Plane Buyers, Worried About Trade Tensions, Ask for Anonymity

18 Luglio 2018 - 3:36PM

Dow Jones News

By Robert Wall and Andrew Tangel

FARNBOROUGH, England -- Airline customers are shying away from

putting their names on plane deals, worried it could exacerbate

global trade tensions, Eric Schulz, Chief Commercial Officer of

plane making giant Airbus SE said Wednesday.

Plane buyers have asked to remain unnamed "not to fuel the fire"

on trade, Mr. Schulz said. That anxiety is particularly pronounced

in Asia, he told investors.

"The world today is governed by the tweets we receive every

morning from one side of the Atlantic," Mr. Schulz said.

That is creating pressure among airlines and governments, he

said, adding that "some of our customer have asked as not to fuel

the [trade] war."

The European plane maker kicked off the third day of this week's

Farnborough International Air Show with the announcement of a deal

for six A330-900 wide-body planes from an undisclosed customer.

More than half of the company's Farnborough orders so far are from

buyers which aren't publicly identified. "Clearly we don't like

undisclosed orders but we have to respect customers," Mr. Schulz

said.

Boeing, the world's largest plane maker by sales and the biggest

U.S. exporter, Wednesday announced a deal from VietJet Aviation

Joint Stock Co. valued at $12.7 billion before industry-standard

discounts. The budget carrier plans to buy 100 of Boeing's 737 Max

plane though the contract still needs to be completed.

Aerospace companies are gathered at Farnborough amid heightened

trade tensions between the U.S. and China, as well as among

Washington and a number of the U.S.'s traditionally close trading

allies, including the European Union, Mexico and Canada. Industry

officials said they aren't seeing an impact on demand for travel or

planes, but are watching if trade could dent demand.

Boeing hasn't announced any deals with undisclosed buyers at the

biennial aerospace jamboree outside London.

Mr. Schulz said he expected to exit from the air show with

around 750 aircraft deals. Strong demand, particularly for

single-aisle planes, could allow Airbus to charge airlines more for

each, he said.

Mr. Schulz also said he was targeting orders this year for the

A380 superjumbo, the Toulouse, France-based company's struggling

flagship airplane. The A380 is popular with customers, but has

struggled to win big orders because airlines worry about filling

the double-decker plane that can seat more than 200 passengers.

Airbus has had to cut production plans for the A380 to about six

planes a year in 2020 because of slack demand. Chief Financial

Officer Harald Wilhelm said the program would lose money at that

output level, but that efforts to cut costs to produce the plane

would continue.

Boeing also has enjoyed strong demand for its rival 737 plane.

The Chicago-based plane maker has said it is sold out until 2023.

VietJet said it won't get its first 737 Max until 2022.

Write to Robert Wall at robert.wall@wsj.com and Andrew Tangel at

Andrew.Tangel@wsj.com

(END) Dow Jones Newswires

July 18, 2018 09:21 ET (13:21 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

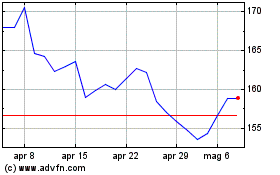

Grafico Azioni Airbus (EU:AIR)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Airbus (EU:AIR)

Storico

Da Apr 2023 a Apr 2024