Saint-Gobain, Sika Settle Takeover Fight -- WSJ

12 Maggio 2018 - 9:02AM

Dow Jones News

By Nathan Allen and Alberto Delclaux

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 12, 2018).

Compagnie de Saint-Gobain and Sika AG on Friday struck an

agreement to end their long-running legal dispute, bringing the

French building-material company's pursuit of a controlling stake

in Swiss-based Sika to a close.

Under the terms of the agreement Saint-Gobain said it paid 3.22

billion Swiss francs ($3.21 billion) to Sika's founding Burkard

family for its Schenker-Winkler Holding AG, which holds a roughly

17% stake in Sika but a majority of the voting rights.

Saint-Gobain subsequently sold about 7% of the equity back to

Sika for 2.08 billion Swiss francs and it will retain the remaining

10.8% stake for at least two years, while Sika will have

preferential buying rights if Saint-Gobain chooses to sell the

stake, the companies said.

Sika will call for an extraordinary shareholders' meeting to

propose canceling the recently acquired 7% stake and standardizing

voting rights so that one share is equivalent to one vote.

Saint-Gobain-controlled Schenker-Winkler said it would vote in

favor of the proposals.

"The board and group management of Sika welcome this positive

outcome. This solution is immediately accretive for our

shareholders and paves the way for a new chapter of our success

story," Sika's Chief Executive Paul Schuler said.

"In our view, the agreement works well for all concerned," says

Robert Gardiner of Davy Research.

The resolution leaves Sika free to pursue larger acquisitions,

as the Burkard family had previously blocked most efforts at deal

making, while several acquisition targets were reluctant to sell as

long as the dispute was going on, Mr. Schuler said.

Now the company plans to go after deals in the range of 300

million to 500 million Swiss francs, he added.

The dispute began in 2014 after the Burkard family agreed to

sell Saint-Gobain a roughly 17% stake in Sika that came with

attached voting rights of 52%, which Sika's management interpreted

as a hostile takeover. Following a prolonged legal battle A Swiss

court ruled in 2016 that the deal would be unlawful and allowed

Sika's management to restrict the family's voting rights.

However, the Burkard family sought to extend its agreement with

Saint-Gobain and continued to propose its own candidates to Sika's

board. All family board members have now stepped down and

Saint-Gobain won't be able to appoint its own candidates, Sika's

Chairman Paul Haelg said.

After the shareholders' meeting the voting rights associated

with Saint-Gobain's 10.8% stake will be reduced to 10.8% from

23.7%, Sika said.

All pending litigation will be dropped and the two companies

plan to extend their existing relationship, Sika said.

(END) Dow Jones Newswires

May 12, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

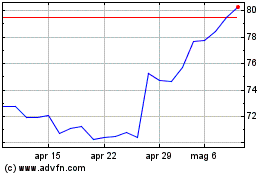

Grafico Azioni Cie de SaintGobain (EU:SGO)

Storico

Da Mar 2024 a Apr 2024

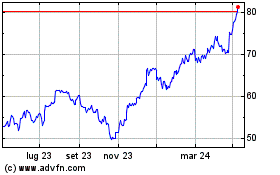

Grafico Azioni Cie de SaintGobain (EU:SGO)

Storico

Da Apr 2023 a Apr 2024