GRAIN HIGHLIGHTS: Top Stories of the Day

18 Aprile 2018 - 11:54PM

Dow Jones News

TOP STORIES:

China Trade Worries Cloud Soybean Markets -- Market Talk

15:38 ET - Soybean futures slide on renewed jitters over trade.

With few recent signs of better export demand to boost prices,

traders are focused instead on threats to demand. In particular,

they are worried that China's move to slap duties of 179% on U.S.

sorghum could prompt further escalation of tensions between

Washington and Beijing, resulting in what many consider the

worst-case scenario: Chinese tariffs on American soybeans.

Meanwhile, weather forecasts suggesting that upcoming rain in the

Plains wouldn't relieve all of the stressed wheat crop boosted

grain prices. CBOT May soybean futures fall 0.4% to $10.41 3/4 a

bushel. May wheat gains 1.9% to $4.75 1/4 while May corn rises 0.7%

to $3.83. (benjamin.parkin@wsj.com; @b_parkyn)

Fighting Words Start Farm Bill Mark Up -- Market Talk

11:48 ET - A partisan battle over the Farm Bill in the House

Agriculture Committee is starting to sound a lot like war. During a

meeting to consider the five-year bill unveiled in the House last

week, committee Democrats lambasted a legislative process they say

has upended a long tradition of bipartisanship on the committee and

text that is deeply flawed. Top Democrat Collin Peterson (D, Minn.)

kicked off opposition to the bill, calling proposals to expand work

requirements for food-stamp recipients an "ideological crusade,"

and expressing concern for the coalition of rural and urban

lawmakers tasked with providing a safety net for farmers and needy

Americans. "This bill ruins that coalition," Peterson said,

lamenting that "we're turning friends into enemies."

(jesse.newman@wsj.com; @jessenewman13)

STORIES OF INTEREST:

Danone's 1Q Sales Mark Improved Pathway: Davy -- Market Talk

1015 GMT - Danone's first-quarter sales confirm that the company

is on an improved pathway, say analysts at Davy Research. The Irish

brokerage doesn't expect any material changes to forecasts, but

says the risk-reward profile is becoming more favorable at Danone.

Davy expects full-year top-line growth will be 1H-weighted due to a

moderation in early-life nutrition in China during the second half.

Danone shares trade up 2.2% at EUR67.52.

(anthony.shevlin@dowjones.com)

THE MARKETS:

Cattle Futures Rise as Meatpackers Gobble Up Livestock

Cattle futures rose after the week's physical trade started

higher.

Cattle markets fell sharply through March as traders bet that

supplies of slaughter-ready livestock would rise in the weeks and

months ahead. But prices have rebounded in April as factors

including bad weather helped stave off the worst of a surplus. That

has forced meatpackers to pay more to secure animals for their

plants.

April-dated live cattle futures rose 0.8% to $1.18975 a pound at

the Chicago Mercantile Exchange. The more-active June contract also

rose.

Hog futures also rose on Wednesday as packers sought more pigs

to slaughter, pushing cash prices higher. CME June lean hog

contracts rose 2.3% to 78.525 cents a pound.

(END) Dow Jones Newswires

April 18, 2018 17:39 ET (21:39 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

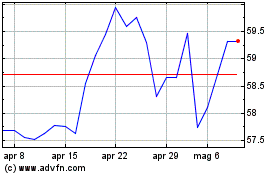

Grafico Azioni Danone (EU:BN)

Storico

Da Mar 2024 a Apr 2024

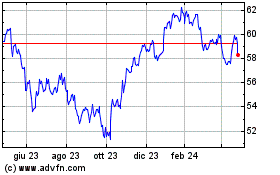

Grafico Azioni Danone (EU:BN)

Storico

Da Apr 2023 a Apr 2024