Rates, Tax Cut Help BofA Profit Rise 33% -- WSJ

17 Luglio 2018 - 9:02AM

Dow Jones News

By Rachel Louise Ensign

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 17, 2018).

Rising interest rates and a massive tax cut carried Bank of

America Corp. to a 33% increase in second-quarter profit, making it

the latest big bank to benefit from strong economic conditions.

Quarterly profit at the Charlotte, N.C.-based bank, the second

largest in the U.S. by assets, rose to $6.784 billion from $5.106

billion a year earlier. Per share, earnings were 63 cents. Analysts

had expected 57 cents a share. Revenue fell to $22.609 billion from

$22.829 billion a year earlier, when the bank posted a one-time

gain related to the sale of a business. Without that gain, revenue

would have risen 3%.

The results marked another quarter during which Chief Executive

Brian Moynihan led the bank to solid earnings growth after several

rocky years after his tenure began in 2010. The bank's strong

results in recent quarters are another sign that many big banks are

back in growth mode a decade out from a financial crisis that

threatened their existence.

On Friday, JPMorgan Chase & Co. and Citigroup Inc. posted

double-digit profit increases for the second quarter. Wells Fargo

& Co. stumbled due to a number of one-time charges that dinged

earnings as well as a shrinking loan book and lower fees in several

of its main businesses.

Bank of America's earnings were "almost all you could have hoped

for," wrote Glenn Schorr, a bank analyst at Evercore ISI. Loans

grew by 2% from a year earlier, while deposits rose nearly 4%. The

lender also cut expenses by 5%. Trading revenue, excluding an

accounting adjustment, rose nearly 7% to $3.596 billion from $3.369

billion in the second quarter of last year.

One weak spot was investment-banking fees, which fell 7% from a

year earlier.

Bank of America shares rose 4.3% Monday, putting them in

positive territory for 2018.

Rising interest rates provided a major lift. Lenders like Bank

of America turn a profit on the difference between what they pay on

deposits and the rate they collect on loans. In the quarter, the

Federal Reserve raised its benchmark rate for a seventh time in

three years.

Banks have been able to pocket most of the benefits from the

rate increases because customers aren't broadly demanding more

interest on their deposits. Overall, Bank of America paid a rate of

0.38% on U.S. interest-bearing deposits in the second quarter,

compared with 0.30% in the first quarter. In its retail banking

unit, the bank paid a minuscule 0.05%.

Banks are expected to eventually have to pay more interest to

keep depositors around, crimping the financial benefit of future

rate increases. Bank of America has managed to keep interest costs

in check better than many of its rivals, giving it more room to

maneuver should consumers begin to demand higher rates.

The recent tax-law changes also provided a major lift. The bank

paid $1.71 billion in income tax in the quarter, down 43% from

$3.015 billion in the same quarter last year, before the

legislation was passed.

The question is whether the good results help change investors'

sentiment about bank stocks. After a huge run-up after the 2016

election, investors have shown little enthusiasm for the industry's

shares this year. Since the start of 2018, the KBW Nasdaq bank

index is roughly flat and trails broader U.S. stock-market

benchmarks.

Investors have grown wary of lenders, analysts say, because of a

flattening of the yield curve: a narrowing of the difference in the

yields of shorter- and longer-term Treasurys.

A flatter yield curve can be bad for banks because they earn

less on loans and securities tied to longer-term Treasurys. The

narrowing also potentially signals problems ahead for the

economy.

"It will have an impact," Bank of America Chief Financial

Officer Paul Donofrio said of the yield curve on a Monday call with

reporters. However, like many lenders, the bank is more sensitive

to shorter-term rates than longer-term ones, which limits the pain

from the current curve, he said.

Investors' tepid feelings about bank stocks seemed to shift

somewhat on Monday, when shares of the four largest U.S. banks all

rose more than 2%.

Write to Rachel Louise Ensign at rachel.ensign@wsj.com

(END) Dow Jones Newswires

July 17, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

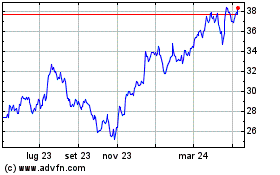

Grafico Azioni Bank of America (NYSE:BAC)

Storico

Da Mar 2024 a Apr 2024

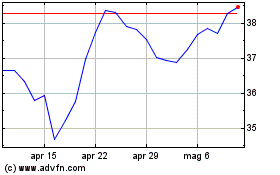

Grafico Azioni Bank of America (NYSE:BAC)

Storico

Da Apr 2023 a Apr 2024