TIDMCOD

RNS Number : 7384N

Compagnie de Saint-Gobain

11 May 2018

PRESS RELEASE

May 11(th) , 2018

SIKA, BURKARD FAMILY AND SAINT-GOBAIN FIND OVERALL AGREEMENT

-- Compagnie de Saint-Gobain (Saint-Gobain) acquired

Schenker-Winkler Holding AG (SWH) from the Burkard family

-- Saint-Gobain/SWH sold a 6.97% stake in Sika AG (Sika) to Sika

for a total consideration of CHF 2.08 billion

-- Saint-Gobain retains 10.75% interest in Sika through SWH for a minimum of two years

-- Sika calls shareholders' meeting to introduce unitary share

class, cancellation of opting-out and elimination of 5% transfer

restrictions and to cancel the 6.97% shares acquired from SWH

-- Parties terminate all legal proceedings

-- Sika and Saint-Gobain intend to extend their existing business relationship

Sika, the Burkard family and Saint-Gobain have signed agreements

which terminate and resolve their dispute to the common benefit of

all parties involved and that of their respective shareholders and

stakeholders. The following has been agreed:

Saint-Gobain acquired SWH, Sika acquired registered shares

representing 6.97% of Sika's share capital

Saint-Gobain acquired all outstanding shares of SWH from the

Burkard family for a purchase price of CHF 3.22 billion. It

reflects an increase of above CHF 500 million from the purchase

price agreed in December 2014 between Saint-Gobain and the Burkard

Family, taking into account the increase in Sika's value since

2014. Sika purchased a 6.97% stake in Sika from SWH (representing a

23.7% voting interest) for a total consideration of CHF 2.08

billion. This amount contains a CHF 795 million premium over the

market value as of May 4th, 2018.

Termination of litigation, special audit, special experts

All pending litigation will be terminated. Furthermore, it is

intended to propose to the shareholders of Sika to terminate the

mandate of the Special Experts.

Introduction one-share, one-vote

Sika will call for an extraordinary shareholders' meeting (EGM)

for June 11, 2018 and will propose to:

-- cancel the 6.97% shares acquired from SWH by way of capital reduction

-- convert all shares into a single class of registered shares

("one share-one vote") in a ratio 1:60 (bearer share based)

-- eliminate the 5% transfer restrictions

-- eliminate the opting-out clause

SWH, fully owned by Saint-Gobain at the time of the EGM, will

vote in favor of all resolutions. Urs F. Burkard, Jürgen Tinggren

and Willi Leimer have resigned from the board of directors of Sika.

All independent directors will continue to serve the company and in

time will seek to strengthen the board with new appointees.

Future relationship between Saint-Gobain and Sika

The future relationship between Saint-Gobain and Sika will be on

both the shareholder and the business levels:

Saint-Gobain will become a shareholder of Sika through SWH.

After the EGM it will hold 10.75% of votes and capital interest in

Sika. The parties have agreed on lock-up (2 years) and stand-still

obligations (up to 10.75% for four years, up to 12.875% for the

following two years) with regard to Saint-Gobain's stake in Sika.

In case of an intended sale, these shares will first be offered to

Sika up to 10.75%.

The two groups will also continue their substantial existing

business relationship and seek to further expand it to areas of

mutual benefit while preserving and respecting each group's

economic and legal independence.

Sika will fund this transaction through a bridge loan committed

by UBS. Subsequently, Sika intends to optimize its capital

structure through the issuance of debt and debt-like securities,

while maintaining both the investment grade rating as well as the

financial flexibility to fund the defined growth strategy of the

company.

Paul Hälg, Chairman of the Board of Directors of Sika and Paul

Schuler, CEO of Sika: "The Board and Group Management of Sika

welcome this positive outcome. This solution paves the way for a

new chapter of our success story. Sika remains committed to a

strong S&P investment grade credit rating. The introduction of

a modern governance structure will provide Sika with a solid base

to accelerate its growth. The biggest thanks go to all our

employees who with their dedication and loyalty made the great

success of Sika and this solution possible."

Urs F. Burkard, spokesman for the Burkard family: "We are

pleased that Saint-Gobain, as a significant Sika customer, is now

the company's largest shareholder. The solution agreed between the

parties involved takes into account the interests of all

shareholders and forms the basis for continuing Sika's success

story. The primary concern of the family has always been to ensure

Sika's success and long-term prosperity."

Pierre-André de Chalendar, Chairman and CEO of Saint-Gobain:

"This is a very positive settlement for Saint-Gobain, both from a

financial and a strategic perspective. We materialize a substantial

positive net result in excess of EUR600 million for our

shareholders. We also retain a minority stake in a great company

and will enhance the relationship between the two groups."

ABOUT SAINT-GOBAIN

Saint-Gobain designs, manufactures and distributes materials and

solutions which are key ingredients in the wellbeing of each of us

and the future of all. They can be found everywhere in our living

places and our daily life: in buildings, transportation,

infrastructure and in many industrial applications. They provide

comfort, performance and safety while addressing the challenges of

sustainable construction, resource efficiency and climate

change.

EUR40.8 billion in sales in 2017

Operates in 67 countries

More than 179,000 employees

www.saint-gobain.com

@saintgobain

Analyst/Investor relations Media relations

------------------------------------ ---------------------------------

+33 1 47

62 44 29

+33 1 47 +33 1 47

Vivien Dardel 62 35 98 62 30 10

Floriana Michalowska +33 1 47 Laurence Pernot +33 1 47

Christelle Gannage 62 30 93 Susanne Trabitzsch 62 43 25

----------------------- ----------- -------------------- -----------

Analyst/Investor Conference Call, chaired by Mr. Pierre-André de

Chalendar, Chairman and Chief Executive Officer and Mr. Guillaume

Texier, Chief Financial Officer, on May 11, 2018 at 8:30 a.m. Paris

time (GMT + 1)

Dial-in: + 33 (0) 1 72 72 74 03 (code 60116692#)

Please dial in 5 to 10 minutes prior to the scheduled start

time

Replay: + 33 (0) 1 70 71 01 60 (code 418759740#), from 10:30

a.m. Paris time until June 15, 2018.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQABMATMBMBMBP

(END) Dow Jones Newswires

May 11, 2018 02:15 ET (06:15 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

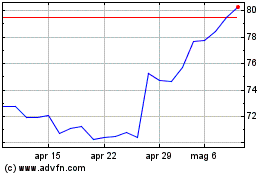

Grafico Azioni Cie de SaintGobain (EU:SGO)

Storico

Da Mar 2024 a Apr 2024

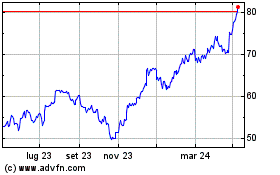

Grafico Azioni Cie de SaintGobain (EU:SGO)

Storico

Da Apr 2023 a Apr 2024