European Firms Start Pulling Out of Iran

16 Maggio 2018 - 7:39PM

Dow Jones News

By Benoit Faucon

LONDON -- European firms have started pulling back investment

and abandoning commitments in Iran, responding to a decision last

week to reimpose broad American sanctions on Tehran by year

end.

Total SA, a French oil giant, said Wednesday it had halted work

on an Iranian natural-gas project and warned it may have to pull

out altogether from its plan to invest $1 billion in the field.

Some shippers of Iranian oil have said they are ceasing to

facilitate such trades because of the new sanctions. Insurance

companies are studying whether they may have to reduce or stop

their underwriting on the Islamic Republic's shipments.

Iran, which is the world's fifth-largest oil exporter and the

holder of the second-largest gas reserves in the world, was seen as

a huge investment opportunity for companies operating in the

industry.

But last week, the U.S. said it would pull out of a deal that

lifted sanctions on Iran in exchange for Tehran curbing its nuclear

ambitions.

European allies have said they won't pull out or enact new

sanctions, but many European firms -- with U.S. businesses, ties or

bank accounts -- could be subject to Washington's sanctions

enforcement. Trump administration officials have publicly warned

European firms to start to wind down their dealings, but has given

companies several months to exit Iran.

In response, Iran's oil minister Bijan Zanganeh accused U.S.

president Donald Trump of working to favor American oil producers

with the complicity of rival countries in the Organization of the

Petroleum Exporting Countries.

Total, in a statement about its Iranian business on Wednesday,

said U.S. banks account for 90% of its global financing, while 30%

of its shareholders are American. "Total has always been clear that

it cannot afford to be exposed to any secondary sanction, which

might include the loss of financing in dollars by U.S. banks for

its worldwide operations, " it said in its statement.

Total said it would seek a waiver from Washington for the gas

project, but wouldn't continue with it if it didn't receive one.

Total has also become a substantial buyer of Iranian crude in the

past two years since sanctions were lifted. It had previously said

it wouldn't seek an exemption for those purchases. It declined to

comment beyond its statement.

In recent days, Wintershall AG, a German energy firm, told its

Iranian partners it may not find funding for Iranian oil projects

because it relies on its parent company, BASF AG, which has huge

chemical operations in the U.S., according to a person familiar

with the matter. A Wintershall spokesman said it strictly complies

"with all national and international laws and regulations."

On Wednesday, Maersk Tankers AS, one of the world's largest

oil-shipping companies, said it would stop taking assignments for

Iranian oil shipments. It said it would wind down any existing

customer orders by early November, the deadline set by Washington

for the return of oil-related sanctions, a company spokesman said

on Wednesday.

Torm AS, another Danish tanker company, has also "stopped taking

new orders in Iran as a consequence of U.S. plans to reimpose

sanctions on Tehran," a spokeswoman said.

Insurance companies are also tightening scrutiny over new

underwriting. The U.S. sanctions "will have a significant impact on

the availability" of insurance for Iran oil shipments, said Andrew

Bardot, the executive officer of London-based International Group

of Protection & Indemnity Clubs.

Mr. Bardot said the group -- a pool of reinsurers that covers

around 90% of the world's tonnage, including tankers -- is in

discussions with the U.S. government to mitigate the impact of

returning U.S. sanctions on insuring Iran oil.

--Sarah Kent in London contributed to this article.

Write to Benoit Faucon at benoit.faucon@wsj.com

(END) Dow Jones Newswires

May 16, 2018 13:24 ET (17:24 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

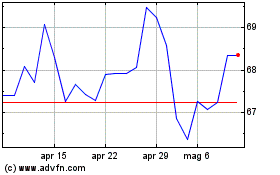

Grafico Azioni TotalEnergies (EU:TTE)

Storico

Da Mar 2024 a Apr 2024

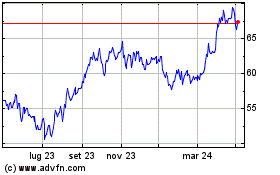

Grafico Azioni TotalEnergies (EU:TTE)

Storico

Da Apr 2023 a Apr 2024