Regulatory News:

Pernod Ricard (Paris:RI):

Press release - Paris, 19 April 2018

VERY GOOD YEAR-TO-DATE SALES: +6.3%

ORGANIC GROWTH

(REPORTED: +0.2%)

Q3: +9.3% ORGANIC GROWTH, ENHANCED BY

FAVOURABLE PHASING OF CHINESE NEW YEAR

CONFIRMATION OF FY18

GUIDANCE1 AT TOP-END OF RANGE:

ORGANIC GROWTH IN PRO2 C.

+6%

DISTRIBUTION OF INTERIM CASH DIVIDEND:

€1.01 PER SHARE ON 6 JULY 2018

EVOLUTION OF DIVIDEND POLICY

Year-to-date Sales

Sales for the first 9 months of FY18 totalled € 7,059

million, with organic growth of +6.3%, driven by Emerging

markets (+13%):

- continued dynamism in the Americas

+6%: good performance in USA and acceleration of Latin

America

- very dynamic Asia-RoW +10%,

thanks to confirmed return to strong growth in China, India (partly

favoured by low basis of comparison), Travel Retail and Africa

Middle East

- Europe +2%: good momentum in

Eastern Europe and stability in Western Europe (good performance in

Germany and UK, but difficulties in Spain and France)

- diversification of sources of

growth:

- Strategic international Brands

+7%: strong performance driven by Martell, Jameson and return

to growth of Chivas

- Strategic Local Brands +7%:

dynamism driven largely by Seagram’s Whiskies (partly favoured by a

low basis of comparison in India) but also strong double-digit

performance of Olmeca / Altos

- Strategic Wines: stability with

continued strong results for Campo Viejo offset by adverse phasing

(UK and Kenwood in the US)

Reported growth was +0.2% due to unfavourable FX over the

period, mainly linked to the strengthening of the Euro, in

particular vs. the USD.

Q3 Sales

Sales for the third quarter of FY18 were enhanced by CNY and

Easter phasing3 and totalled € 1,977

million, including organic growth of +9.3% and reported

growth of -0.5%. This comprised:

- continued dynamism in the Americas

+6%: good overall performance

- Asia-RoW +18%: strong underlying

performance enhanced by favourable CNY phasing in China and cycling

demonetisation in India in FY17

- modest decline in Europe -1%:

continued difficulties in Spain and France together with

unfavourable shipment phasing in Russia and adverse basis of

comparison in UK

1 Guidance provided to market on 9 February 2018 of organic

growth in PRO between +4% and +6%2 PRO = Profit from Recurring

Operations3 Chinese New Year on 16 February 2018 vs. 28 January

2017 and Easter 1 April 2018 vs. 16 April 2017

Interim cash dividend

The Board of Directors meeting on 18 April 2018, under the

chairmanship of Alexandre Ricard, decided to distribute an interim

cash dividend of €1.01 per share for the current FY18 financial

year. In line with Pernod Ricard’s standard practice, the interim

dividend is equal to 50% of the total dividend paid out in the

previous financial year.

The ex-dividend date will be Wednesday 4 July 2018 and the

interim dividend will be paid on Friday 6 July

2018.

Dividend policy

evolution

Given the profit growth acceleration and debt deleveraging since

FY16, Pernod Ricard’s Board of Directors is recommending an

inflection of its dividend policy, to be decided at the AGM on

21 November 2018. It is recommending to progressively increase

the dividend distribution over the next 3 years to c. 50% of

Net profit from Recurring Operations, starting with FY18 (vs.

the historical rate of c. 1/3.)

The Group remains committed to value-creating M&A

while retaining an investment grade rating.

As part of this communication, Alexandre Ricard, Chairman

and Chief Executive Officer, stated,

“We have very strong year-to-date Sales growth at +6.3%. Our

strategy is consistent and driving results, in particular in terms

of diversifying the sources of growth.

We confirm our FY18 guidance1 given to the market on 9 February

2018 at the top-end of the range, with organic growth in Profit

from Recurring Operations of c. +6%2.”

Note: All growth data specified in this press release refers to

organic growth (at constant FX and Group structure), unless

otherwise stated. Data may be subject to rounding.

A detailed presentation of Sales for the third quarter of FY18

can be downloaded from our website: www.pernod-ricard.com

1 Guidance provided to market on 9 February 2018 of organic

growth in PRO between +4% and +6%2 Over the full FY18, the FX

impact on Profit from Recurring Operations is estimated at

approximately -€ 200m, based on average FX rates for full FY18,

including rates projected on 13 April 2018, particularly a EUR/USD

rate of 1.23

Definitions and additional information related to the use of

non-IFRS measures

Pernod Ricard’s management process is based on the following

non-IFRS measures which are chosen for planning and reporting. The

Group’s management believes these measures provide valuable

additional information for users of the financial statements in

understanding the Group’s performance. These non-IFRS measures

should be considered as complementary to the comparable IFRS

measures and reported movements therein.

Organic growth

Organic growth is calculated after excluding the impacts of

exchange rate movements and acquisitions and disposals.

Exchange rates impact is calculated by translating the current

year results at the prior year’s exchange rates.

For acquisitions in the current year, the post-acquisition

results are excluded from the organic movement calculations. For

acquisitions in the prior year, post-acquisition results are

included in the prior year but are included in the organic movement

calculation from the anniversary of the acquisition date in the

current year.

Where a business, brand, brand distribution right or agency

agreement was disposed of, or terminated, in the prior year, the

Group, in the organic movement calculations, excludes the results

for that business from the prior year. For disposals or

terminations in the current year, the Group excludes the results

for that business from the prior year from the date of the disposal

or termination.

This measure enables to focus on the performance of the business

which is common to both years and which represents those measures

that local managers are most directly able to influence.

Profit from recurring

operations

Profit from recurring operations corresponds to the operating

profit excluding other non-current operating income and

expenses.

About Pernod Ricard

Pernod Ricard is the world’s n°2 in wines and spirits with

consolidated Sales of €9,010 million in FY17. Created in 1975 by

the merger of Ricard and Pernod, the Group has undergone sustained

development, based on both organic growth and acquisitions: Seagram

(2001), Allied Domecq (2005) and Vin&Sprit (2008). Pernod

Ricard holds one of the most prestigious brand portfolios in the

sector: Absolut Vodka, Ricard pastis, Ballantine’s, Chivas Regal,

Royal Salute and The Glenlivet Scotch whiskies, Jameson Irish

whiskey, Martell cognac, Havana Club rum, Beefeater gin, Malibu

liqueur, Mumm and Perrier-Jouët champagnes, as well Jacob’s Creek,

Brancott Estate, Campo Viejo and Kenwood wines. Pernod Ricard

employs a workforce of approximately 18,500 people and operates

through a decentralised organisation, with 6 “Brand Companies” and

86 “Market Companies” established in each key market. Pernod Ricard

is strongly committed to a sustainable development policy and

encourages responsible consumption. Pernod Ricard’s strategy and

ambition are based on 3 key values that guide its expansion:

entrepreneurial spirit, mutual trust and a strong sense of

ethics.

Pernod Ricard is listed on Euronext (Ticker: RI; ISIN code:

FR0000120693) and is part of the CAC 40 index.

Upcoming communications

DATE1

EVENT

Wednesday 6 June 2018

Asia Conference call Wednesday 29

August 2018

FY18 Full-year Sales & Results Thursday 18

October 2018

Q1 FY19 Sales Wednesday 21 November 2018

Annual General Meeting

1 The above dates are indicative and are liable to change

Appendices

YTD Sales by Region

Net Sales

(€ millions)

H1 FY17 H1 FY18 Change Organic Growth

Group Structure Forex impact

Americas 1,431 28.3% 1,399 27.5% (32) -2% 79

6% (13) -1% (98) -7% Asia / Rest of the World 2,040 40.3% 2,065

40.6% 25 1% 136 7% (1) 0% (110) -5% Europe 1,589 31.4% 1,619

31.8% 29 2% 42 3% (4) 0% (8) -1%

World 5,061 100.0% 5,082

100.0% 22 0% 256

5% (19) 0% (216)

-4%

Net Sales

(€ millions)

Q3 FY17 Q3 FY18 Change Organic Growth

Group Structure Forex impact Americas 602

30.3% 545 27.5% (58) -10% 37 6% 0 0% (95) -16% Asia / Rest of the

World 837 42.1% 901 45.6% 64 8% 151 18% (0) 0% (87) -10% Europe 547

27.5% 532 26.9% (15) -3% (4) -1% (1)

0% (11) -2%

World 1,987

100.0% 1,977 100.0% (9)

0% 184 9% (1) 0%

(192) -10%

Net Sales

(€ millions)

9M FY17 9M FY18 Change Organic Growth

Group Structure Forex impact Americas 2,033

28.9% 1,943 27.5% (90) -4% 116 6% (13) -1% (192) -9% Asia / Rest of

the World 2,878 40.8% 2,966 42.0% 88 3% 286 10% (1) 0% (197) -7%

Europe 2,136 30.3% 2,150 30.5% 14 1% 38

2% (5) 0% (19) -1%

World 7,047

100.0% 7,059 100.0% 12

0% 440 6% (20) 0%

(408) -6%

Bulk Spirits are allocated by Region according to the Regions’

weight in the Group

Foreign exchange impact on YTD FY18 Sales

Forex impact 9M FY18

(€ millions)

Average rates evolution On Net Sales FY17

FY18 %

US dollar USD 1.09 1.19 9.9% (170)

Japanese yen JPY 117.75 132.16 12.2% (15) Indian rupee INR 72.92

76.97 5.5% (39) Argentinian peso ARS 16.68 21.73 30.3% (23) Chinese

yuan CNY 7.38 7.81 5.8% (42) Pound sterling GBP 0.86 0.89 3.4% (11)

Other currencies (108)

Total

(408)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180418006429/en/

Contacts Pernod RicardJulia Massies / VP, Financial

Communication & Investor Relations, +33 (0)1 41 00 41 07Adam

Ramjean / Investor Relations Manager, +33 (0)1 41 00 41 59Emmanuel

Vouin / Press Relations Manager, +33 (0)1 41 00 44 04Alison Donohoe

/ Press Relations Manager, +33 (0)1 41 00 44 63

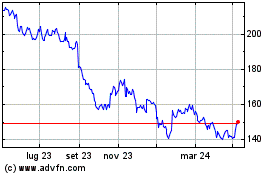

Grafico Azioni Pernod Ricard (EU:RI)

Storico

Da Mar 2024 a Apr 2024

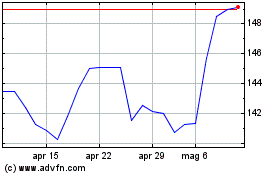

Grafico Azioni Pernod Ricard (EU:RI)

Storico

Da Apr 2023 a Apr 2024