By Samantha Pearson and Jeffrey Lewis

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 7, 2018).

SÃO PAULO -- Boeing Co.'s takeover of Embraer SA's commercial

jetliner business marks the end of an era for one of Brazil's most

successful companies, and the beginning of a potentially bitter

political dispute.

Coming ahead of Brazil's hotly contested October elections, the

$3.8 billion deal announced Thursday is shaping up to become a

divisive campaign issue here, analysts said, evoking nationalist

ire in much the same way that Harley-Davidson in the U.S. has

recently been lambasted by President Donald Trump for shifting some

operations overseas.

Embraer was privatized in 1994, but "it is still seen as a

national asset by Brazilians, and one they don't want to lose,"

said Sérgio Lazzarini, a professor at São Paulo business school

Insper and author of books on crony capitalism in Brazil.

The front-runner in Brazil's elections, Jair Bolsonaro, a

right-wing former army captain, has largely backed the partnership

with Boeing. Brazil, one of the most closed emerging-market

economies, "cannot isolate itself from the world," he said in a

recent television interview.

But swaths of left-leaning politicians have opposed the

takeover. The president of the Workers' Party, Sen. Gleisi

Hoffmann, called it an attack on national sovereignty and decried

the sale of national technology "for the price of a banana." Ciro

Gomes, a center-left politician who ranks third in most polls,

vowed to reverse the deal should he become president -- a scenario

that is possible, but viewed as somewhat unlikely, analysts

say.

Unions have called on the government to veto the deal with

Boeing via its so-called golden share in Embraer, while others have

accused the companies of trying to sneak through the takeover at a

time when the soccer-mad nation is distracted by the World Cup.

Set up by Brazil's military government in 1969, Embraer has gone

from an unprofitable state company to one of the world's biggest

producers of commercial jets. It is held up by many as a shining

example of first-rate manufacturing in a developing country better

known for producing soybeans, cattle and iron ore, and a cherished

reminder of the nation's proud aviation history.

It was with mixed feelings, then, that Brazilians received the

news Thursday that Embraer's commercial business, responsible for

58% of the company's revenue last year, was being sold off.

Boeing will take an 80% stake in Embraer's commercial airplane

and services business. Embraer will own the remaining 20%, with the

right to force Boeing to buy it out over the next decade.

"Everything in Brazil that has any value" gets sold to

foreigners, said Tatia Jois, 40 years old, a film and television

extra from São Paulo.

Embraer's success, though, has come because of its focus on

global markets and independence from the government.

"The real question we should be asking," said Mr. Lazzarini, "is

not why it's being sold, but why aren't there more companies like

Embraer in Brazil?"

Embraer's early bet on midsize plane production for the growing

regional aviation market began to win the company orders in the

U.S. in the 1980s. The company is now heavily dependent on the U.S.

market, with more than 2000 employees in the U.S. and a factory in

Florida. The North American market generated 57% of sales in 2017,

while Brazil accounted for only 13%.

Brazil's government has given Embraer relative freedom, standing

back as the company purchased most of its parts from foreign

players and announced heavy layoffs in the wake of the 2008

financial crisis to remain nimble.

The result of these efforts can be seen from the air above the

lush sugar-cane fields of Gavião Peixoto in rural São Paulo, home

to one of Embraer's gleaming production facilities. A vast campus

of manicured green lawns and white and blue buildings extends

across the horizon, punctuated by the longest private runway in the

Southern Hemisphere, once an alternate landing site for the U.S.

space shuttle.

In Gavião Peixoto, the company is building its new KC-390

military transport aircraft along with other planes, which on a

recent day were scattered about the vast hangars like the abandoned

toys of a child's playroom.

The defense business was excluded from Thursday's deal, but the

two companies said they would explore a joint venture for certain

defense products.

Boeing and Embraer resumed talks about a joint venture in

commercial aviation last year after rivals Airbus SE and Bombardier

Inc. started developing their own partnership plans at the Paris

Air Show, according to people familiar with the situation.

"The powerful partnership between Bombardier and Airbus had been

threatening Embraer's leading position in the market for regional

aviation," said Victor Mizusaki at investment bank Bradesco BBI in

São Paulo.

Aside from boosting Embraer's position in an increasingly

challenging market, the deal will also give the company access to

Boeing's sales network. The U.S. company's ability to negotiate

lower prices from suppliers will also benefit Embraer.

The companies said Thursday they plan to get the approval of

Brazil's government while President Michel Temer is still in power.

His successor may try to put up roadblocks to the deal while it

goes through final regulatory approvals next year, although this is

unlikely, analysts said.

"Brazil has kept its agreements in recent years...but it really

depends on who wins in October," said Shin Lai, an investment

strategist at São Paulo-based research company Upside Investor.

"Right now the situation is very cloudy because we just don't know

if the next president will see that keeping this kind of commitment

is important."

Write to Samantha Pearson at samantha.pearson@wsj.com

(END) Dow Jones Newswires

July 07, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

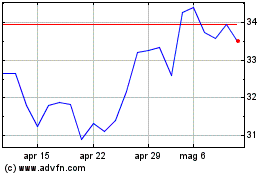

Grafico Azioni EMBRAER ON (BOV:EMBR3)

Storico

Da Mar 2024 a Apr 2024

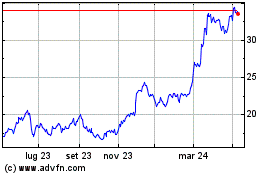

Grafico Azioni EMBRAER ON (BOV:EMBR3)

Storico

Da Apr 2023 a Apr 2024