A study initiated to enable a change in

Universal Music Group’s shareholding structure

- Vivendi first quarter 2018 revenues:

€3,109 million, up 16.0%1 (+3.3%1 at

constant currency and perimeter)

- Universal Music Group: strong

increase in operations with a 31.5%1 growth in

subscription and streaming revenues at constant currency and

perimeter. 7.2% organic growth at the end of April (4.5% at the end

of March)

- Canal+ Group: continuation of

recovery with a total of 15.3 million subscribers (+620,000

year-on-year)

- Good start for the other businesses:

Dailymotion, Gameloft, Havas and Vivendi Village

Regulatory News:

Vivendi (Paris:VIV):

This press release contains unaudited consolidated revenues2

established under IFRS, which were approved by Vivendi’s Management

Board on May 14, 2018, reviewed by the Audit Committee on May 15,

2018, and by the Supervisory Board on May 17, 2018.

Vivendi’s Supervisory Board met today under the chairmanship of

Mr. Yannick Bolloré and reviewed the Group’s consolidated revenue

figures for the quarter ended March 31, 2018, which were approved

by the Management Board on May 14, 2018.

REVENUES FOR THE FIRST QUARTER OF 2018

For the first quarter of 2018, Vivendi’s revenues amounted to

€3,109 million, compared to €2,680 million for the same period

in 2017, an increase of 16.0% notably resulting from the

consolidation of Havas (+€482 million).

At constant currency and perimeter3, revenues increased by 3.3%

compared to the first quarter of 2017, driven by the growth of

Universal Music Group (+4.5%) and Canal+ Group (+2.5%), which

confirms its recovery, as well as the improvement in the operating

performance of Dailymotion within New Initiatives.

Vivendi is confident about the prospects of its main businesses

for the rest of the 2018 year.

Change in revenues by business

segment

Three months ended March 31, (in millions of euros)

2018 2017 % Change

% Change atconstantcurrency

% Change atconstantcurrency

andperimeter3

Revenues Universal Music Group 1,222 1,284 -4.8% +4.5% +4.5%

Canal+ Group 1,298 1,272 +2.1% +2.5% +2.5% Havas 482 -

na4

na na Gameloft 79 91 -13.4% -7.4% -7.4% Vivendi Village 23 26

-11.1% -10.3% -3.3% New Initiatives 16 10 +55.8% +55.8% +55.8%

Elimination of intersegment transactions (11) (3)

Total Vivendi 3,109 2,680 +16.0%

+22.2% +3.3%

Universal Music Group

Vivendi's Supervisory Board approved the Management Board's

proposal notably to examine and carry out the necessary preliminary

legal operations required for a potential change in the Universal

Music Group’s shareholding structure.

Thereafter, the Management Board will present the various

options for such an evolution.

The user growth recently reported by the major streaming

platforms continues to support the strong increase in Universal

Music Group’s (UMG) subscription and streaming revenues. At the end

of April 2018, UMG’s revenues amounted to €1,657 million, up 7.2%

at constant currency and perimeter compared to the same four-month

period in 2017.

For the first quarter of 2018, revenues amounted to €1,222

million, up 4.5% at constant currency and perimeter compared to the

same period in 2017 (down 4.8% on an actual basis).

Recorded music revenues were up 5.9% at constant currency and

perimeter as growth in subscription and streaming revenues (+31.5%)

more than offset the decline in physical (-26.2%) and download

(-25.6%) sales.

Physical sales were particularly strong in the first quarter of

2017, notably driven by the soundtrack releases from La La Land,

Fifty Shades Darker and Moana. For the first quarter of 2018,

physical sales were also impacted by the timing of

releases, with slippage into the second quarter in some

markets, notably Japan, and the continued transformation of the

music business.

Recorded music best sellers for the first quarter of 2018

included the Black Panther soundtrack, a new release from Migos and

carryover sales from Post Malone, Imagine Dragons and Kendrick

Lamar.

According to Nielsen, UMG had the No. 1 album in the United

States with Migos’s Culture II and the No. 1 track with Drake’s

God’s Plan in the first quarter of 2018. In addition, UMG songs

occupied the No. 1 spot on the Spotify Global Chart for 12 weeks of

the first quarter of 2018.

Kendrick Lamar won the Pulitzer Prize for music for his album

“DAMN.”, the first win for a non-classical or jazz musician since

music was first included in the awards 75 years ago.

In today’s ever increasing global music market, UMG signed an

exclusive international recording agreement with Kris Wu, one of

Asia’s biggest stars and an artist whose creative success spans

music, film and television.

Music publishing revenues grew by 3.9% at constant currency and

perimeter, also driven by increased subscription and streaming

revenues, as well as better performance revenues.

Merchandising and other revenues declined by 18.7% at constant

currency and perimeter, due to lower touring activity and the

timing of retail promotions.

Canal+ Group

Canal+ Group’s revenues amounted to €1,298 million, up 2.1%

compared to the first quarter of 2017 (+2.5% at constant currency

and perimeter).

This trend was driven by the significant increase in the

subscriber base which reached a total of 15.3 million,

representing a year-on-year increase of 620,000 subscribers. (See

Appendix II)

In mainland France, the good momentum observed in the second

half of 2017 continued, with a stabilization of revenues for the

pay-TV business, notably resulting in a substantial decrease in the

individual subscriber churn rate5 of 2.2 percentage points to

15.0%.

The strong year-on-year growth trend in revenues outside of

France continued, mainly thanks to the African operations which

recorded a 12.3% growth at constant currency and perimeter.

Studiocanal’s revenues grew by 19.2% at constant currency and

perimeter, thanks to more theatrical releases (The Commuter, Early

Man, The Mercy, Brillantissime, Return of the Hero (Le Retour du

héros) and The Little Witch in Germany) and very strong video

sales, notably of Paddington 2.

In February 2018, Canal+ Group launched a pay-TV service in

Myanmar in partnership with the Burmese media group Forever. Canal+

Myanmar offers nearly 80 channels covering all themes, including

eight Canal+ channels in the Burmese language and showcasing local

content. The establishment of Canal+ Group in Myanmar, one of the

largest countries in Asia with annual economic growth of 7%, is

part of its long-term strategy to develop in territories with

strong growth potential.

In March 2018, Canal+ Group entered into an agreement with the

American company DirecTV for the broadcast of several Canal+ Group

channels. DirecTV customers who subscribe to the new FrenchDirect™

offer gain access to Canal+ International, a new general-interest

entertainment channel, to the CNews channel and, since the

beginning of May, to Studiocanal TV, which is built on

Studiocanal’s expansive catalog.

In April 2018, Canal+ Group and UMG launched the Deutsche

Grammophon+ channel, a service that allows subscribers to enjoy the

richness of this label’s catalog, which celebrates its 120th

anniversary this year. This catalog is editorialized in playlists,

with high-fidelity sound and, for the first time, videos are

available with Dolby Atmos sound.

On May 10, 2018, Canal+ Group announced that it will now offer

the Apple TV 4K as a set-top box to its subscribers in France.

Subscribers and new Canal customers will enjoy the best myCanal

experience, which will benefit from all the power of the Apple TV

4K and its ultra-fluid ergonomics. myCanal is the leading media app

in France across all platforms with more than 13 million mobile

downloads and 1 million daily users. The Apple TV 4K will be

offered to Canal subscribers at the same prices as those charged

for its own set-top box.

Havas

The revenues (gross margin) generated by Havas, fully

consolidated since July 3, 2017, amounted to €482 million in the

first quarter of 2018.

North America delivered a satisfactory performance (+2.2%

excluding Arnold’s impact) due to the good performances of Edge,

Havas Media and Havas Life. Arnold experienced a difficult start to

the year due to the loss of some clients.

The various European countries reported mixed performances,

notably due to the loss of the PSA media account last year, which

affected several countries. Business in France was slowing down

(organic growth of -2.3%) although BETC and Fullsix/Ekino performed

very well. Italy and Poland both reported strong growth.

Havas had a very good start to the year in the Latin America and

Asia Pacific regions (+4.6% and +7.8%, respectively, at constant

currency and perimeter), both of which remain very dynamic and

promising with strong development potential for Havas.

In the first quarter of 2018, Havas’ organic growth stood at

-0.1% excluding Arnold’s impact.

Havas continues to strengthen in certain areas of strategic

expertise and certain geographical regions. Since the beginning of

the year, Havas has made two acquisitions: DAA (Deekeling Arndt

Advisors), a German-based agency specializing in public relations

and finance, and M&C Consultancy, a London-based healthcare

communication agency.

In Paris, Havas created a new French agency, Plead, a subsidiary

specializing in strategic and sensitive executive communication

consulting. In addition, Havas Paris launched Blockchain, the first

fully-integrated communications offering designed to support

businesses involved in blockchain technology (a sequential

distributed database without any control). This offering was

launched in partnership with Blockchain Partner, the French leader

in blockchain consulting. In addition, the group created the Havas

China Desk, an offer aimed at supporting both clients seeking to

expand their presence in China and Chinese brands looking to expand

internationally.

Among the awards won in the first quarter of 2018, at the 5th

edition of the Media Agency of the Year awards (Prix Agence Média

de l'Année) in France, Havas Group's media business was named Group

of the Year, while Socialyse was awarded the content prize in the

Pure Player category and Agence79 won the data prize in the Pure

Player category. In the United States, Havas Media was named Agency

of the Year by MediaPost. The Host/Havas Australia agency was

ranked the No. 2 agency on the Campaign Brief Hot List 2018. BETC

was ranked among the best agencies in the world by the Gunn

Report.

On April 16, 2018, Vivendi received €76.2 million in dividends

from Havas.

Gameloft

With almost 2 million downloads per day across all platforms in

the first quarter of 2018, Gameloft is one of the leading mobile

game publishers in the world. Gameloft's revenues amounted to €79

million, down 7.4% at constant currency and perimeter compared to

the first quarter of 2017, notably due to the lack of new mobile

games releases in the first quarter of 2018.

The breakdown of revenues by geographical market was as follows:

36% in the EMEA region (Europe, the Middle East and Africa), 32% in

North America, 24% in Asia Pacific, and 8% in Latin America.

For the first quarter of 2018, Gameloft’s average number of

monthly active users (MAU) reached 114 million and its average

daily active users (DAU) reached 13 million. 62% of Gameloft’s

revenues were generated by internally developed franchises.

Gameloft has benefited from the strong performance of its

catalogue, notably its bestselling games such as Dragon Mania

Legends, Disney Magic Kingdoms, March of Empires, Asphalt 8:

Airborne and Minion Rush.

On May 3, 2018, Gameloft released Dungeon Hunter Champions, the

latest game in a series with over

100 million downloads. The new game took this hack'n'slash

franchise (an action role-playing video game) in a whole new

direction by introducing brand new worlds and characters that go

beyond the scope of the original saga. This new take on the

franchise has been hailed by its players, as sales of the game were

off to an excellent start even before its release in China.

Vivendi Village

Vivendi Village’s revenues amounted to €23 million, compared to

€26 million for the first quarter of 2017, a decrease of -3.3% at

constant currency and perimeter.

Vivendi Ticketing’s revenues amounted to €11 million for the

first quarter of 2018. In mid-April 2018, Vivendi, through See

Tickets, acquired Paylogic, a ticketing and technology company

based in Amsterdam, to form a global ticketing network spanning

Europe and the United States. With this acquisition, the ticketing

unit expects to sell more than 20 million tickets a year to

over 5,000 clients in over 30 countries.

Live performance revenues were up 11.9% compared to the first

quarter of 2017, primarily due to the development of Olympia

Production and of eight CanalOlympia venues currently operating in

Africa. At the end of April, Vivendi and Orange announced the

signing of a partnership with this network of venues to make the

cinema more accessible to all through the "Cinédays" program which

allows Orange customers to benefit from a 2 for 1 cinema ticket,

once or twice a week.

New Initiatives

New Initiatives, which groups together projects being launched

or under development including Dailymotion, Vivendi Content

(Studio+ and Vivendi Entertainment) and GVA (Group Vivendi Africa),

recorded revenues amounting to €16 million, an increase of 55.8%

compared to the first quarter of 2017, primarily thanks to

Dailymotion’s performance.

Dailymotion’s new user experience, deployed worldwide at the end

of 2017 on mobile, desktop and mobile app, has borne fruit. The

share of premium content consumption increased by 17% between

December 31, 2017 and March 31, 2018, and the number of views of

desktop premium content per session increased by 52% when it was

launched.

Designed primarily for 25-49-year-olds, Dailymotion's new user

experience leverages premium content from hundreds of leading

partners around the world, including Universal Music Group, CNN,

and Vice.

In March 2018, GVA, a new player in the African telecoms market,

in distribution partnership with Canal+ Togo, launched Canalbox its

first high-speed fiber internet offer in Lomé. Already available in

Libreville and Lomé, the FTTH Canalbox network will soon be

deployed in several other African cities. GVA benefits from the

strong expertise of the Canal+ Group in Africa and relies on the

power of the brand, on the very important commercial network

distributing Canal+ Group's products and on high-quality

service.

FIRST QUARTER HIGHLIGHTS AND RECENT EVENTS

- On January 16, 2018, Vivendi entered

into a hedging transaction to protect the value of its equity

interest in Fnac Darty. The hedge involves a forward sale based on

a reference price of € 91 per share (i.e., approximately € 268

million). Vivendi retains the option to unwind this transaction

either in cash or in shares at maturity, i.e., during the second

half of 2019 at the latest.

- On March 20, 2018, Vivendi announced

the sale of its entire 27.27% interest in Ubisoft at a price of

€66 per share, representing an aggregate amount of €2 billion.

This interest had been acquired by Vivendi over the past three

years for €794 million. On March 23, 2018, Vivendi received €1.51

billion in connection with this sale (the outstanding €0.5 billion

is to be received at the beginning of October 2018 under the

forward sale commitments on the balance of the Ubisoft

investment).

- On April 19, 2018, Vivendi's Annual

Shareholders' Meeting approved all the resolutions submitted to

their vote, notably including:

- the appointment of Michèle Reiser as a

member of the Supervisory Board for a four-year period, as well as

the renewal of the term of office of Philippe Bénacin, Aliza Jabès,

Cathia Lawson-Hall and Katie Stanton for the same four-year period;

and

- the distribution of an ordinary

dividend of €0.45 per share, up 12.5%, representing a total

distribution of €568 million. The dividend was paid on April 24,

2018 (following the coupon detachment on April 20, 2018).

- Following the Shareholders' Meeting of

April 19, 2018, Vivendi's Supervisory Board unanimously appointed

Yannick Bolloré as Chairman, replacing Vincent Bolloré. The

Supervisory Board also confirmed Philippe Bénacin as

Vice-Chairman.

- During its meeting on May 17, 2018, the

Supervisory Board unanimously approved the renewal of the terms of

office of the entire Management Board for a four-year term.

- On May 4, 2018, Telecom Italia’s

Shareholders’ Meeting renewed its Board of Directors, appointing

five of the ten Board candidates presented by Vivendi; Vivendi’s

slate obtained 47% of the vote compared to 49% for Elliott’s

slate.But the “new governance” is a concern to Vivendi, which is

the largest shareholder holding 24% of the company’s ordinary

shares. The risk of a dismantling and a governance that would not

take into account the shareholders’ interests, may cause Vivendi to

consider, as permitted by the law, to request the convening of a

Shareholders’ meeting to propose to reorganize the Board of

Directors.

About Vivendi

Since 2014, Vivendi has been focused on building a world-class

content, media and communications group with European roots. The

clear and ambitious strategy that was set in motion three years ago

has been successfully executed by the Management Board. First, in

content creation, the Group owns powerful, complementary assets in

music (UMG), mobile games (Gameloft) and movies/series (Canal+

Group), which are the three most popular forms of entertainment

content in the world today. Second, in the distribution market,

Vivendi has acquired the Dailymotion platform and repositioned it

to create a new digital showcase for our content. The Group has

also joined forces with several telecom operators and platforms to

maximize the reach of its distribution networks. In 2017, a third

building block – communications – was added to this structure, via

Havas. Havas possesses unique creative expertise in promoting free

content and producing short formats, which are increasingly viewed

on mobile devices.www.vivendi.com, www.cultureswithvivendi.com

Important Disclaimers

Cautionary Note Regarding Forward-Looking Statements. This press

release contains forward-looking statements with respect to the

financial condition, results of operations, business, strategy,

plans and outlook of Vivendi, including the impact of certain

transactions, the payment of dividends and distributions, as well

as share repurchases. Although Vivendi believes that such

forward-looking statements are based on reasonable assumptions,

such statements are not guarantees of future performance. Actual

results may differ materially from the forward-looking statements

as a result of a number of risks and uncertainties, many of which

are outside our control, including, but not limited to, the risks

related to antitrust and other regulatory approvals as well as any

other approvals which may be required in connection with certain

transactions and the risks described in the documents of the Group

filed by Vivendi with the Autorité des marchés financiers (the

French securities regulator), which are also available in English

on Vivendi's website (www.vivendi.com). Investors and security

holders may obtain a free copy of documents filed by Vivendi with

the Autorité des marchés financiers at www.amf-france.org, or

directly from Vivendi. Accordingly, we caution readers against

relying on such forward-looking statements. These forward-looking

statements are made as of the date of this press release. Vivendi

disclaims any intention or obligation to provide, update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise.

Unsponsored ADRs. Vivendi does not sponsor any American

Depositary Receipt (ADR) facility in respect of its shares. Any ADR

facility currently in existence is “unsponsored” and has no ties

whatsoever to Vivendi. Vivendi disclaims any liability in respect

of any such facility.

ANALYST CONFERENCE CALL

Speakers:Arnaud de PuyfontaineChief Executive

OfficerHervé PhilippeMember of the Management Board and

Chief Financial Officer

Date: May 17, 20186:00 pm Paris time – 5:00 pm London

time – 12:00 pm New York time

Media invited on a listen-only basis.

The conference call will be held in English.

Internet: The conference call can be followed on the

Internet at: www.vivendi.com (audiocast)

Numbers to dial:France: +33 (0)1 76 77 22 57United

Kingdom: +44(0) 330 336 94 11USA: +1 323 794 25

51Confirmation code: 895 7076

On our website www.vivendi.com will be available an audio

webcast and the slides of the presentation.

Appendix IAdoption of IFRS 15

As from January 1, 2018, Vivendi has applied the new accounting

standard on revenues: IFRS 15 - Revenues from Contracts with

Customers, with no material impact on Vivendi’s consolidated

revenues and operating results. In accordance with IFRS 15, Vivendi

has applied this change of accounting standard to fiscal year 2017;

therefore, the data contained in this press release relative to the

first quarters of 2018 and 2017 is comparable.

Impacts related to the application of IFRS 15 on Vivendi’s

revenues for the first quarter of 2017 and for fiscal year

2017:

(in millions of euros)

Three months endedMarch 31, 2017

Year endedDecember 31, 2017

Revenues (as previously published) (A) Universal

Music Group 1,284 5,673 Canal+ Group 1,278 5,246 Havas (a) - 1,151

Gameloft 68 258 Vivendi Village 26 109 New Initiatives 10 51

Elimination of intersegment transactions (3) (44)

Total

Vivendi 2,663 12,444 IFRS 15

restatements (B) Universal Music Group - - Canal+ Group (6)

(48) Havas (a) - - Gameloft 23 70 Vivendi Village - - New

Initiatives - - Elimination of intersegment transactions - -

Total Vivendi 17 22 Restated

revenues (A+B) Universal Music Group 1,284 5,673 Canal+ Group

1,272 5,198 Havas (a) - 1,151 Gameloft 91 328 Vivendi Village 26

109 New Initiatives 10 51 Elimination of intersegment transactions

(3) (44)

Total Vivendi 2,680 12,466

a. As a reminder, Vivendi has fully consolidated Havas since

July 3, 2017.

No material impact is expected for Universal Music Group and

Havas as their revenue recognition was already compliant with IFRS

15.

Appendix II

Canal+ GroupKey performance

indicators

in thousands

March 31, 2017 March 31, 2018

Δ

Individual subscribers 14,135

14,747 +612 Mainland France 8,084 8,011 -73

International 6,051 6,736 +685

Collective contracts

572 580 +8 Total 14,707

15,327 +620

FTA-TV audience share * 3M

2017 3M 2018

Δ

C8 5.0% 3.9% -1.1pt CStar 1.4% 1.4% - CNews 0.5% 0.5% -

Total 6.9% 5.8%

-1.1pt

* Source: Médiamétrie - Population aged 25-49.

1 Compared to the first quarter of 2017.2 As from January 1,

2018, Vivendi has applied the new accounting standard on revenues:

IFRS 15 - Revenues from Contracts with Customers, with no material

impact on Vivendi’s consolidated revenues and operating results. In

accordance with IFRS 15, Vivendi has applied this change of

accounting standard to fiscal year 2017; therefore, the data

contained in this press release relative to the first quarters of

2018 and 2017 is comparable. For a detailed presentation of the

impacts related to the application of this standard on revenues for

the first quarter of 2017, please refer to page 10 of this press

release.3 Constant perimeter reflects the impacts of the

acquisition of Havas (July 3, 2017) and the sale by Vivendi Village

of Radionomy (August 17, 2017).4 na: not applicable.5 Churn per

individual retail subscriber with commitment, over a 12-month

period, excluding wholesale customers.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180517006155/en/

MediaParisJean-Louis Erneux+33 (0)1 71 71 15

84Solange Maulini+33 (0) 1 71 71 11 73orLondonPaul Durman+44

20 7186 8890orInvestor RelationsParisXavier Le Roy+33

(0) 1 71 71 18 77Julien Dellys+33 (0) 1 71 71 13 30Nathalie

Pellet+33(0)1 71 71 11 24

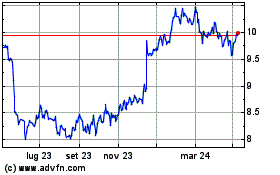

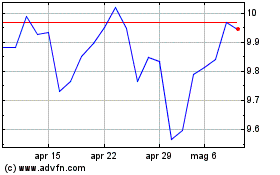

Grafico Azioni Vivendi (EU:VIV)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Vivendi (EU:VIV)

Storico

Da Apr 2023 a Apr 2024