SocGen Shares Plunge After 1Q Results -- Earnings Review

04 Maggio 2018 - 2:20PM

Dow Jones News

By Pietro Lombardi

Societe Generale SA (GLE.FR) reported first-quarter results

Friday, sending its shares down 6.3% at 1146 GMT. Here's what you

need to know:

PROFIT FORECAST: France's third-largest listed bank by assets

reported a 14% increase in first-quarter net profit to 850 million

euros ($1.02 billion). Analysts had expected Societe Generale's net

profit to stand at 811.5 million euros, according to a consensus

forecast provided by FactSet.

NET BANKING INCOME: Net banking income, the bank's top-line

revenue figure, fell to EUR6.29 billion compared with EUR6.47

billion a year earlier. This undershot expectations, with analysts

expecting roughly flat net banking income at EUR6.47 billion,

according to FactSet.

WHAT WE WATCHED

LITIGATION: Societe Generale said a final agreement on two

pending disputes in the U.S., related to benchmark interest rates

and transactions involving Libyan counterparties, "is expected to

be reached within the coming days or weeks," with "monetary

penalties ... expected to be in line with the provision allocated

to these two cases," it said. Analysts at Jefferies mention the

lack of finalization as one of the factors weighing on the

stock.

The bank's provision for litigation was stable at EUR2.3

billion, of which about EUR1 billion was allocated for these

litigations, SocGen said.

FRENCH RETAIL AND INTERNATIONAL OPERATIONS: The bank said the

low interest rate environment weighed on French retail banking

revenue, which fell 0.7% on year. However, SocGen expects a

stabilization in 2018. Revenue was up 2.5% in the bank's

international retail banking and financial services business.

INVESTMENT BANKING BUSINESS: The performance of the CIB business

is one of the factors affecting the stock, according to Jefferies.

The global banking and investor-solution business, which includes

investment banking and asset management, reported a 13% fall in

revenue, hurt by a decline in global markets. The results come

"against the backdrop of a weaker dollar and in relation to a high

comparison base on rate products in Q1 2017," the bank said.

Revenues of fixed income, currencies and commodities, or FICC, were

down 31% on year. Equities and prime services revenues fell

11%.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

May 04, 2018 08:05 ET (12:05 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

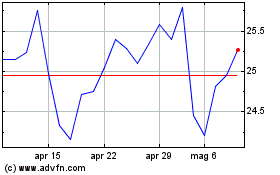

Grafico Azioni Societe Generale (EU:GLE)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Societe Generale (EU:GLE)

Storico

Da Apr 2023 a Apr 2024