Pound Drops As U.K. Inflation Rises Less Than Forecast

18 Luglio 2018 - 9:05AM

RTTF2

The pound fell sharply against its major counterparts in the

European session on Wednesday, after U.K. consumer inflation grew

less than expected in June, reducing hopes for a rate hike from the

Bank of England next month.

Data from the Office for National Statistics showed that

consumer prices climbed 2.4 percent year-over-year in June, the

same rate of increase as in the previous two months. Meanwhile, the

inflation was expected to accelerate to 2.6 percent.

On a monthly basis, consumer prices remained flat in June versus

the expected increase of 0.2 percent.

Core inflation that excludes energy, food, alcoholic beverages

and tobacco, eased to 1.9 percent in June from 2.1 percent in

May.

Another report from the ONS showed that input price inflation

quickened to 10.2 percent in June from 9.6 percent a month ago.

Prices were expected to grow by 10.1 percent.

Meanwhile, monthly inflation eased notably to 0.2 percent from

3.3 percent in May. The expected increase was 0.4 percent.

Output price inflation edged up to 3.1 percent in June from 3.0

percent in the prior month. Month-on-month, output prices gained

0.1 percent from May, when it rose by 0.5 percent.

Meanwhile, European shares rose amid growth optimism after

Federal Reserve Chairman Jerome Powell offered a positive outlook

of the U.S. economy and reiterated the Fed's plan for gradual rate

increases.

The currency held steady against its major rivals in the Asian

session, with the exception of the greenback.

The pound declined to 0.8924 against the euro, its lowest since

March 9. On the downside, 0.91 is likely seen as the next support

for the pound.

Final data from Eurostat showed that euro area annual inflation

accelerated in June, exceeding the European Central Bank's target

of "below, but close to 2 percent".

The annual inflation rate rose to 2 percent from 1.9 percent in

May, in line with the flash estimate.

The pound fell to a 10-1/2-month low of 1.3010 against the

dollar and a weekly low of 147.09 against the yen, reversing from

its early highs of 1.3117 and 148.24, respectively. Next key

support for the pound is likely seen around 1.28 against the

greenback and 145.00 against the yen.

The U.K. currency dropped to near a 3-week low of 1.3030 against

the franc, after having advanced to 1.3139 at 3:00 am ET. The pound

is seen finding support around the 1.29 region.

Looking ahead, U.S. housing starts and building permits for June

are scheduled for release in the New York session.

At 10:00 am ET, Federal Reserve Chairman Jerome Powell will

testify on the Semiannual Monetary Policy Report before the House

Financial Services Committee in Washington DC.

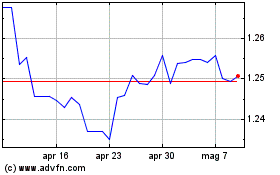

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Mar 2024 a Apr 2024

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Apr 2023 a Apr 2024