Pound Falls After BoE Carney Warns Of Serious Consequences From No Deal Brexit

17 Luglio 2018 - 10:36AM

RTTF2

The pound dropped against its major counterparts in the European

session on Tuesday, trimming its early gains, after the Bank of

England Governor Mark Carney warned of major economic consequences

to the U.K., if a no-deal Brexit scenario arises.

"Speaking very narrowly about the financial services side, in

the event of a no-deal scenario... there would be big economic

consequences. We might have a lot of idle bankers as there is not a

lot of demand for their services," Carney said lawmakers.

Crashing out would prompt the BoE's monetary policy committee to

reassess the economic outlook and interest rates.

It is too early to predict the direction in which rate could

move if a no-deal Brexit happens, he said.

Figures from the Office for National Statistics showed that

Britain's employment level set a fresh record in the three months

to May and unemployment remained at its lowest since 1975.

The number of employment reached a record high of 32.399 million

in the March to May period, rising by 137,000 from the previous

three months. Economists had forecast employment growth of

115,000.

The employment rate rose to a record 75.7 percent from 75.6

percent in the three months to April period.

Investors keep an eye on Federal Reserve Chairman Jerome

Powell's semi-annual congressional testimony due shortly to see

whether the Fed will raise rates again too soon.

The currency held steady against its major counterparts in the

Asian session, with the exception of the yen.

The pound declined to weekly lows of 0.8874 against the euro and

1.3129 against the franc, from its early highs of 0.8840 and

1.3205, respectively. On the downside, 0.90 and 1.30 are likely

seen as the next support levels for the pound against the euro and

the franc, respectively.

The pound slipped to a 4-day low of 1.3186 against the dollar,

after having advanced to 1.3269 at 4:45 am ET. The pound is likely

to target support around the 1.30 area.

Reversing from an early high of 149.09 against the yen, the

pound weakened to 148.47. The pound is seen finding support around

the 147.00 mark.

Looking ahead, U.S. industrial production for June and NAHB

housing market index for July, as well as Canada manufacturing

sales for May are scheduled for release in the New York

session.

At 10:00 am ET, the Fed Chairman Jerome Powell will testify

before the Senate Banking Committee.

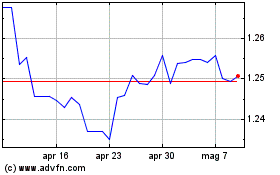

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Mar 2024 a Apr 2024

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Apr 2023 a Apr 2024