BHP Billiton Notches Iron Ore, Met Coal Output Records -- Commodity Comment

18 Luglio 2018 - 2:42AM

Dow Jones News

By Rhiannon Hoyle

SYDNEY--BHP Billiton Ltd. (BHP.AU) on Wednesday reported an 8%

increase in group copper-equivalent production for the year through

June, including output records at its Australian iron ore and

metallurgical coal operations. Here are some comments from the

report.

On iron-ore output:

"Total iron ore production for the 2018 financial year increased

by 3% to a record 238 million tons (275 million tons on a 100%

basis). Western Australia iron ore production of between 241-250

million tons, or between 273-283 million tons on a 100% basis, is

expected in the 2019 financial year. A program of work to optimize

maintenance schedules across our supply chain and improve port

reliability and performance is planned for the September 2018

quarter, with a corresponding impact expected on production and

unit costs."

On petroleum production:

"Total petroleum production for the 2018 financial year

decreased by eight per cent to 192 million barrels of oil

equivalent. In our Conventional business, volumes are expected to

decrease to between 113-118 million barrels of oil equivalent in

the 2019 financial year as a result of additional downtime from

planned dry dock maintenance at Pyrenees and natural field decline

across the portfolio. Given our intention to exit Onshore U.S., no

annual guidance for the 2019 financial year for these assets will

be provided, however until completion, which we are targeting by

the end of the 2018 calendar year, we expect a production run rate

broadly consistent with the second half of the 2018 financial

year."

On Escondida copper output:

"Escondida copper production for the 2018 financial year

increased by 57% to 1.2 million tons, reflecting a full year of

production following the industrial action in the previous year and

supported by the start-up of the Los Colorados Extension project on

Sep. 10, 2017. Production of between 1.12-1.18 million tons is

forecast in the 2019 financial year, as higher expected throughput

is offset by a significant decrease in average concentrator head

grade consistent with the mine plan."

On Olympic Dam copper output:

"Olympic Dam copper production decreased by 18% to 137,000 tons

as a result of the planned major smelter maintenance campaign in

the first half of the 2018 financial year and a slower than planned

ramp-up. The operation returned to full capacity during the June

2018 quarter. Production is expected to increase to between

200-220,000 tons in the 2019 financial year reflecting improved

operational stability and higher ore grades from the Southern Mine

Area."

On Australian metallurgical coal production:

"At Queensland Coal, record production for the 2018 financial

year was supported by record stripping performance, increased truck

hours and higher wash-plant utilization from low-cost

debottlenecking activities. Production records were achieved at

Peak Downs, Saraji, Caval Ridge, South Walker Creek and Poitrel. In

the June 2018 quarter, production increased by 16% from the

previous quarter following improved operational conditions at

Blackwater (geotechnical issues) and Broadmeadow (challenging roof

conditions), increased feed rates at the Caval Ridge wash-plant,

and utilization of additional wash-plant capacity at Poitrel

following the purchase of the remaining 50% of the Red Mountain

processing facility."

-Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

July 17, 2018 20:27 ET (00:27 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

Grafico Azioni Bhp (LSE:BHP)

Storico

Da Mar 2024 a Apr 2024

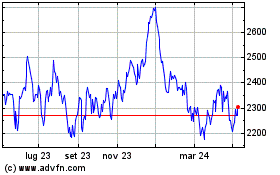

Grafico Azioni Bhp (LSE:BHP)

Storico

Da Apr 2023 a Apr 2024