At a Glance: Saint-Gobain and Sika Reach Peace After Bitter Battle

11 Maggio 2018 - 1:33PM

Dow Jones News

THE NEWS: Compagnie de Saint-Gobain SA (SGO.FR) and Sika AG

(SIK.EB) have struck an agreement to end their long-running legal

dispute, bringing the French company's pursuit of a controlling

stake in Sika to a close.

THE BACKGROUND: The dispute arose in 2014 after Sika's founding

Burkard family agreed to sell Saint-Gobain its roughly 17% stake in

Sika, along with its controlling voting rights.

Sika's management interpreted the deal as a hostile takeover and

moved to block it.

Following a prolonged legal battle a Swiss court ruled in 2016

that the deal would be unlawful and allowed Sika's management to

restrict the family's voting rights.

However, the Burkards sought to extend their agreement with

Saint-Gobain and continued to propose candidates to Sika's

board.

THE DEAL: Saint-Gobain paid 3.22 billion Swiss francs ($3.21

billion) to the Burkard family for its stake.

Sika then immediately bought back a 7% stake from Saint-Gobain

for CHF2.08 billion--equivalent to a CHF750 million premium--and

will cancel out the shares via a capital reduction.

This leaves Saint-Gobain with a 10.8% stake and no majority

voting rights.

It must retain the stake for at least two years, while Sika has

the right of first refusal to buy back its shares if Saint-Gobain

chooses to sell at any time.

WHAT'S NEXT: Sika will call an extraordinary shareholders'

meeting and propose the cancellation of its newly acquired 7%

stake, as well as the conversion of all shares into a single class,

where one share is equivalent to one vote.

Sika's CEO said the company is now free to go after acquisitions

of up to CHF500 million, as the Burkards had previously blocked

most efforts at dealmaking.

THE MARKET REACTION: Shares in Sika rose more than 10% in early

trade on news of the resolution, while Saint-Gobain was trading

around 2.8% higher shortly after midday.

Davy Research said the agreement "works well for all concerned,"

and ensures Sika's future independence.

Bernstein said Sika's CHF750 million premium was a fair price

for its freedom and called the deal a "face-saving exit" for

Saint-Gobain.

Write to Barcelona editors at barcelonaeditors@dowjones.com

(END) Dow Jones Newswires

May 11, 2018 07:18 ET (11:18 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

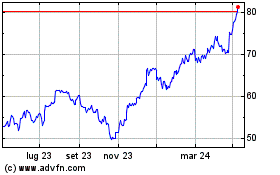

Grafico Azioni Cie de SaintGobain (EU:SGO)

Storico

Da Mar 2024 a Apr 2024

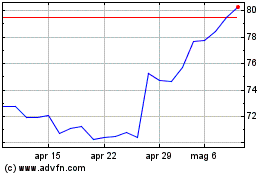

Grafico Azioni Cie de SaintGobain (EU:SGO)

Storico

Da Apr 2023 a Apr 2024