for the Akzo business.

Carlyle beat out private-equity firms Apollo Global Management and

an alliance of Bain Capital Private Equity and Advent International

Corp.

Global private-equity firms are under increasing pressure to do

larger deals after they raised a record $453 billion in 2017,

leaving them with more than $1 trillion to invest, according to

data provider Preqin.

In December, KKR & Co. won out over Apollo and CVC Capital

Partners for the margarine-and-spreads business of Unilever PLC in

a EUR6.8 billion deal.

In January, a Blackstone Group LP -led consortium struck a deal

to buy a controlling stake in the financial-information business of

Thomson Reuters Corp. for $17 billion.

However, bigger deals also come with greater risk, as

demonstrated by the recent bankruptcies of Toys "R" Us Inc. and

iHeart Media Inc.

"Were the industry to perform due diligence on itself, these

trends would raise a red flag," management-consulting firm Bain

& Co. said in a private-equity report referencing the pressure

to complete bigger transactions. The firm is separate from Bain

Capital.

Still, Carlyle has experience investing in the chemicals sector.

In 2016, the firm struck a $3.2 billion deal to acquire Atotech

Solutions, a supplier of plating chemicals used in circuit boards

and semiconductor manufacturing from French energy giant Total

SA.

In 2013, the group bought Axalta Coating Systems Ltd. from

DuPont Co. for $4.9 billion and the assumption of $250 million in

pension costs. It then installed a new chief executive and chief

financial officer, who oversaw investments in emerging markets and

a cost-cutting effort. Carlyle took Axalta public in 2014, with a

partial sale of its stake generating a return of more than double

the cash it invested in the business.

Akzo, which traces its roots in part back to dynamite inventor

Alfred Nobel, said it would generate proceeds of about EUR7.5

billion from the sale and expects to distribute the bulk of that to

shareholders as part of the company's previously stated plan. The

deal is also meant to make it easier for investors to value Akzo by

simplifying its corporate structure with a focus only on paints and

coatings.

The paints-and-coatings business faces a challenging environment

amid higher raw materials costs and foreign-exchange volatility. In

2017, Akzo's paints and coatings division increased its revenue by

2% to EUR9.61 billion, but operating income fell about 11% to

EUR825 million. Akzo manufactures paint brands such as Dulux, and

its coatings include Interpon among others. Coatings are used to

prevent corrosion and improve durability in such sectors as

automotive, electronics, mining and marine.

Write to Ben Dummett at ben.dummett@wsj.com

(END) Dow Jones Newswires

March 28, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

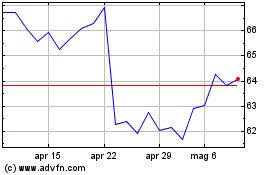

Grafico Azioni Akzo Nobel NV (EU:AKZA)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Akzo Nobel NV (EU:AKZA)

Storico

Da Apr 2023 a Apr 2024