Glencore Looks to Shore Up Investor Confidence With Buyback

05 Luglio 2018 - 2:58PM

Dow Jones News

By Scott Patterson

Glencore PLC said Thursday it would purchase $1 billion in stock

from investors, launching the buyback just days after disclosing it

had received a subpoena from the U.S. Department of Justice.

Glencore's shares fell as much as 12% Tuesday after it said the

Justice Department was seeking records related to its compliance

with American antibribery and anti-money-laundering laws in the

Democratic Republic of Congo, Nigeria and Venezuela. It declined to

provide details.

Glencore's shares are down 16% so far this year, compared with

advances by mining-giant rivals that are benefiting from strong

commodity prices amid steady appetite for resources in China and

elsewhere. Anglo American PLC is 12% higher year-to-date, BHP

Billiton Ltd. is up 11% and Rio Tinto PLC has gained 2%.

Glencore has long signaled a buyback. Amid several years of low

commodities prices, Chief Executive Ivan Glasenberg sold off assets

and pared back debt dramatically. More recently, prices have

bounced back strongly, boosting Glencore's stock price. On

Thursday, shares rose more than 2% after the buyback

disclosure.

The Anglo-Swiss mining company's shares have been weighed down

this year by a series of negative news surrounding its giant copper

and cobalt mining operations in Congo. The Congolese government has

imposed a new mining code seeking to extract higher payments from

mining companies, a move Mr. Glasenberg and other mining executives

have rallied against.

Glencore faced a legal threat from Congo's state-owned mining

company, Gecamines, which sued one of its Congo copper companies,

Katanga Mining, over its $9.2 billion debt load. Glencore later

said a unit of Katanga Mining would issue $5.6 billion in stock to

retire debt, resolving the dispute.

Glencore also sued in Congo by its former partner, Israeli

billionaire Dan Gertler, who last year was sanctioned by the U.S.

Treasury Department for alleged corruption in Congo. Glencore

temporarily halted royalty payments it owed Mr. Gertler following

the sanctions, prompting the lawsuit. In June, Glencore said it

would resume the payments.

Write to Scott Patterson at scott.patterson@wsj.com

(END) Dow Jones Newswires

July 05, 2018 08:43 ET (12:43 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

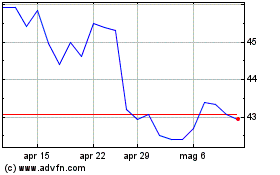

Grafico Azioni BHP (ASX:BHP)

Storico

Da Mar 2024 a Apr 2024

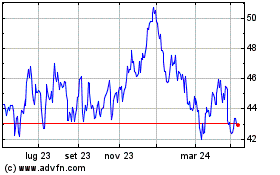

Grafico Azioni BHP (ASX:BHP)

Storico

Da Apr 2023 a Apr 2024