Qualcomm Faces Demise of NXP Deal as U.S.-China Trade Fight Rumbles On

23 Luglio 2018 - 3:48PM

Dow Jones News

By Tripp Mickle

Qualcomm Inc. is set to find out this week if its $44 billion

deal to buy chip maker NXP Semiconductors NV will become one of the

biggest casualties in the escalating U.S.-China trade battle.

Wednesday is the expiration date for its merger agreement with

NXP, a deal struck in October 2016 that Qualcomm touted as

transformational, saying it would diversify a largely

smartphone-driven business into the fast-growing automotive chip

market.

China is the last of nine markets where Qualcomm and NXP need

approval from competition authorities, but that decision has been

snarled in the wider trade feud for months. Beijing's State

Administration for Market Regulation could still sign off, but

trade specialists said President Donald Trump's threat Friday to

put tariffs on $500 billion in Chinese imports makes that highly

unlikely by Wednesday. And Qualcomm, which extended the deadline in

April, has said it doesn't plan to do so again.

The demise of the Qualcomm-NXP deal more than 20 months after it

was struck would illustrate the consequences of U.S.-China trade

tension. The impact so far has been spread among many companies,

with the Trump administration having imposed tariffs on $34 billion

in Chinese imports across many industries, with tariffs on another

$16 billion worth under review. China has matched with a 25% tariff

on $34 billion in U.S. products and identified another $16 billion

worth for additional duties.

Qualcomm's fortunes already have been whipsawed by White House

priorities and U.S.-China jousting. In March, Mr. Trump saved the

San Diego company from a hostile takeover by rival Broadcom Ltd.,

blocking the deal in the interest of national security concerns

focused on China.

Then, Qualcomm nearly lost a significant customer, ZTE Corp.,

when Washington banned U.S. companies from selling components to

the Chinese maker of smartphones and telecom equipment over

sanctions violations -- only to have Mr. Trump later make a deal

with Beijing to save ZTE.

"It's been wild," said Jeffrey Helfrich, portfolio manager at

Dallas-based investment adviser Penn Davis McFarland, which counts

Qualcomm among its largest holdings. "Anyone of the many events in

the past year would drive a CEO crazy."

NXP, a Dutch chip maker with some 30,000 employees and $9.26

billion in revenue last year, also has had its future held hostage

for nearly two years. If the deal fizzles, it would have to explain

to shareholders how the future is bright on its own.

Qualcomm and NXP declined to comment.

Chinese authorities were close to approving Qualcomm's deal in

May, just before the White House blindsided Beijing by announcing

plans to proceed with tariffs on $50 billion of Chinese

imports.

Scott Kennedy, a China scholar at the Center for Strategic and

International Studies, said for Beijing to approve the deal now

would risk showing weakness. "It's hard to meet American demands on

this single case when the entire trade relationship is in serious

trouble of escalating," he said.

Chinese regulators could offer some sort of conditional

approval, Mr. Kennedy said, forcing Qualcomm and NXP to decide if

they want to further delay a final outcome.

China's State Administration for Market Regulation didn't

respond to a request for comment on its status Monday.

The merger extension in April said that if China doesn't approve

by July 25, Qualcomm would pay NXP a $2 billion termination fee.

Qualcomm's board scheduled a meeting for early this week, and

directors are still leaning toward dropping the deal if it isn't

cleared in time, a person familiar with the matter said.

Qualcomm Chief Executive Steve Mollenkopf told investors in

April that the company was working to complete the deal, but "if it

doesn't get done, we're going to move on to another approach."

Qualcomm said at the time it would buy $20 billion to $30 billion

of its stock if the deal collapses, or 23% to 34% of its shares at

its current market value of about $87 billion.

Many Qualcomm investors just want the uncertainty to end, and

see positives if the deal collapses. Some have worried about

Qualcomm's ability to digest NXP -- which has nearly as many

employees as Qualcomm -- especially because its biggest previous

acquisition was the relatively small $3.1 billion purchase of Wi-Fi

chip maker Atheros Communications Inc. in 2011.

And Qualcomm has shown it can reduce its dependence on

smartphone-related chip sales without owning NXP. It generated $3

billion in chip revenue last year outside of smartphones, a 75%

increase from 2015, and it is shipping more than 1 million chips a

day for connected devices.

"I'm happy for them to move on and run their business," said

Charles Lemonides, portfolio manager of ValueWorks LLC, which has

roughly 5% of its holdings in Qualcomm.

Still, a future without NXP would intensify pressure on Mr.

Mollenkopf, who already failed to win majority support from

shareholders in the board selection in March. He also faces a

potential bid for the company from former Qualcomm CEO Paul Jacobs

and is stuck in a legal battle with Apple Inc. over patent

royalties.

Write to Tripp Mickle at Tripp.Mickle@wsj.com

(END) Dow Jones Newswires

July 23, 2018 09:33 ET (13:33 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

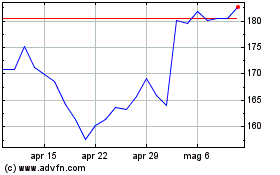

Grafico Azioni QUALCOMM (NASDAQ:QCOM)

Storico

Da Mar 2024 a Apr 2024

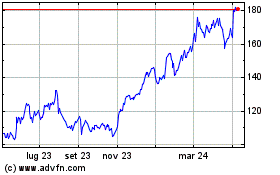

Grafico Azioni QUALCOMM (NASDAQ:QCOM)

Storico

Da Apr 2023 a Apr 2024