AXA's U.S. Subsidiary Shares Fall 1.4% in Stock Market Debut -- Update

10 Maggio 2018 - 5:31PM

Dow Jones News

(Adds details on IPO, stock price, XL acquisition.)

By Max Bernhard

Shares of AXA Equitable Holdings Inc. (EQH) fell 1.4% as it

started trading on the New York Stock Exchange after pricing its

initial public offering below its indicated price range.

AXA Equitable, the subsidiary of French insurance giant AXA SA

(CS.FR), set its offer price at $20 a share, 17% below the bottom

of the $24 to $27 range it gave last month.

AXA SA has offered 137.3 million shares of AXA Equitable on the

NYSE, or 25% of the company, which is valued at $11.2 billion based

on the offer price.

The French insurer had previously said it will use the money

raised to partially finance its planned $15.3 billion acquisition

of insurer XL Group Ltd. (XL).

U.S. bank Jefferies said the lower IPO pricing could leave a

potential financing gap for the acquisition.

"With 3.4 billion euros [$4.0 billion] still required to cover

the XL purchase, AXA [SA] will need to find an alternative source

of funding for EUR300 million to EUR600 million on our

calculations," it says.

An AXA SA spokesman said the company is fully in line with its

financing needs for XL.

At 1440 GMT, shares in AXA Equitable were trading at $19.72 on

the New York Stock Exchange. The offering is expected to close on

Monday, AXA SA said.

AXA Equitable Holdings was founded in New York in 1859, making

it one of America's oldest life insurers. Long known as Equitable

Life Assurance Society of the U.S, it was acquired by AXA in

1992.

Write to Max Bernhard at max.bernhard@dowjones.com;

@mxbernhard

(END) Dow Jones Newswires

May 10, 2018 11:16 ET (15:16 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

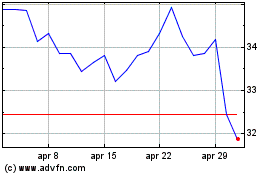

Grafico Azioni Axa (EU:CS)

Storico

Da Mar 2024 a Apr 2024

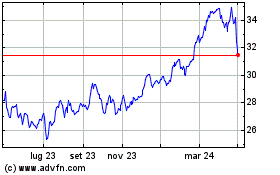

Grafico Azioni Axa (EU:CS)

Storico

Da Apr 2023 a Apr 2024