Pound Drops After U.K. GDP Data, Mortgage Approvals

29 Marzo 2018 - 8:18AM

RTTF2

The pound drifted lower against its major counterparts in the

European session on Thursday, after data showed that UK economy

expanded at a slower pace as previously estimated in the fourth

quarter and mortgage approvals declined more than expected in

February.

Final data from the Office for National Statistics showed that

gross domestic product grew 0.4 percent quarter-on-quarter, slower

than the 0.5 percent expansion seen in the preceding period. The

rate came in line with the second estimate published on February

22.

The statistical office confirmed 1.4 percent annual growth for

the fourth quarter.

Data from the Bank of England showed that the number of loans

approved for house purchases fell to 63,910 from 67,110 in January.

The expected level was 66,000.

Secured lending grew at a faster pace of GBP 3.7 billion after

rising GBP 3.4 billion in January. Consumer credit increased by GBP

1.6 billion or 0.8 percent. This was bigger than the expected

growth of GBP 1.4 billion.

That said, the currency declines were in check amid easing

geopolitical and trade tensions ahead of the Easter break.

The currency has been trading in a negative territory in the

Asian session, with the exception of the greenback.

The pound declined to a 2-day low of 0.8769 against the euro,

from a high of 0.8740 hit at 5:45 pm ET. The pound is seen finding

support around the 0.90 region.

Data from the Federal Labor Agency showed that German

unemployment decreased notably in March.

The number of people out of work decreased by 19,000 in March.

Unemployment was expected to fall 15,000.

The U.K. currency held steady against the greenback, after

having fallen to an 8-day low of 1.4035 at 4:15 am ET. The pair

closed Wednesday's trading at 1.4077.

The pound reversed from an early high of 150.46 against the yen,

falling to 149.54. The next possible support for the pound is seen

around the 147.00 level.

Data from the Ministry of Economy, Trade and Industry showed

that Japan's retail sales advanced a seasonally adjusted 0.4

percent on month in February.

That was shy of expectations for 0.6 percent following the

upwardly revised 1.6 percent contraction in January.

The pound dropped to 1.3434 against the Swiss franc, off its

early high of 1.3474. The pound is likely to find support around

the 1.33 region.

Survey data from the KOF Swiss Economic Institute showed that

Switzerland's economic barometer declined in March.

The economic barometer fell by 2.4 points to 106.0 in March from

revised 108.4 in February. The score was also below the forecast of

107.2.

Looking ahead, at 8:00 am ET, German preliminary CPI for March

is scheduled for release.

In the New York session, Canada GDP data for January and

industrial product price index for February, as well as U.S. weekly

jobless claims for the week ended March 24, University of

Michigan's final consumer sentiment index for March and personal

income and spending data for February are set for release.

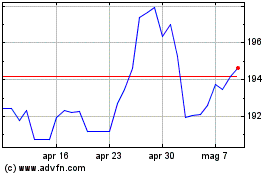

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Mar 2024 a Apr 2024

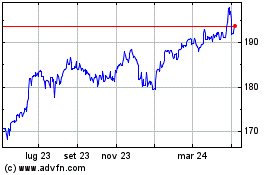

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Apr 2023 a Apr 2024